How to Do a CMA in 2023: The Ultimate Guide

- Get Your Subject Property Information

- Select Your Comparable Properties

- Choose your Adjustments and Adjust

- Review Market Activity

- Select a Price Recommendation

- Prepare the Presentation

- Use an Adjustment Matrix

- Use More Comps

- Paired Sales Analysis

- Bracketing

- Home Price Appreciation (HPA)

- Talk Zestimates and Tax Appraisals

- Remember Active Listings

- Include “Non-Comparable” Listings and Withdrawns/Expireds

Example of a Complete Real Estate CMA

Continuing Education (CE) for CMAs

The price is the most important part to get right when marketing a home successfully. Overpricing a home can lead to long DOMs and lost faith from the seller, price drop after price drop.

Underpricing a home can result in losing the listing.

Unfortunately, pricing a home is deceptively difficult. Real estate is extremely heterogeneous. No two homes are alike.

For too many agents, the CMA is an afterthought. This is a golden opportunity for the agent who goes above and beyond win the listing!

How to Do a CMA

1. Get Your Subject Property Information

Use Realist if your MLS provides it.

CMA software might auto-populate subject home details, but be sure to confirm these are correct with the county tax records. You do not want to price a home at the wrong specifications.

Verify your home facts. Ask your seller for builder plans or past appraisals, so that you can get the most square feet for them supported by documentation. Tax assessor square feet are seldom completely accurate.

If your seller is claiming a different number, be sure to get the documentation to back it up in the MLS: an appraisal, builder plan, or something.

Review and confirm the home details with the seller at the listing appointment.

What counts as a bedroom?

When counting things like bedrooms, bathrooms, and finished square footage in basements, be sure to refer to local building requirements. Many areas have adopted the International Residential Code for definitions of things like bedrooms. But some local areas might have additional requirements.

The IRC defines a bedroom as the following:

- A floor area of not less than 70 square feet and not less than 7 feet in any horizontal dimension

- A minimum ceiling height of 7 feet, and if there is a sloped ceiling, then a minimum of 50% of ceiling must be a minimum of 7 feet high

- At least one operable emergency escape and rescue opening with a clear opening of not less than 5.7 square feet, and a required egress window that must have a minimum width of 20 inches, a minimum height of 24 inches, and a maximum window sill height of 44 inches.

Importantly, the above is why many basement rooms cannot be counted as bedrooms unless a walkout basement. There has to be a window that someone can escape if a fire.

Your local area may require closets to count as a bedroom.

2. Select Your Comparable Properties

Comparables, or “comps”, are similar properties in the area that have sold recently.

Below are the rules of thumb when selecting comps, in order of priority (in my personal opinion – every market is different!). You might still use comparables that don’t meet all these criteria, but perhaps consider weighing them less than comparables that do meet the criteria.

- Same building (condos) / Same neighborhood (single family)

- Same pool count

- Sold in the last 365 days (or last 3 months if lots of comps)

- Same garage count

- Same builder

- +/- 250 sqft

- Same story count

I’m not afraid to go back more than a year if it means staying in the same subdivision. I would rather take my chances messing up appreciation assumptions rather than looking at comps in an adjoining neighborhood that sells $40,000 more than the subject neighborhood.

Review your sold properties for major differences that may have influenced the final sale price. For example:

- screen out “as-is”, “TLC”, “investor-special”, and tenant-occupied comps. I use the Highlight This! Chrome extension to help me quickly see “problem” words when reviewing comp descriptions.

- beware homes that sold dramatically under list price (likely price-drop-in-lieu-of-repairs)

- review comments for possible dissimilarities to your subject (e.g. “Texas basements”, mother-in-law suites, seller financing, etc)

3. Choose your Adjustments and Adjust

How do the differences between homes affect your price?

Things to adjust for include:

- Square footage

- Lot size

- Year built

- Pools

- Garages

- Bedrooms and bathrooms

- Interior upgrades

- Exterior Features

- Externalities (e.g. busy roads, golf course, etc)

- Appreciation/Depreciation

You’ll want to use an adjustment matrix. More on that in a moment.

How much should you adjust for square feet?

A common rule is 1/3 of the average price per square foot of comps. If most homes are selling for $150/sqft, then your adjustment should be $50/sqft.

“Why not the full $150/sqft”, your seller may ask? The total $150 price per square foot reflects the entirety of the home value, and isn’t limited to the value of the square footage. The lot’s value is included. The most expensive parts of the home are often the bathrooms and kitchens, but you aren’t necessarily getting more of those when you add square feet (and can adjust for them separately). Therefore the square footage adjustment is not the full price per square foot of the home.

4. Review Market Activity

Now is a good time to step back and look at the bigger picture. What is going on in the local market? Are 75% of active neighborhood listings under contract? Is there a comparable active that looks like the same model on the same street pending in 3 days on market at $20,000 over your price?

Maybe you can afford to lean forward a bit and be a little aggressive with the price! Say as much to the seller.

The opposite situation is equally relevant. Look at expired and withdrawn listings. Maybe you are looking at a few solds, but there are some very concerning similar homes that failed to sell at your price recommendation.

In 2012 when the market was still recovering, almost 2/3 of the listings in my city failed to sell at all. If I had only been looking at homes that sold, I’d be ignoring most of the data that is showing caution and red flags.

My seller deserves to know about this information and have a full picture of the market!

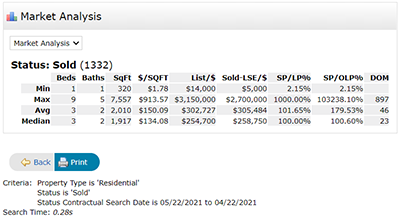

You can rely on your local MLS or association market materials. Or, even better, pull your own market stats from your MLS.

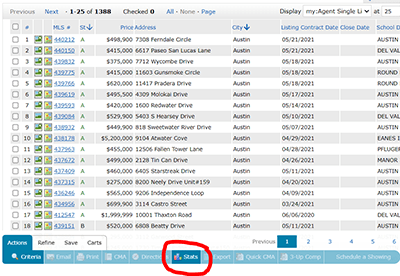

Below is an example of how to pull stats from Corelogic’s Matrix. It allows you to easily see the average DOM, price, and sale-price-to-list-price ratio. Most other MLS systems (Paragon, DynaConnect, FBS, etc) will have similar tools.

5. Select a Price Recommendation

Select a price recommendation!

Don’t call it a “home value”. “Valuations” are the business of appraisers. Instead, you are recommending a price that will get your seller’s home sold for top dollar.

I personally don’t see anything wrong with reaching a little bit on the list price. I would say something like “I think your home is worth $235,000 but would be willing to test the market at $245,000 and review after two weeks.”

Some agents might disagree and consider that overpromising. It’s up to you and your style!

Does your seller hate it? Check out how to handle some of their objections. Hopefully, your airtight CMA, overflowing with high-quality information, and your careful due diligence will win them over.

6. Prepare the Presentation

An analytical seller might be happy with your Excel file and raw MLS printouts.

Your average seller, however, will probably be better persuaded if your presentation is solid. Be prepared to explain the numbers and address concerns.

An easy but expensive way to do this is with quality CMA software. Most CMA software allows you to create aesthetically pleasing and organized CMA presentations that can be shared both at the listing appointment and via email.

Cloud CMA

$49+/mo. The best-in-class CMA software, Cloud CMA is part of the Cloud Agent Suite (which includes Cloud MLX, Cloud Attract, and Cloud Streams). Cloud CMA creates visually clean and elegant CMAs that will reflect well on you and your brand. It is available in most major MLS markets. I recommend this as the bread-and-butter CMA solution for the modern agent.

Build your seller’s net sheet as well.

I like being conservative on the net sheet, even if it means my net might look worse than a competitor agent’s sheet. I would much rather get to closing with my homeowner learning they are getting more than they expected than the other way around.

Rehearse your presentation with your colleagues or broker, including your objection handling scripts.

Tips: The Science

A CMA is a little bit art and a little bit science.

It takes some time in the business before you can judge the value of a beautiful Hill Country view, or how much a faux wood tile upgrade will add to the home value.

Nevertheless, approaching your CMA methodically and with numbers will improve your pricing.

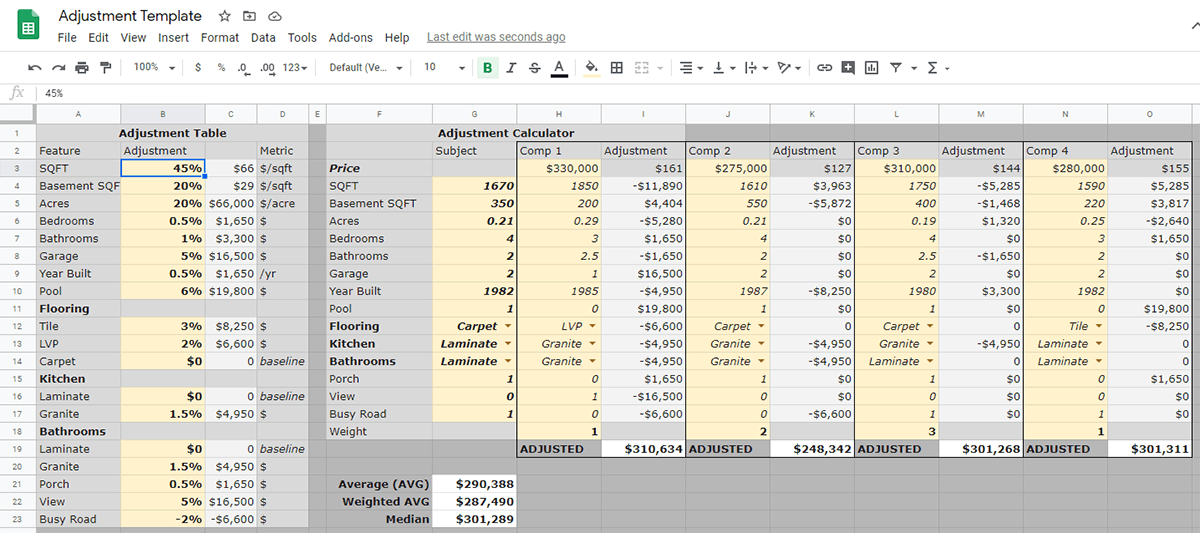

Use an Adjustment Matrix

You should have an adjustment matrix.

An adjustment matrix is a list of features and how much to adjust for each, either a dollar figure or a percentage. Your broker may have one already for your local area. It had recommendations or rules of thumb for how to adjust for different features.

It blows my mind but most CMA software does not easily allow you to get granular with adjustments. I have yet to find one that really dives into this.

Swiftly adjusting for relevant features like upgraded kitchens, pools, and “externalities” like views is essential to accurately capturing the comps’ relevance to your price recommendation. Showing sellers you’ve done some digging and haven’t left behind their granite counter upgrades in the analysis can be the kind of attention to detail that wins a listing.

I’ve created a sample adjustment template for you here! Just make a copy, modify the adjustments to suit your market, and insert the comps’ sale prices, sold dates, and home features! It’s a little more granular and customizable than the tools I’ve found available from MLSs.

Adjustment Template

The first version is filled in with an example CMA. Just delete/edit the yellow cells to start your own, or start from the Blank Version!

Use More Comps

Appraisers generally only use 3 or, at most, 4 comparable homes.

That is an incredibly small sample size. A single outlier could throw off your entire analysis and price recommendation.

A home may have sold over or under market value for a variety of reasons that wouldn’t be obvious from an MLS listing. Maybe the home smelled bad. Maybe the owners were difficult about showings. Maybe it was a cash buyer who didn’t get an appraisal and overpaid using the listing agent.

My rule is to use all comps, not just 4. If it’s a comp, throw it in. You’ll get both more accurate and more precise.

For these reasons, I also am fond of using median instead of an average or even weighted average. Medians eliminate the outliers. And with as much imperfect information as there is in real estate, there are going to be outliers that you cannot account for.

Paired Sales Analysis

Maybe your home has a feature that you’re not sure how to adjust for. Common examples are pools or “externalities” like busy roads, green space, or a lake view.

How do you compare a comp that doesn’t share these features? Is a lake view worth $10,000 or $50,000? That is a big difference to your seller! But maybe no other lake view homes have sold in the past year. What are you to do?

A paired sales analysis is a method in which you go back in time until you find a lake view home sale. Maybe it was in 2017. That’s no longer a good comp, but you can then compare it to non-lake-view homes that also sold in 2017. How much more $/sqft did the lake view home sell for? That difference might be a useful lake view adjustment.

Paired sales analysis can make your CMA more accurate by $10,000s depending on the feature.

Bracketing

Using comps that are both larger and smaller than the subject is ideal.

This is called bracketing.

If your home is the largest house in the neighborhood and all your comps are 500 sqft smaller, you are in real danger of over or under-valuing the home if your sqft adjustment isn’t perfect. Finding at least one larger home can help do a sanity check on your adjustments.

Larger homes can be especially problematic, because there is probably a diminishing return on square feet over a certain threshold. Is a 5500 square foot home really worth more than a 5000 square foot home the same way a 1500 square foot home is worth more than a 1000 square foot home?

Home Price Appreciation (HPA)

Failing to account for appreciation in a hot market can lose you a listing fast when you come in $10,000 under the other, appreciation-savvy agent.

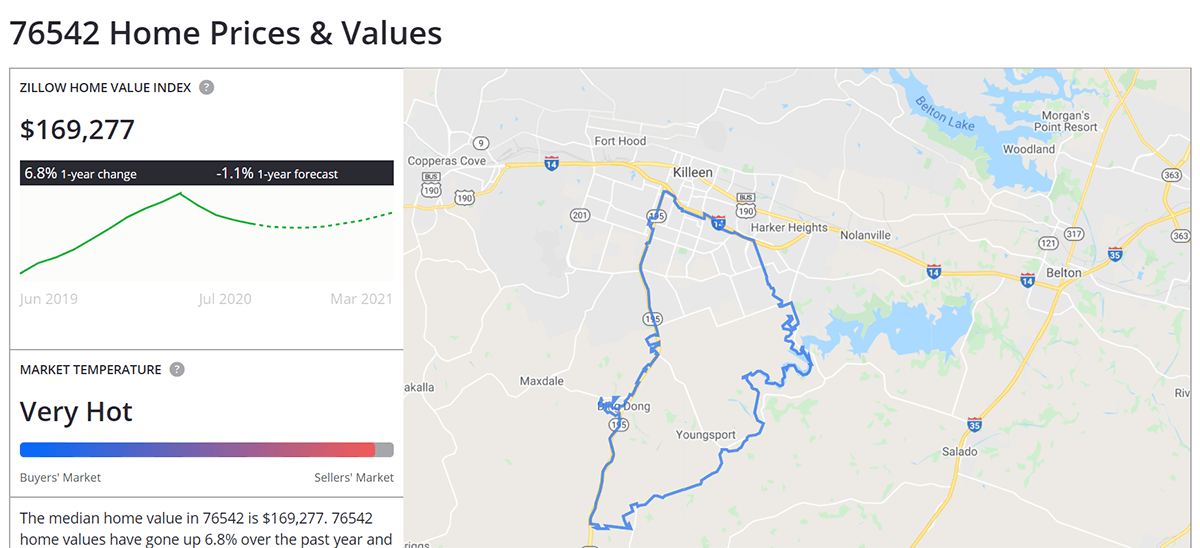

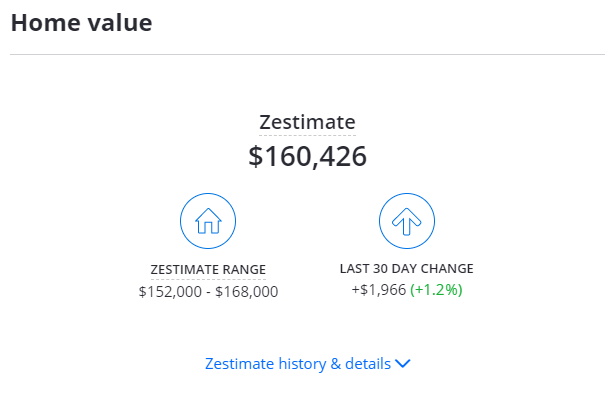

Zillow has an easy market summary by zip code you might want to use.

It includes appreciation in the past year as well as a forward-looking 1 year forecast.

A simple way to use this might be to cut the appreciation in half (assuming you are going back a year for comps and average comp closed 6 months ago) and add that to the price. For example, in my zip code above, it shows a 6.8% improvement in the past year. I might increase my price recommendation by 3.4% to account for the market improvement.

It’s a rough number, but appreciation is unknown and approximate, anyway. This is just one method of getting closer.

More Tips: The Art

You can get very detailed in carefully selecting a price recommendation for a home. You might have a very high accuracy rate. That’s great!

It’s not good enough. You’ve got to sell your homeowner on it, too.

Your analytical sheets and attention to detail will help show them your work. But now you need to also be prepared to explain it coherently and win the listing.

Talk Zestimates and Tax Appraisals

Apparently, most agents aren’t using the Zestimate in their listing presentation.

As Jay Thompson puts here, that is madness.

You absolutely need to be prepared to talk about AVMs like the Zestimate. In the 2020s, real estate consumers have increasingly more information at their fingertips, for free. They see homes. They see sales. They see Zestimates. They see their tax assessment. And they have an idea of what their home is worth before you ever step in the door.

You absolutely need to be prepared to discuss this if your recommendation diverges from these numbers.

Zillow has a table showing how accurate they believe the Zestimate is by metro area or State. You can use these numbers to show your homeowners how confident the Zestimate actually is (often it’s not very confident). In non-disclosure states like Texas, the Zestimate is especially uncertain.

For example, only 82.9% of home sales in Connecticut are within 5% of the Zestimate according to Zillow’s own data at the time of this writing. That is a lot of homes that are $10,000s off.

Similarly, you need to knock down concerns about tax assessments. At least where I live, tax assessments often include new construction homes. They are only using the previous calendar year of sales by the time they are published, meaning they are often using sales over a year old by the time I am sitting across from a seller looking at a CMA. They just aren’t very good.

Remember Active Listings

Be careful using active listings in CMAs.

I’m not sure you should use them in the CMA at all. If it is pending, then maybe you’re okay. If it’s an active that’s been languishing on the market with no price drops at 176 DOM, then maybe not.

However, it is very useful to be prepared to talk about actives with your seller. They obviously have seen their neighbors’ signs and gawked at their pictures on Realtor.com.

Come prepared with information like what is under contract, what is not, and the DOM. The home that is asking $50,000 more than your recommendation may have been sitting on the market. Look up the views and saves on Zillow to get an idea of how popular that home has been. You might be able to make the case to the homeowner that their neighbor’s head is in the clouds and that they don’t want to join them there.

Include “Non-Comparable” Listings and Withdrawns/Expireds

When making a CMA, we are trained to look for something built within 3-5 years of the comp, within 250 square feet, and then pick the best four that most closely resemble our subject property. We then include great pictures of those four homes, price adjustments, and come up with the price we recommend.

We show up for the listing presentation, start going over the comps, and the first thing out of the seller’s mouth is:

“But that one across the street sold for $385,000”

You have no idea which house he is talking about – it wasn’t one of the four comps. So you whip out your phone to your MLS app to try to find it, but your MLS app is a pain in the tush, and you’re feeling pretty awkward by now.

I’ve been in this situation enough times that I come to a listing presentation with everything that has been listed in their neighborhood. Everything.

That way, the conversation goes more like this:

“But that one across the street sold for $385,000!”

“Unfortunately, no. I see this one right here. It was listed for 6 months and actually expired. The agent just took their sign out”

Or maybe the conversation goes like this:

“It did indeed sell, but it was 500 square feet larger than your home, which is why I didn’t include it among my comparables, and even then while it was listed at $385,000, it only sold for $360,000”.

That is powerful and shows you are prepared! Bring along all the listing history in the neighborhood!

Example Complete Real Estate CMA

Here is an example of how I use the template above in my own DIY CMA.

I have custom displays set up in Matrix titled CMA with the fields that I want to show buyers and sellers. I share all the local activity, including withdrawn and expired and non-comparable sales.

Then I add the full printouts of the most comparable sales.

It’s not as beautiful as what you can produce with a service like Cloud CMA, but I like handing my sellers all the gritty details straight from the MLS with no fluff.

I don’t recommend this style for everyone, but I’ve gotten positive reactions from my more analytical sellers who want to see the full picture.

This particular pricing was extremely weird in which I used all active and pending listings. Normally that is heresy. But the sales in this neighborhood were almost entirely as-is listings bought to be flipped or as cheap rentals, and I felt the more comparable pending listings were a better reflection of a good ARV for my client.

Preparing a Market Analysis – Best Practices

CONTINUING EDUCATION (CE)

Interested in learning more about CMA best practices while earning CE credit? The CE Shop provides courses in the following states on market analysis.

Conclusion

A good CMA can be the difference between snagging or losing a listing. The free CMA software in MLSs are maddeningly flawed products. I recommend making your own CMAs using something like my products above or using a CMA software to professionalize your CMAs.

I know a little something about how to do a real estate comparative market analysis, or “CMA”.

In addition to being a real estate agent with a fair amount of local experience, I am the Pricing Manager for a single-family institutional landlord after stints in the pricing departments at two iBuyers: Zillow Offers and Offerpad.

As such, I’ve seen the good, bad, and ugly of CMAs. Here are some of the things I’ve learned about how to get the price right!

Updated March 12, 2023; Originally published on August 27, 2020.

Great article. Thanks.

Great insight, Brian. I read in another post that you put all this together in Adobe Acrobat. Any more insight on that part of the process? Do you have a sample CMA you could share?

That was silly of me not to have that already. I just edited the article to include a sample CMA section where you can download a CMA I did a couple days ago. It’s very much “my style” and I am sure most will want something more aesthetically pleasing. But the principles of choosing and adjusting for comps should be useful regardless of how you package it for the listing presentation.

How can I best fill in the adjustment cells on your template? I work in Denver, CO and I want to make sure I fill the template correctly. Thank you

The gold cells are designed for filling it in. When I use it, I find it easiest to make a copy of the existing template and then replace the comps with their information. But you may want to review the adjustments on the left to see how it matches your market.

Different areas, of course, would have totally different adjustments… how would I go about determining the % values (yellow…column B) in my particular market?

Lots of brokers have adjustment matrixes based on their hands on experience. In many cases, that might suffice and you can use this to just easily apply those adjustments to all the comps as you fill them in.

If you want to get really into it, you could use price pairing in the MLS to derive some data-driven adjustments for features like pools (e.g. pool homes sell for $250/sqft and non-pool homes sell for $225/sqft and therefore, if the average sqft is 2000, I should adjust about $50k for a pool, or 11%).

Thank you!

This was one of the most well-done and useful pieces of knowledge and information share on the entire web. Thank you kindly for sharing your expertise with all of us. I hope it comes back to you in huge blessing. Thank you

Thank you – glad it was helpful!

This may sound silly, but how did you come up with the “weight” for the homes in the CMA Adjustment Spreadsheet?

I’ll generally weigh the homes based on how similar they are or how recent. More recent sales will be weighed higher. Same story, pool count, subdivision, year built, etc. So that is very subjective. As far as the actual number you use, you can use whatever # you like. The weight will be relative to other numbers you use. So if it’s easier to weigh them “25, 25, 10, 40” for a 100 total, then that works! I use a simple scoring system of 1-10, meaning a property I rate a 3 will be weighed 3x as much as a… Read more »

I have been looking for a good way to automate my CMAs for some time and the subtractions and additions can be the most difficult part. I realize you cannot totally automate a CMA as each property has its own unique features and neighborhoods but setting up a basic plan can be very beneficial. You did a terrific job, much better than the CE Shop course, Preparing a Market Analysis although I did learn some things from this as well. Thank you so much for sharing.