Real Estate AVMs and What They Mean for Realtors in 2023

An automated valuation model (AVM) in real estate is an estimated fair market value for a property, produced by a machine learning model.

AVMs are just one example of the many ways big data is influencing the future of residential real estate.

AVMs input sale prices and property data as features into a machine-learning model to create a home value estimate.

You may be familiar with consumer-facing AVMs like the Zillow Zestimate. But the primary consumers of AVMs are mortgage lenders and institutional investors.

Yes, lenders have appraisers to confirm the value of a property they are lending on. But lenders and mortgage investors use AVMs in risk management fields, estimating home equity, and quickly coming up with approximate portfolio value.

Even further, Fannie Mae now purchases qualified homes without appraisals. As AVMs further improve, they will conceivably begin allowing more and more loans to skip the traditional appraisal process. In fact, real estate appraisers have ever-shrinking job security as they get replaced by the big data and machine learning tools of AVMs.

So how about we check out some AVMs! I looked up the AVMs for the same property at six different sites to get a feel for how diverse these AVMs are.

List of Common Real Estate AVMs

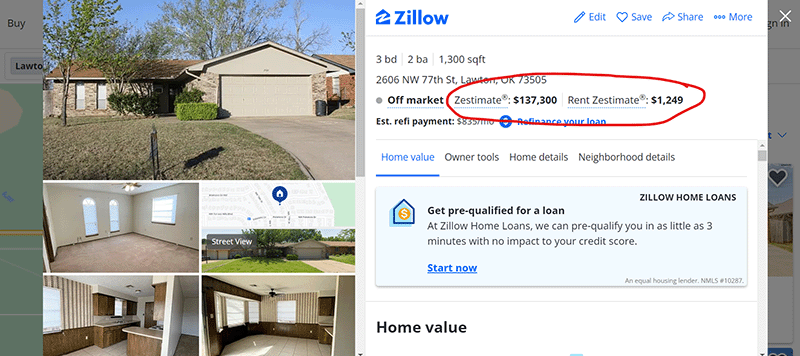

Zillow Zestimate

Of course, you know the Zestimate!

The Zestimate was one of the first publicly available AVMs, which at the time was quite controversial, especially among real estate agents.

But Zillow clearly knew what they were doing as even NAR has an AVM now (more on that below).

The Zestimate is so pervasive in the consumers’ minds that agents need to be prepared to speak about it in their listing presentations, explaining why it is high, low, or, occasionally, right on the money.

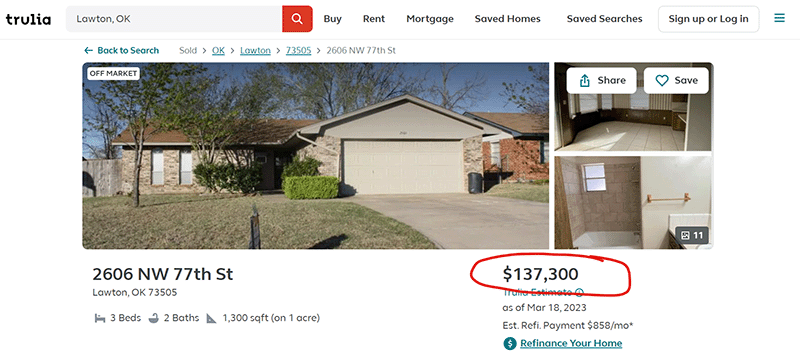

Trulia AVM

Despite being part of the same company as Zillow, Trulia has in the past had different consumer-facing AVMs. Zillow has multiple AVM models that they test separately. But it looks like for the moment the #s are now the same.

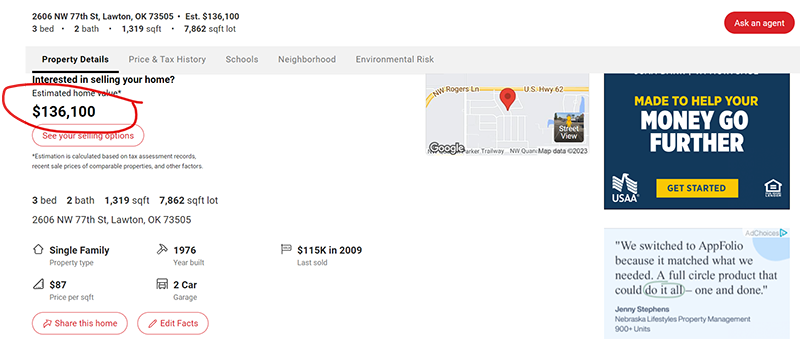

Realtor.com AVM

Realtor.com also has an AVM prominently on their property pages, exactly like Zillow and Trulia.

While their estimate is on the higher side for this particular online home page, it doesn’t mean that they are higher generally. This is just one data point.

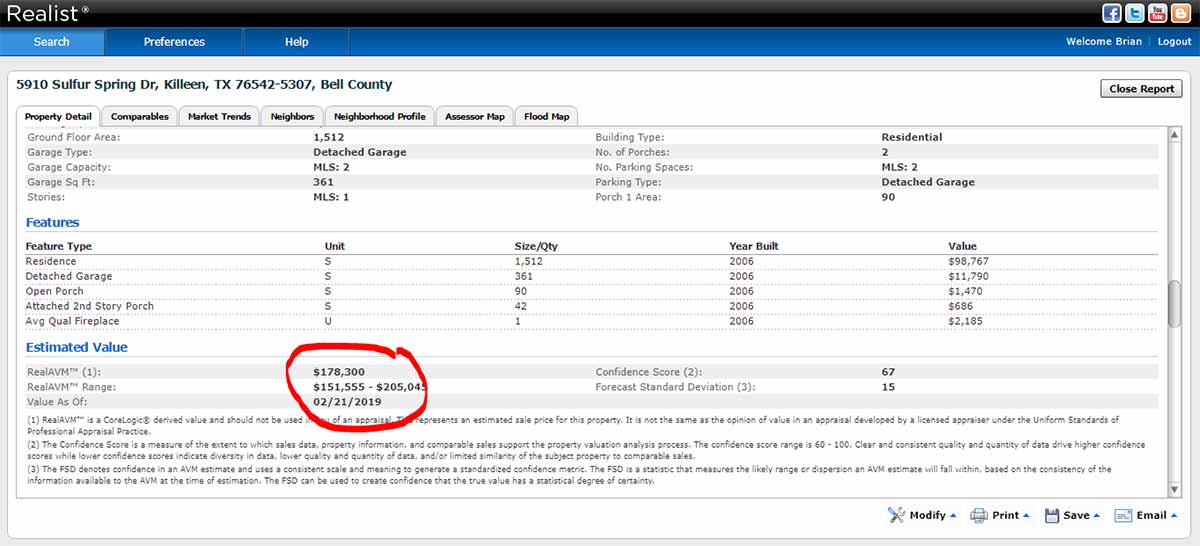

CoreLogic RealAVM

RealAVM is one of the products from real estate data goliath CoreLogic. Realist pulls from public records to create a reasonably complete picture of a home’s traits and history.

While there is no consumer-facing AVM that I am aware of, real estate brokers with CoreLogic’s Realist product have the RealAVM as part of their property information sheet. It includes a range and confidence score.

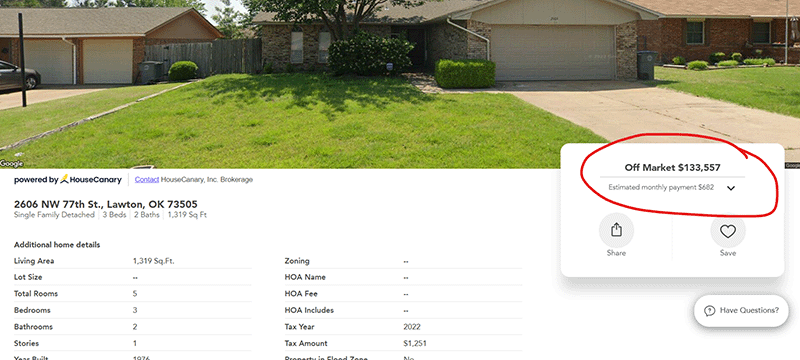

HouseCanary

HouseCanary is an established AVM and brokerage CMA company that has provided B2B AVMs to agents, brokers, and, especially, institutional investors. They launched their own portal to compete with the likes of Zillow and Realtor.com called ComeHome.

Naturally, their portal includes an AVM as a prominent feature of their property pages.

It’s common for companies to have multiple methods of calculating AVMs, and even use each other’s tools. For example, CoreLogic above has added HouseCanary’s AVM estimate to a group of other AVMs that help inform their lenders and investors on pricing.

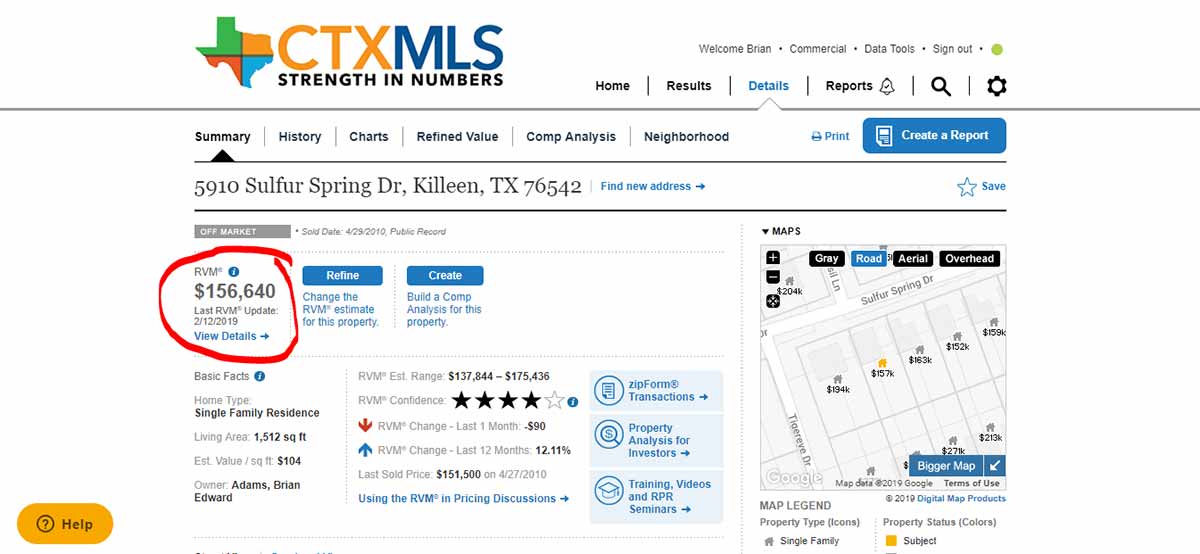

Realtor Property Resource (RPR) RVM

A lot of real estate agents resent AVMs. They feel that AVMs are trying to do their job – inform sellers of what their home is worth. Moreover, AVMs like the Zestimate might give sellers incorrect expectations about the actual value of their home.

I once worked with a seller whose Zestimate was $70,000 higher than the $200,000 I told her her home was worth. She listed with another agent who listed it at $240,000. Five months later it finally sold for $205,000.

But before Realtors get too grumpy, they should realize: the National Association of Realtors itself has an AVM.

RPR calls their AVM an “RVM” for “Realtors Valuation Model”. RPR is NAR’s property database with information, listing tools, CMA functions, and, yes, an automated valuation model estimate.

Realtors have access to the RVM via RPR, a member benefit for all NAR members.

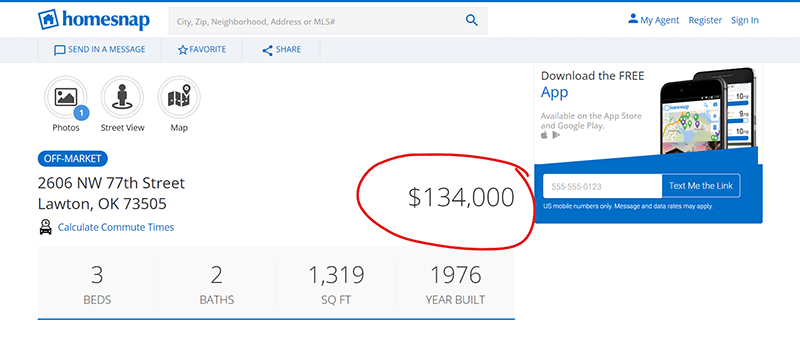

Homesnap

Homesnap is the agent-friendly consumer face of Broker Public Portal.

And includes an AVM! It looks like they round to the nearest $1000.

Freddie Mac Home Value Explorer

Freddie Mac is one of the two government sponsored enterprises GSEs (the other being Fannie Mae). These are giants of the secondary mortgage market that repackage conforming mortgages to be bought and sold by investors.

These companies have AVM needs because they often need to quickly and approximately evaluate portfolios of hundreds, thousands, or even hundreds of thousands of homes.

Freddie Mac has a Home Value Explorer for an AVM.

Others

Often mixtures of AVMs are used. For examples, Realtor.com uses at least 3 different third-party vendors to producer their AVM estimates on their website. Other AVM companies include:

- ATTOM Data Solutions

- Collateral Analytics (Black Knight)

- Veros

- Quantarium (Xome)

- Clear Capital

iBuyers

Arguably, if not for the AVM, the new iBuyer model of real estate would not exist.

Zillow used a version of the Zestimate when it was an iBuyer. But other iBuyers are developing their own tools for valuing properties. Opendoor makes some offers entirely based on what their AVM, although subject to change after the inspection.

In order to be cost effective, iBuyers cannot afford to have an army of pricing analysts to price the hundreds of inquiries they get, or updated offers they send. When only a small percent of inquiries are serious sellers, you can lose a lot of money quickly on variable costs in a low-margin business model.

The efficiency of creating an automatic valuation means these iBuyers can respond quickly to inquiries and be very efficient in their pricing strategies. While all iBuyers still employ pricing teams to manage the offer price, their AVMs are a key to their success and growth.

Pros and Cons of AVMs

Pros

- Quick. Pricing a home can take 10-60 minutes or more depending on how accurate and experienced you are. When you are a business needing to price hundreds or thousands of homes in order to inform a business decision, the speed of an AVM is an essential shortcut.

- Lead Generation. Zillow uses the Zestimate for lead generation. Consumers know they can go to their site to get a guess of what another house is worth, even if it is off the market.

- Equity Tracking. Tools like Homebot use AVMs to estimate a homeowner’s home equity in monthly market updates. While it might not be perfectly accurate, it’s a helpful way of estimating your financial situation.

Cons

- Less Accurate. Some think that accuracy is a benefit of AVMs because humans can have biases. Well, so can AVMs. It is simply laughable that an AVM can be as comprehensive in valuing heterogenous real estate inventory as can a human. Read more about my own experience in the pricing industry and why automated valuations will lag human accuracy for the foreseeable future.

- Unreliable or Useless in Data Thin Areas. Some types of homes or segments or locations have extremely few sales in any given year. An AVM struggles to price homes like these. Sometimes it simply cannot and many AVMs will not provide an estimate at all. Secondly, the quality of the data can be an issue for AVMs. Agents may misreport home characteristics in the MLS. A tax assessor may have counted the garage as conditioned square footage.

- Ignorant of the condition. An AVM doesn’t know if your roof just sprung a leak, or your foundation has sunk a foot into the ground on half your home. Nor would it know necessarily if you had put in a pool or remodeled the entire home, something that would improve the value.

- Late to changing market conditions. An AVM is a “nowcast”, reflecting what the home is worth today. Some AVMs are capable of “forecasting” homes and making estimates of home appreciation. These can be useful for home sellers and make AVMs more accurate, but AVMs regularly misjudge economic conditions and over or underestimate home prices.

Dealing with AVMs as a Realtor

Fortunately, AVMs are nowhere near being able to replicate the price analysis of a well-trained real estate agent. The good ole fashioned CMA is still far superior to robots at identifying a price for a home. Humans are still better at selecting comparable properties, and have more comprehensive access to information about subject properties using MLS data.

Agents often use a valuation tool like CloudCMA or dashCMA, both of which reference common AVMs like the Zestimate to compare to the agent’s analysis.

Nevertheless, AVMs are ubiquitous. It’s almost a foregone conclusion that your home seller has looked at at least one public portal with a home value estimate.

As an agent, you have to manage those expectations when your CMA suggests a different price, as it often does.

If your price is higher, then hopefully you are bringing good news to your homeowner!

If your recommended price is lower, then be prepared to explain the limitations of AVMs – share this article even! – as well as come prepared with a solid CMA with lots of information that confirms your pricing recommendation.

Zillow has a page about its accuracy and confidence level in different markets. Depending on your market, this information might be useful when dealing with a seller who is influenced by the Zestimate.

Conclusion

There is no substitute for a real estate agent’s comparative market analysis (CMA) or broker’s price opinion (BPO).

AVMs have a long way to go, but as real estate data and the models improve, so will AVMs. But it will be decades at least before pure number crunching can reliably surpass the accuracy achievable with a capable, well-informed, local expert.

Become that expert by learning how to crush CMAs with some CE!

Preparing a Market Analysis – Best Practices

CONTINUING EDUCATION (CE)

Interested in learning more about CMA best practices while earning CE credit? The CE Shop provides courses in the following states on market analysis.

Updated March 18, 2023; Originally published March 1, 2019.