Zillow 2.0 Failure | Why Is Pricing Homes So Hard?

I worked for Zillow Offers from 2019 to 2021 in their acquisitions department and had front-row seats to the abrupt defeat of Zillow Offers.

If I could describe the reason Zillow failed in a single word, it would be schwerpunkt.

Schwerpunkt is a German military term that means the center of gravity. The US Army manual ADP 3-0 defines the center of gravity (COG) thusly:

A center of gravity is the source of power that provides moral or physical strength, freedom of action, or will to act (JP 5-0). The loss of a center of gravity can ultimately result in defeat. A center of gravity is an analytical tool for planning operations. It provides a focal point and identifies sources of strength and weakness. However, the concept of center of gravity is only meaningful when considered in relation to the objectives of the mission.

ADP 3-0

Zillow failed to keep its center of gravity. But what is the schwerpunkt of an iBuyer? What is the one element that you cannot fail at without risking the entire enterprise?

I would argue the iBuyer schwerpunkt is accurately pricing homes.

And, unfortunately for Zillow, accurately pricing homes is really hard.

The Rise and Fall of the Zillow Zestimate

How is it possible for Zillow, of all companies, to fail at pricing homes? They’re Zillow!

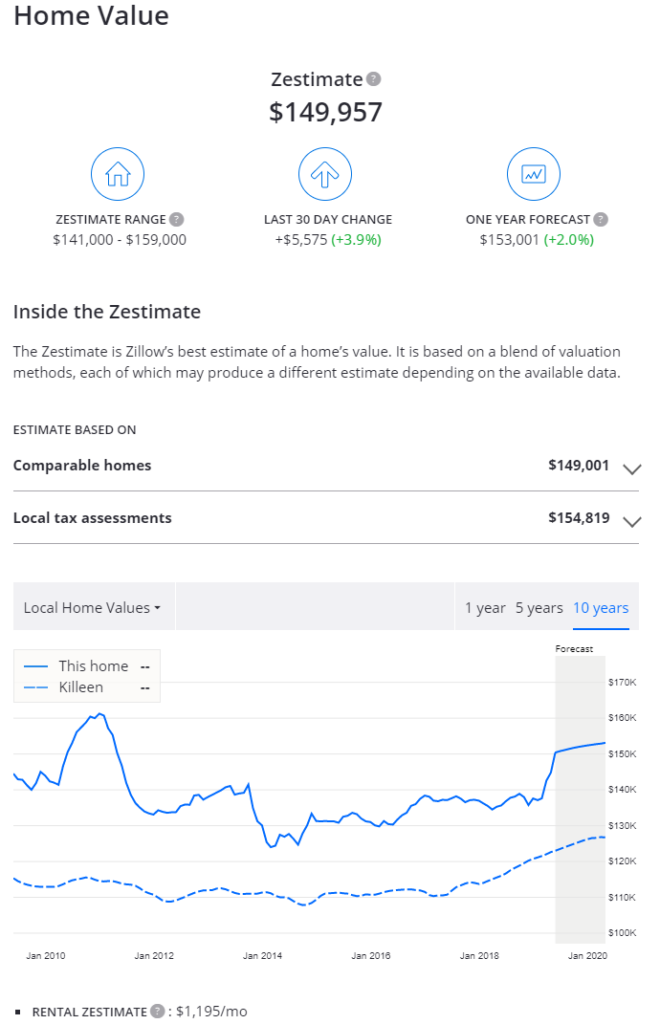

Zillow built an empire on the back of the Zestimate, a home price estimate. The Zestimate made AVMs cool and accessible! Zillow prided itself as a technology company with first-class data science and economist talent hired from the likes of Amazon, Facebook, and Google. They were as well poised as anyone to succeed at scalable and algorithmic home pricing!

In fact, iBuying was conceived as an extension of the Zestimate. In 2006, the Zestimate was new and unique. It catapulted Zillow into relevance and allowed it to surpass its established competitor, Realtor.com.

But ten years later, everyone has their own AVM. Zillow lost its unique selling proposition.

But what if, unlike Realtor.com or Corelogic or House Canary or any of the other AVMs, Zillow put its money where its mouth was? What if the Zestimate was a guaranteed offer?

The resulting business model would be that of a market maker, someone who buys and sells a commodity at small margins. Zillow would benefit by capturing huge portions of the real estate transaction like mortgage and insurance and become the ecosystem of real estate in the same way Amazon is the ecosystem of online commerce.

And it would all begin with the Zestimate 2.0.

But Zillow had a long way to go to get to Zestimate 2.0. Since its inception, real estate agents lampooned Zestimates as inaccurate. Here’s just a sampling of the popular memes agents have acrimoniously shared.

Zillow was betting on itself in Zillow Offers. But it would seem agents have the last laugh.

With Zillow Offer’s demise, the Zestimate has seemingly been exposed as a fraud. Instead of capturing the transaction as a market maker, Zillow must look elsewhere to launch its badly damaged journey toward becoming the ecosystem of real estate.

That is, at best, an oversimplistic narrative that doesn’t explore why pricing homes is so hard, and how the future may still be different.

Why Pricing Homes is So Dang Hard

It turns out pricing homes is difficult.

This isn’t about “algorithm vs human”. Both humans and algorithms have a role in pricing homes. Even crafting a simple CMA with adjustments and appreciation is technically a form of an algorithm that most agents use. Big companies like Zillow just use increasingly sophisticated algorithms.

An NBER paper from a year ago has a really interesting summary of the dilemma that is specific to iBuying, but also applicable to all home valuation operations.

To provide valuable liquidity service, transactions must be closed quickly. Yet, the intermediary must also be able to price houses precisely to avoid adverse selection, which is difficult to accomplish quickly. Low underlying liquidity exacerbates adverse selection

I talk below about a few of those challenges mentioned, and more. They are impediments to accurate pricing for both humans and algorithms alike.

Heterogeneity

Let’s start with the obvious reason that pricing homes is difficult: heterogeneity.

There are no two homes that are alike. Not even your cookie-cutter D R Horton new build is identical to the same floorplan built down the street. The location, orientation, finishings, and more are all different. After a year or two of use, the condition is now different.

When selecting comparables for your market analysis, you are constantly making compromises. You pick a comp with a pool, and try to adjust for it. You pick a comp from 8 months ago, and try to include appreciation. You pick a comp from a different builder, and weigh it less in your final recommendation. You pick a pending comp and guesstimate its close price. It’s a lot of work accounting for all these differences between homes (which we’ll talk more about in a bit).

The opposite of heterogeneity is homogeneity, or what are called fungible goods in economics. Two dollars are effectively identical. A barrel of oil is effectively identical in value to another barrel of oil. Your iPhone 13 is effectively identical to another iPhone 13. Consequently, these things are generally very easy to price!

Fine art is perhaps the only other expensive asset more heterogeneous than homes.

Illiquidity and Transaction Volume

Have you ever bought an extremely small-cap stock with very little trading volume?

The first time I did, it was shocking to me.

Unlike big companies that trade constantly, the spread on a small-cap stock is huge. There may only be a willing buyer at $5/share and a willing seller at $10/share. Is that stock worth $5? $10? $7.5? Who knows!

Further, when I purchased it, my tiny amount of money was enough to move the stock up! I single-handedly caused the stock to gain for just a few $1000.

Then, when I tried to sell, there was no one buying at the last sale price! The only way to exit the position was to accept a price several dollars less than what the “market” price was, based on its last sale.

Housing is far more illiquid than these stocks. Transactions take weeks, not minutes.

Consequently, the transaction volume is also greatly reduced. There are oftentimes only a dozen or even fewer transactions per year in a single neighborhood.

When you purchase a highly liquid stock like $AAPL, the price you pay is based on the price paid just seconds before. There is enough volume that the information you have is extremely current.

Compare that to a home, where you might have to look back 6 months or more before finding a really good comparable sale. Think back 6 months. Has the market changed in the past 6 months? You have to figure out how and figure that into your price.

Bad and Missing Data

Digital real estate data is fragmented. Not even Black Knight and Corelogic have comprehensive databases of available digital real estate data.

But worse, most real estate data does not exist digitally. It is analog.

You, Mr. and Mrs. Real Estate Agent in Your Town, USA know useful things about your local market that is not recorded anywhere, or represented in an Excel spreadsheet.

Friederich Hayek wrote beautifully on this phenomenon he called the Local Knowledge Problem:

Today it is almost heresy to suggest that scientific knowledge is not the sum of all knowledge. But a little reflection will show that there is beyond question a body of very important but unorganized knowledge which cannot possibly be called scientific in the sense of knowledge of general rules: the knowledge of the particular circumstances of time and place. It is with respect to this that practically every individual has some advantage over all others because he possesses unique information of which beneficial use might be made, but of which use can be made only if the decisions depending on it are left to him or are made with his active cooperation.

The Use of Knowledge, Friedrich Hayek

Location, location, location! By its very nature, it defies digitalization!

Take a moment and think about every plausible element that might affect a home’s value. I call these “pricing influences”. How many pricing influences are captured digitally somewhere for a pricing analyst or algorithm to consider?

Let me give it a quick albeit incomplete try:

- Externalities (backs to a railroad, views, etc)

- Internalities (# beds, sqft, flooring type, etc)

- Supply and Demand

- Floorplans

- Builder Quality

- Seasonality

- Depreciation (roof, HVAC, etc)

- Repair Concessions

- Seller Concessions

- Foundation Stigma

- Other Stigma (haunted!)

- Future Development

- Tax Treatment

- Personal Property

- Encumbrances

- Mismatched Upgrades

- Appreciation

- Listing Agent Quality

- Buyer Type (institutional vs retail)

- Smells

- Showing availability

- Dual agency

- Cooperating commissions

- Occupancy Type

- Financing Type

- Arms Length Transaction

- Distressed Sale

- Listed in Portals?

- Listed in “correct” MLSs?

- Zoning

- School District

How much of this data is in the MLS? I’d say less than half. And even then, that’s assuming the listing agent A) bothered to fill it in, and B) did so correctly.

“Externalities” and “internalities” alone, as categories, account for a nearly infinite amount of possible data about a home to consider.

Supply and demand is another fickle category that requires describing the state of housing inventory in the local market and the waxing or waning demand for said inventory.

Meanwhile, the primary data collectors in our industry are real estate agents themselves. How thorough are agents at filling in all the available fields in a listing? How accurate are they? About half of Austin agents are putting “hardwood floors” in MLSs when they’re actually luxury vinyl plank.

How consistent are agents about whether or not to count the office as a bedroom?

How often are agents about closing out listings with correct representations of the seller concessions, often sums that can affect a CMA by $1000s or $10,000s?

The Real Estate Standards Organization (RESO) is making great strides in data standardization in the industry, but is still far from categorizing all the influences I shared above.

The result is that both humans and algorithms are working with a very incomplete picture of all the features and facts that influence the price of a home.

Subjective Extrinsic Value

Two dollars is worth more than one dollar. That’s not confusing. That’s probably true for literally everyone on the planet. That value is intrinsic to the nature of dollar bills.

A cure for diabetes has no downsides. Its value is intrinsic, and would be appreciated by again literally everyone on the planet.

There’s no such thing as real estate with intrinsic value.

Instead, real estate’s value is only in what buyers assign it. And in some cases, it is less than $0!

Not only that, but the value people assign to real estate and its features are highly subjective. So much so that one property feature might add value for one buyer while subtracting value for another.

Consider an above-ground pool. Those would seem like a positive adjustment on a real estate comparative market analysis (CMA). Pools are worth money, even above-ground pools! Right?

Except for the buyer who dreads the expensive maintenance and liability of pool ownership and is actually planning on paying money to tear the pool out! That pool is worth negative money! The house is worth less!

It’s not as simple as just adding a $15,000 adjustment for an above ground pool.

Even things we might think as having an unambiguous value like square feet or acreage can get complicated for the retired couple who doesn’t want too much house to clean or a big yard to mow. Suddenly, that space can start taking on negative value. There is a marginal diminishing utility that is different for every buyer.

Chaos Theory, aka “The Butterfly Effect”, and the Long Sales Cycle

Pricing homes can be better described as forecasting home prices. And it’s not that much different than forecasting the weather.

If you haven’t read about how Edward Norton Lorenz stumbled upon what would ultimately be called chaos theory, it’s worth reading about more!

Basically, he was trying to use a computer to predict the weather. While running the exact same simulation, he continued to get completely different results. He finally figured out why. He was rounding to the 1000s place in one simulation and not the other. One simulation was using 0.892243 and the other was using 0.892.

That 0.000243 difference was enough to radically change the weather prediction.

Chaos theory is summarized as follows:

The present determines the future, but the approximate present does not approximately determine the future.

Chaos Theory

This phenomenon is also called “the butterfly effect”. The tiny change in atmosphere from a butterfly flapping its wings in Brazil can cause a tornado in Texas.

It’s a major obstacle to predicting anything. It’s not good enough to be “mostly right” about the world as it exists today, because “mostly right” will not predict the world of tomorrow.

What does this have to do with real estate?

Real estate has a very long sales cycle. It is almost always at least a month if not several months between when you price a home and when it actually sells.

There’s no better example of just how much havoc this can wreak than the 2021 housing market that did Zillow in.

Who could have anticipated that COVID would cause the real estate market to surge, even after a ten-year bull market? Or that the surge would not only continue into 2021 but rise as much as 50% in markets like Austin? Failing to predict the Austin market alone introduced 5-10% error in home pricings.

Meanwhile, the demand for single-family homes shot through the roof while condos languished behind in many markets, due to the COVID-inspired work-from-home trend.

In a complex world, actions and events have non-linear consequences out of proportion to their size and are nearly impossible to predict accurately and precisely.

This is true of all forecasting, and especially true when forecasting requires the kind of precision that iBuying would.

Adverse Selection

Unfortunately, it’s not enough to be accurate. You have to be precise, too.

Imagine you are too conservative by 5% on half your pricings, and too aggressive by 5% on the other half. No big deal! It averages out to 0%! That is technically perfect accuracy!

Except for adverse selection.

Adverse selection means that your worst pricings are the ones most likely to count. For both Realtors and iBuyers, their worst pricings are the homes they overprice.

If you promise a homeowner more than their house is worth, they are far more likely to accept your offer than they are if you are offering less than their home is worth.

Some unethical Realtors do this intentionally. It’s called “buying a listing“. It’s a lot easier to drop the price on a listing later than to have not gotten the listing at all! The agents who gave the seller a “correct” price didn’t get the listing, did they?

I would argue it doesn’t reflect well on your business, though, to have your sign in front of overpriced homes that are not selling.

Unlike agents, iBuyers are much more accountable to their price they offer. They are actually buying the home! That makes adverse selection even far more dangerous.

The deleterious impacts of adverse selection will compound with more competition. If your competition is pricing better than you are, you are more likely to convert on your worst pricings. They won’t undervalue the homes you do, meaning they will get the listing instead of you. And they won’t overvalue the homes you do, meaning that you will get the listing on overpriced listings.

You and your competition are in a Red Queen’s Race. It’s not enough to get better at pricing! You have to get better at pricing as compared to your competitors.

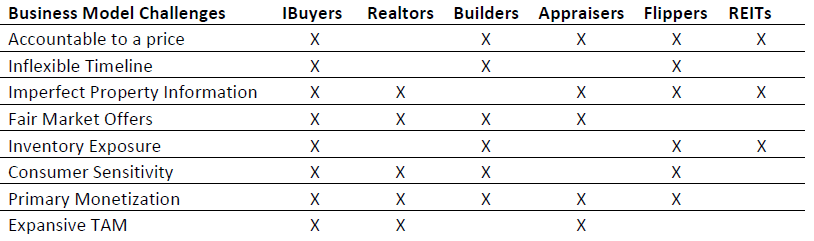

iBuyers Have it the Worst!

When it comes to pricing homes, there is no more difficult business model than iBuying.

Home flippers buy at 70% ARV to paper over underwriting errors.

Realtors aren’t personally held accountable to their price, while still promising homeowners the upside of full market value.

Appraisers work for lenders, whose valuations seldom become relevant except during foreclosure and repossession, usually years after the appraisal was conducted.

Builders have a consistent and highly predictable product about which they have nearly perfect information, down to the brand, cost, and color of grout used between bathroom tiles.

Real estate investment trusts (REITs) and institutional investors can strategically time their dispositions to make the most of market movements, all while monetizing the asset with rental income. Plus, rental consumers are less sensitive to home features and condition than are buyers. Renters intend to live in the home for shorter durations and are less exacting about the home they are renting. Unlike a market maker, REITs have no intention of serving the majority of US households and have a much more selective TAM (total addressable market). Some REITs completely close down operations in entire cities just to reallocate capital to more favorable markets. The REIT model has also benefitted from existing almost entirely during historic housing bull markets in which pricing misses are salvaged via appreciation.

The iBuyers have none of these advantages.

Zillow failed to execute a vision to create a new category of home valuations that could respond to all these challenges.

Why Pricing is the iBuyer Schwerpunkt: Trust

So what?

Who cares if pricing homes is hard? Buy the ones that work out, and charge a fee to make up the difference!

The reason that is wrong is getting back to the Zestimate, and how so many agents mocked it for so long.

The entire premise of Zillow Offers was to supercharge consumer trust in the Zestimate. Zillow was putting its money where its mouth was. The point was to earn trust. And you do that with accurate prices.

Selling with a market maker is the equivalent of placing a market order on the stock market. You trust that your order will be filled at or near the prevailing market value.

Selling traditionally with an agent is the equivalent of selling with a limit order. You do not trust a single value and want to be sure you don’t get an unsatisfactory price.

So how accurate does the Zestimate need to be to earn the consumer’s trust?

You tell me. How close does an offer need to be to your home’s fair market value for you to accept it? Plus or minus 5%? 2% 1%? At what point are you comfortable filling in a market order instead of a limit order?

I don’t know the answer to that question, but I am guessing it’s less than 5% for the vast majority of consumers. 5% on a $320,000 transaction, the average home price in America, is $16,000. That’s 30% of an American’s entire average annual salary! Most consumers are going to be price sensitive to that amount.

You can have bad customer service. You can have sloppy renovations. You can list homes for too high or too low. But you will survive if you can price homes well!

The reverse is not true. You can have amazing customer service. You can have cost-efficient renovations. You can list homes for exactly the right price. But you will go out of business if you price homes poorly.

That’s why accurate home pricing is iBuying’s schwerpunkt.

I might be biased, as pricing homes was my job at Zillow. Of course I think I was the most important part of the business model! But hopefully I’ve persuaded you that I am important!

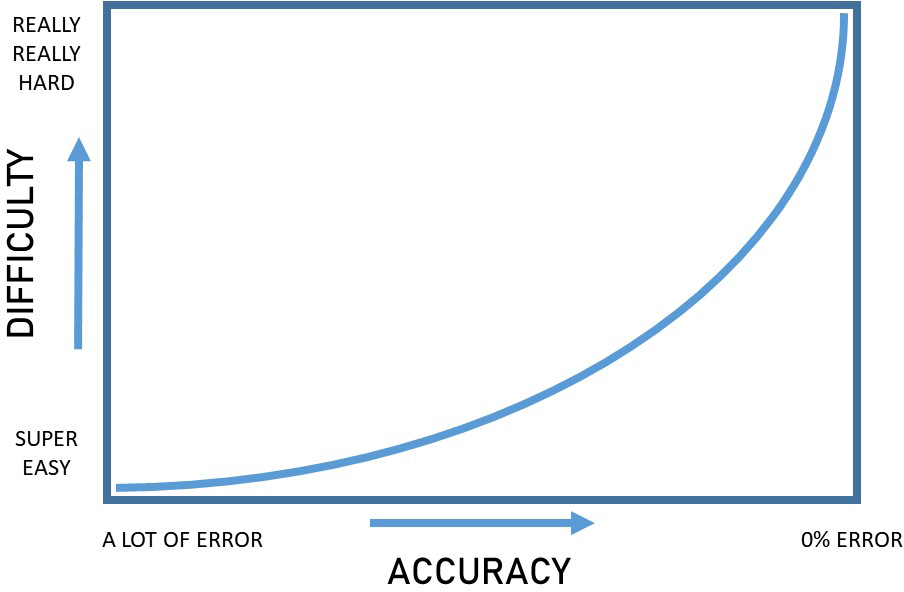

The Asymptote of Perfection

A final thought on trust and how hard it is to price homes.

What are the odds you could correctly guess a home’s value from a single picture and address within plus or minus 50%?

Probably pretty good!

Plus or minus 10%?

Doable!

Plus or minus 2%?

😬

Let’s imagine that you would need to be within 1% of the final resale price consistently to earn trust. The average home sale today is about $320,000. That means a market maker offer would need to be plus or minus $3200.

A $500 pricing error means you’re already 15% off target. Mistaking a Kenmore dishwasher for a Bosch dishwasher has a major impact on your pricing success.

Each marginal improvement in pricing accuracy becomes exponentially more challenging. Every next basis point in accuracy is going to be more difficult to earn than was the previous basis point.

You’ll never reach perfection.

Hopefully “good enough” is somewhere far enough to the left on the X-axis that the effort required is within your means.

How to Get Better at Pricing

So how do we get “good enough”? Pricing homes is what I do! Surely it isn’t hopeless! There are a few items that come to mind:

Shorten the Sales Cycle

The longer the time between when you price the home and when it sells, the more opportunities for your prediction to be wrong. Whether it is the changing market conditions or a busted pipe in the home, time is not a prognosticator’s friend.

For Realtors, an example to shorten the time between pricing and sale is to be sure to update your CMA the same day you send the listing paperwork. Mabe the listing presentation was a few weeks before. Have you updated your CMA since then? A lot can happen in two weeks that is relevant to the market potential of your home.

For iBuyers, shortening the sales cycle means getting faster with renovations and turnaround, and perhaps giving consumers shorter closing windows.

Get Better Data

MLSs are frankly pretty abysmal, in my opinion, at curating data that can be optimally used for data consumers.

Maybe that’s intentional to try to make it hard for the “technology” guys to find the data too useful.

A small example I already mentioned are the close-out fields. Our MLS has a single field for “seller concessions” when closing out. What the heck does that mean? Is that the number in Paragraph 12 of the TREC contract? Does that include repair concessions? Title, survey, and home warranty? Was dropping the price to accommodate a low appraisal a “concession”?

These numbers represent $1000s and $10,000s worth of influence on the market price of a home that are not reliably represented. Not in my MLS, anyway.

Getting more involved in the UX of Matrix and Paragon, via your MLS Committee or board, might be a worthwhile way of improving this for Realtors.

In the meantime, be sure you are familiar with the RESO dictionary yourself and using terms and fields correctly when crafting CMAs.

For larger brokerages and enterprises, it may mean integrating more third-party data sources from companies like Corelogic and Black Knight to give themselves as complete a picture of the data as practical.

Think in Terms of Probabilities

With respect to how subjective real estate is, it may be better to think in terms of probabilities.

I used the example of how an above-ground pool may be a positive for some buyers and a negative for others. How should we adjust for pools, then, when pricing?

Well, perhaps we can estimate the probability that buyers will find that feature desirable and the value they may assign to it.

Instead of “pools are worth $15,000“, it becomes “80% of buyers would value an above ground pool at $20,000, and 20% at -$10,000, and I will therefore adjust pools at $14,000 [(20,000 * 0.8) + (-10,000 * 0.2)]”.

Obviously, a home with an above-ground pool is more likely to attract home buyers interested in above-ground pools, but we’ve already accounted for that in our percentages, estimating that 80% likelihood that the final buyer will appreciate the pool.

Using this method, we can also start to get an idea of how error-prone our pricing analysis might be. In this case, we might be wrong by $6000 in the case of a pool-loving buyer or $24,000 in the case of someone keen on tearing the pool down.

An alternative way of thinking about this is that we are pricing the home $6000 less than “full market value” based on the 20% risk that the eventual buyer does not value the pool the same way the ideal buyer would be expected to.

Embrace Optionality

This is a bit cheating as it’s less about getting better at pricing and instead about surviving the inevitable pricing mistakes.

Nassim Taleb wrote Antifragile, a worthwhile book about long-tail risks and building organizations impervious to them. Or, better yet, according to Taleb, organizations that thrive on long-tail risks.

His prescription for this is optionality. That is, setting yourself up so that you have as many future options as possible and can quickly pivot between solutions as events unfold.

An example in the iBuyer space would be partnering with institutional investors to buy rentals. If you overprice homes and end up with aged inventory on your books, being able to quickly pivot these into rentals can limit your losses, or even serve as a countercyclical business model! You built optionality for yourself!

Lead with Auftragstaktik

Good forecasting means being adaptable, and making rapid, small changes that update with changing conditions.

Phillip Tetlock wrote the excellent book Superforecasting, about how people can be trained to get better at predicting world events. It has a lot of interesting advice on Ferminization, Brier scores, and more.

But what spoke directly to my heart the most (and admittedly confirmed my priors as a West Point graduate) was the chapter on leading a forecasting organization. He advocates for Auftragstaktik.

Auftragstaktik is called “Mission Command” in the US military. Leaders share and achieve alignment on the end state or mission, and ensure the team is well trained. But they give flexibility to subordinates in how to accomplish the mission.

Instead of relying entirely on the accuracy of forecasting in a centralized plan, Mission Command enables rapid and effective adaptation to a changing and data-rich environment.

Other relevant military concepts to good forecasting include net-centric operations and power to the edge. Empower the people closest to the problem because they will be best equipped to respond and adapt to current conditions.

What’s Next for iBuying ?

Zillow did not fail because pricing homes is hard.

This article isn’t a dissection of the reasons Zillow failed. If you want to know my thoughts there, you can read an article I wrote that does not mention Zillow but was very much written with my Zillow experience as a subtext.

Zillow failed at iBuying for reasons that were ultimately unique to Zillow.

These problems are all tractable, and companies like Opendoor and Offerpad are eagerly carrying that torch along.

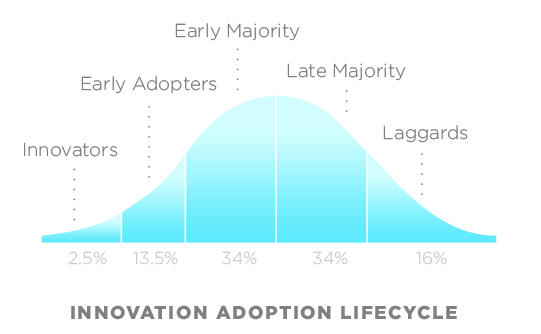

In the near future, iBuying may remain a niche offering. Even in its most established markets, iBuying is less than 10% of transactions, firmly within, at most, the “early adopter” stage of the technology adoption lifecycle.

5-10% of transactions is nothing to sneeze at, though. Nationalized, that would make iBuyers one of the most successful business models in residential real estate. Even if their short-term value proposition is less-accurate-offers-but-convenience-for-those-in-a-pinch, there is a market for that!

Then, as they get more accurate over time, they will have the potential to eat into the “early majority” and “late majority” market share.

Meanwhile, there will be intense competition between the few remaining participants to become the top dog in a winner-take-most race to accuracy and market share.

Conclusion

Pricing homes consistently within 10% of their value is not that hard. It can be done.

Unfortunately, the business models of the future are going to require a lot more accuracy than that.

And meanwhile, what is the schwerpunkt of your business? Is it consistent lead generation? Building your personal brand? Agent recruitment? First-class customer service?

Make sure you understand what are the critical elements that will make your business work. Don’t make Zillow’s mistake!