How to Complete a Seller’s Net Sheet

You’re a listing agent getting ready to present your CMA to your homeowner.

While a strong CMA is important for persuading a homeowner of a price, there is another number they likely care just as much about: their net!

What does it cost to sell a home and, more importantly, what are they taking home at the end of the day?

This guide is hopefully usable for a variety of states, but as a Texas real estate agent, I am using my Texan knowledge and documents as an example.

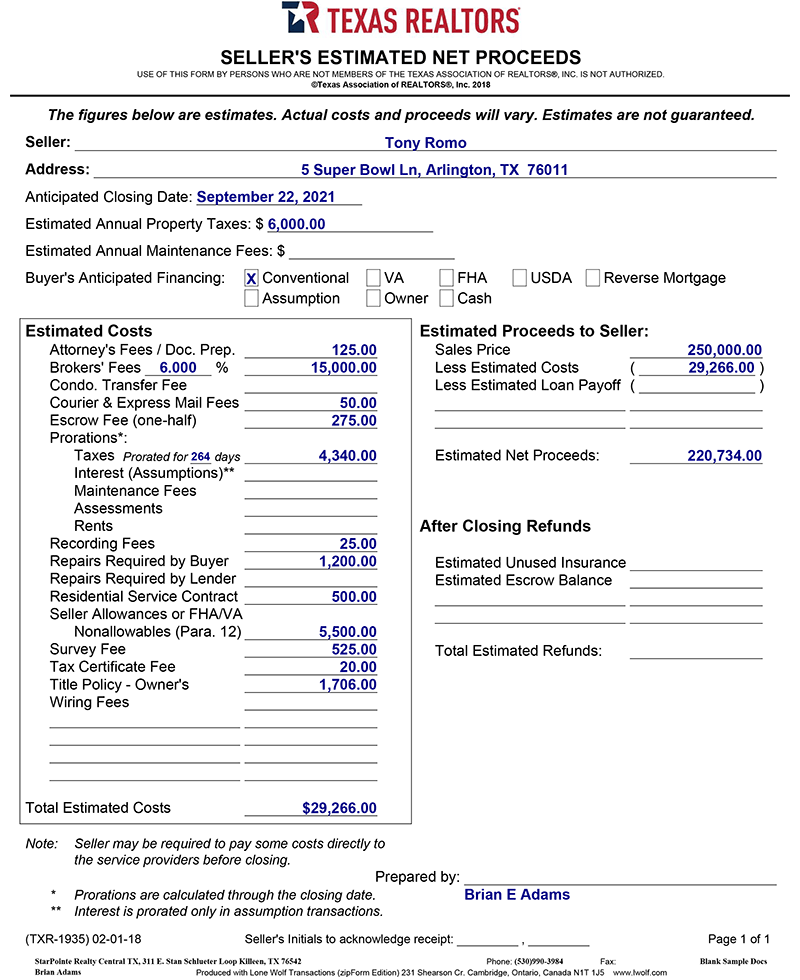

Example Seller’s Net Sheet

This is a Texas net sheet I drew up for our imaginary friend, Tony Romo.

The above is a reasonably buyer-friendly net sheet for our current market. It’s unlikely a buyer would get $5500 in closing costs and especially unlikely they would get a residential service contract. But I also like to be conservative on my net sheets so that any surprises are in the positive direction!

In this example, I don’t have an imaginary mortgage pay-off amount. Include this if you have it from your seller, or you can fill it in during the listing presentation when consulting about their pay-off. Quick subtraction will reveal the actual number they should be expecting to pay or earn from closing.

If that number is negative, then you will be having a different conversation about either brining money to closing, considering a short sale, not selling at all, or perhaps turning the property into a rental until no longer upside down on the mortgage.

Seller Net Sheet Sections: Explained

Again, this is for Texas, so your state’s net sheet may look different and have different transaction costs associated. For example, Pennsylvania assesses a hefty transfer tax that Texas does not have.

Title Fees*

*Check with your title company for specific figures for most of these line items.

A significant portion of the line items in the seller’s net sheet are related to title company-related expenses.

Some of these may be fixed by the state or county. Others depend on the title company, like the escrow fee.

- Attorney’s Fees / Doc Prep. A fee the title company pays to the attorney preparing the final documents for closing.

- Courier & Express Mail Fees. This sum covers the overnight mailing that a title company does, as when filing the deed with the county.

- Escrow Fee (one-half). The fee that the title company charges for their closing services. Usually, this fee is split 50/50 between buyer and seller. It varies based on title company. If you are wondering whether a title company is more or less expensive than another, this would be the main item to compare between companies.

- Recording Fees. The state and/or county fee for recording the deed after the transaction.

- Tax Certificate Fee. A certificate from the local county confirming that the taxes are fully paid on the subject property.

These fees are negotiable, and depend on the title company. If particular about the fees, the best idea is to shop around different title companies.

Prorations

- Taxes. A buyer is only responsible for the portion of property taxes during the time they own the property, prorated from the funding date. The problem with this is that taxes for the entire year are usually paid in one payment. Depending on whether that payment has been made for the year yet or not can dramatically impact the net sheet. If already paid, then the seller will get a credit from the buyer for the rest of the year. If not paid yet, the seller will owe the buyer for the seller’s share of the year’s taxes. It’s likely best to just let the seller know that this represents an estimate and can vary.

- Interest (Assumptions). This is only applicable for financing in which the loan is being assumed and a portion of the interest is prorated.

- Maintenance Fees Assessments. This is a spot to put a recurring HOA maintenance fee assessment if applicable.

- Rents. For investment properties you may want to represent prorated rents. As these depend on the day of the month closing happens which is seldom known during a listing appointment, you may want to just leave it blank on most occassions.

Commission

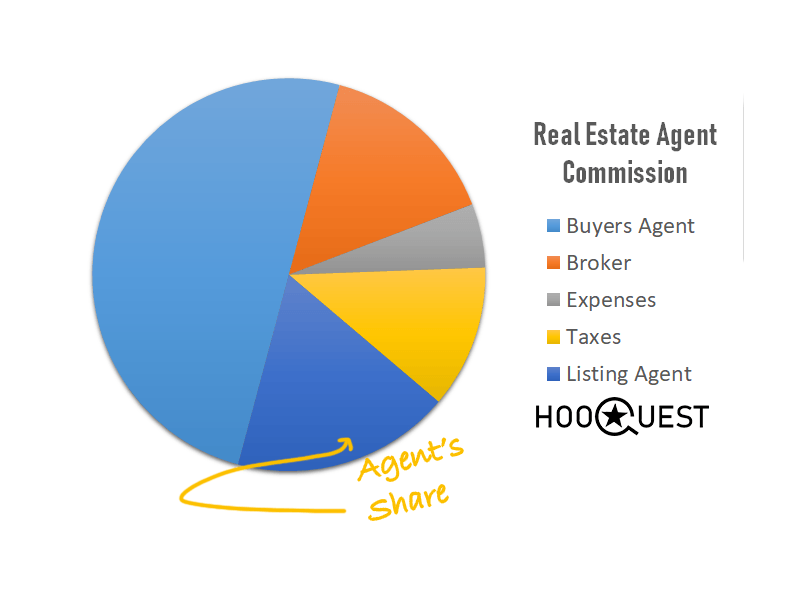

No surprise. The commission is on the seller’s net sheet. Commissions are negotiable between brokerage and seller.

Some brokerages charge commission as a percent while others charge a flat fee.

The commission on the net sheet should include whatever commission is being offered to the cooperating buyer’s agent.

The commission seems like a lot of money. And…it is. But ultimately only a fraction of it ends up in the Realtor’s bank account.

Negotiable Transaction Items

- Title Policy – Owner’s. This is a title related fee, but is negotiable in most contracts whether the buyer or seller pays. In Texas, even in hot markets, it is still the most common arrangement for the seller to pay for this policy. Title insurance is a one-time insurance that covers title mistakes which are rare but costly. It is often fixed by the state based on the home sale price and not negotiable. There are many online calculators available to determine this amount for your state.

- Condo Transfer Fee. Alternatively “private transfer fees”, these may be charged by the local HOA. Often is is just a few hundred dollars but some neighborhoods with lots of amenities like boat docks and the like can charge $1000s. Who pays is negotiable between buyer and seller in the contract.

- Repairs Required by Buyer. This spot is for anything you anticipate the buyer possibly asking for during negotiations: obvious carpet repairs, replacing the A/C, etc. I like to put a placeholder $1200 in this when presenting to homeowners, explaining that even in hot markets it’s not unusual for something to come up and I want my final net to be a conservative number. Nobody wants a seller walking away from closing with less than promised.

- Repairs Required by Lender. If you know of repairs that will be necessary to past conventional or, especially, a FHA appraiser’s muster, you may want to account for those anticipated expenses here.

- Residential Service Contract. It used to be common in my market for buyers to negotiate for the seller to pay for a first year of a home warranty from American Home Shield or Old Republic or the like. In this hot market, it is not nearly as common. Although another possible use case are the home warranty seller plans, if you want to better protect your seller during the listing and inspection. That can still be helpful in any market, hot or not.

- Seller Allowances of FHA/VA Nonallowables. Alternatively, this is just “seller paid closing costs”. In Texas, this is where I would put the anticipated number in paragraph 12. This number will depend on the lender and financing and is negotiable. Generally, I would expect a buyer’s closing cost to be at least $4000 or 3% of the loan, whichever is higher. In hot markets, sellers are almost never paying closing costs except in the case of VA and FHA nonallowables. But even then, nonallowables are costs the buyer is not allowed to pay for. Realtors or lenders can pay these amounts instead for an even more seller-friendly deal in hot markets working with a VA loan.

- Survey Fee. If you have an existing survey in good shape, then great! Otherwise, you and the buyer may be negotiating over who pays in the contract. A survey in my market for simple, single-family residential homes costs $550-$650. But for larger properties with acreage it will quickly go into the $1000s.

Optional Fees

These fees depend on the seller’s needs, though some title companies will offer for them for free.

- Wiring Fees. If your homeowners want their proceeds wired rather than a check, some title companies will charge them the $20 or so.

- Mobile Notary. If they can’t come to closing in person and prefer not to go to a notary in their location, homeowners can have a mobile notary meet them wherever they like to sign the closing docs. Some title companies offer this for free, though, in my experience, most do not. It can cost an additional $150-$250.

Seller Costs Not Included on the Net Sheet

The Texas seller’s net sheet leaves off some context to consider when selling a home that you may want to explain during your listing presentation.

Repairs and Make Ready

In addition to possible repairs negotiated as part of the contract, your homeowner may need to do some basic repairs and make-ready in order to get the home in turn-key, market-ready condition.

The most common ongoing maintenance activities to account for include:

- Cleaning

- Lawncare

- Pool care

Even if doing it themselves, like cleaning, there is a cost to that! It costs their time.

Holding Costs

A major expense for homeowners while a home is on the market are the holding costs. These costs commonly include:

- Mortgage payments

- Utilities

- Insurance

- HOA fees

If an owner occupant, then maybe these are costs they would incur anyway living in another home.

But especially for absent homeowners, the monthly cost of a mortgage, insurance, and keeping the utilities on for showings can easily add up to $1000s or even $10,000s.

I recommend budgeting the holding costs somewhere for the seller if they are selling a vacant home. It will help make future decisions regarding price drops easier. If you budgeted 90 days of holding costs between listing and closing, but are not on track, then dropping the price might partially pay for itself if you can get it sold sooner.

Holding costs are especially important to consider when comparing listing to selling to an iBuyer like Opendoor. iBuyer transactions can be quicker and avoid some of the holding costs incurred during the length of time it takes to list, show, negotiate, and close a transaction.

Risk Premium

Related to the holding cost is risk. When you own an asset like a home, you are shouldering some amount of risk that something deleterious will occur that you cannot predict.

Risks could come from natural disasters, criminal mischief, or fluctuating market conditions.

Professional asset managers usually have a risk premium assessed to account for these unknown unknowns.

One of my toughest listings was one where there was a sudden freeze and a pipe burst, flooding the entire house. It was vacant and several hours before we noticed and were able to turn it off. While my seller had insurance, it still took three weeks to repair and cost him a hefty deductible.

“Risk” doesn’t need to be a line-item on your seller’s estimated net sheet, but it can be a good talking point during your listing consultation.

Like holding costs, risk can be a reason to price closer to full market value and avoid a long listing timeline.

Obviously, risk goes both ways. It’s not impossible that the market changes for the better and a homeowner benefits a longer holding period.

Opportunity Costs

You likely can’t put a number on this cost, but it is still important.

What are the opportunity costs of listing a home?

By selling, a seller is incurring an opportunity cost to reap possible gains in a market. But by not selling, a seller is forgoing an opportunity to reinvest the proceeds into a hot stock, or perhaps the opportunity to move into a different home under favorable market conditions.

Any time we have a choice, the “opportunity costs” are the choices we did not make. Were there better choices?

This is all art and no science. Your responsibility as a real estate consultant is to coach your clients through all their options and make sure they understand the risks and rewards of each.

Income Taxes

The proceeds, or “capital gains”, of eligible primary residences are not taxed on income at all! This is one of the biggest advantages of homeownership. Untaxed wealth!

However, there are limits (currently $250,000 for single sellers and $500,000 for married sellers). If the home was not a primary residence for the homeowners within at least 2 of the previous 5 years, then the entire capital gains is subject to normal taxation.

The title company will not withhold any money for taxes. If sellers are going to owe capital gains tax, they need to consider this and set aside the money themselves so they aren’t shocked next April.

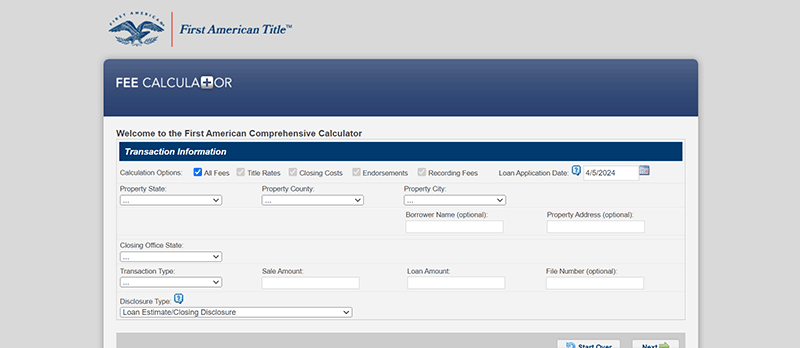

Seller’s Net Sheet Calculator

In addition to promulgated forms from state associations, many title companies will have online seller net calculators for either agents or homeowners to estimate what they would receive at the end of the transaction.

First American Title is one of the largest title companies in the USA and has a reasonably comprehensive seller’s net calculator.

Or, just check with your favorite local title company. You may need to consult with them, anyway, if you aren’t already familiar with the typical expenses for the different services like surveys and insurance.

Conclusion

You now know how to create a seller net sheet!

Don’t be shy about reaching out to your preferred title company to fill in real numbers instead of guessinsg. It’s unpleasant to break news to a seller that they are paying more in transaction costs than they were expecting.

Updated April 5, 2024; Originally published February 1, 2021