Ultimate Guide to the Real Estate “iBuyers” in 2024

Perhaps you’ve seen a Google ad. Maybe you got something in the mail from Opendoor.

Who are they and are they legit?

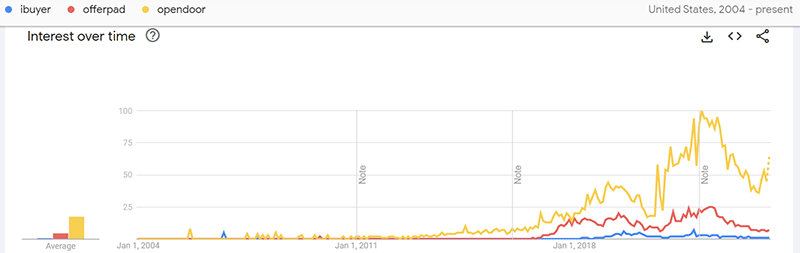

They are called iBuyers, and yes, they are indeed a legit new entrant to the real estate space, funded by billions of dollars in an effort to transform how we buy and sell homes.

Table of Contents

- What is an iBuyer?

- List of iBuyers

- Can They Purchase at Full Value?

- Will They Buy My Home?

- How to Shop Different iBuyers

- The Future of iBuyers

What is an iBuyer?

An iBuyer is a company that buys your existing home and then (usually) resells it on the open market.

The “i” stands for “instant” – instant buyer. While it’s not literally instant, it is usually a much more streamlined process than a traditional sale.

Instead of listing your home traditionally with a real estate agent, waiting for offers, accepting showings, and going through a long escrow, the iBuyer offers to cut out all the hassle by buying your home directly themselves. Cash. Simply sign up on any one of their websites and you can get a cash offer. Sometimes you can expect that offer within 24 hours, although with a company like Opendoor you can often get an instant offer.

They turn around and sell it themselves, putting up with the hassle of getting it ready, listed, and sold to a traditional buyer.

That sounds great, right?

The catch, of course, is that it will cost you a little something. You will seldom get the same amount of money you would have if you had listed your home traditionally, soliciting top dollar from area buyers.

They sound like a real estate flipper!

Right you are. Their model is very similar.

But unlike most flippers, iBuyers intend to buy with low margins and high volume. That means their offers are often not true “low balls” but closer to your home’s actual value. They then charge fees that would be reasonably comparable to those you would normally pay for real estate brokers to sell your house.

They are not a scam. And they might be a worthwhile option to consider if you are willing to accept a little less for the convenience of a quick and smooth transaction.

Pros of Selling to an iBuyer

- Quick close on a day of your choosing. Most iBuyers give you tremendous flexibility to choose your closing date. Some will even let you stay in the home a few days after closing.

- No showings (except inspectors). No need to gussy up the house and put up with showing after showing. The iBuyers will buy your home as-is where-is.

- Buy your next home without a contingency. As discussed in the “soft” iBuyer section, one great purpose of iBuyers is to allow you to seamlessly move into your next home. One of the biggest headaches for homeowners who can’t qualify for two mortgages is timing everything just right to sell their current home so they can buy their next home. And sellers look disfavorably on offers with contingencies. You can eliminate that problem by working with an iBuyer to sell your current home.

- Better than selling to a flipper. Unlike typical investors, iBuyers are built for scale and operate on razor-thin (sometimes even negative!) margins. If you are interested in selling to an investor (like during a probate sale), check with the iBuyers first.

Cons of Selling to an iBuyer

- Less than full fair market value. The iBuyers ostensibly try to offer full market value, but they are usually on the conservative side. You can generally expect an offer slightly under your actual fair market sale price that you could achieve by listing traditionally. And, to note, FTC forced Opendoor to pay a fine for overstating the financial math of selling to Opendoor.

- High fees. IBuyers make their money on the fees. However, industry guru Mike DelPrete estimates that these fees average to about 1.3% more than the cost of selling traditionally. Is the convenience worth 1.3% of your home value?

- Not so “guaranteed” offer? While the iBuyers may make an initial offer on your home, the terms can change after they inspect your home. Or they may elect to withdraw their offer altogether due to new information.

- Few homes/markets qualify. The iBuyers only operate in a fraction of America’s real estate markets (see below). And even then, they are very particular about what homes they buy.

List of iBuyers

The iBuyer business model is low-margin and capital-intensive.

The rocking and rolling real estate markets of the COVID era have ruined several iBuyers, including one of the biggest: Zillow Offers. Zillow launched its own iBuyer in 2018 to compete with Opendoor, only to call it quits barely three years later after dramatically overpaying for homes in 2021.

Redfin shuttered RedfinNow and Anywhere (formerly Realogy) shut down Realsure. Other would-be iBuyers like Fello pivoted their business model away from holding homes and into technology.

There are really only two remaining major contenders: Offerpad and Opendoor. Even some of the other listed iBuyers like Keller Offers are actually partnerships with Offerpad to provide their offers.

ExpressOffers

ExpressOffers is eXp Realty’s iBuyer that they launched in 2019. eXp is an emerging contender in the brokerage space, and its agents can offer the ExpressOffers program to sellers in quite a few states not currently covered by other iBuyers, by matching you with a local real estate investor.

Keller Offers

Keller Offers is the brokerage KW’s iBuyer. KW agents can present offers, available in 21 markets as of this writing.

Offerpad

Offerpad is chasing on the heels of Opendoor, and is in many of the same markets. They have grown more slowly and carefully than other iBuyers, but are also in some markets like Birmingham, AL where there are few other iBuyer options.

Opendoor

Opendoor is the grandaddy of iBuyers. They do more transactions than any other iBuyer. They got their start first and have raised over $1B in capital with which to buy homes. Opendoor also has a “soft” iBuyer program in which they allow buyers to make cash offers on homes. In 2020, Opendoor partnered with Realtor.com to make offers on homes.

Which Cities Are They Active In?

As of this writing, the iBuyers are active or expect to be active soon in the following cities:

| City | ||

|---|---|---|

| Albuquerque | X | |

| Asheville | X | |

| Atlanta | X | X |

| Austin | X | X |

| Birmingham | X | |

| Boise | X | |

| Boston | X | |

| Charlotte | X | X |

| Chicago | ||

| Cincinnati | X | |

| Colorado Springs | X | X |

| Columbia | X | X |

| Columbus | X | |

| Dallas/Fort Worth | X | X |

| Denver | X | X |

| Greensboro-Winston | X | |

| Greenville | X | |

| Houston | X | X |

| Indianapolis | X | |

| Jacksonville | X | X |

| Kansas City | X | X |

| Killeen | X | |

| Knoxville | X | |

| Los Angeles | X | |

| Las Vegas | X | X |

| Miami | X | |

| Minneapolis/St. Paul | X | |

| Nashville | X | X |

| Oklahoma City | X | |

| Orlando | X | X |

| Phoenix | X | X |

| Portland | X | |

| Prescott | X | |

| Raleigh-Durham | X | X |

| Riverside | X | |

| Sacramento | X | |

| Salt Lake City | X | |

| San Antonio | X | X |

| San Diego | X | |

| San Francisco | x | |

| St. Louis | X | X |

| Tampa | X | X |

| Tucson | X | X |

| Washington DC | X |

Can They Really Purchase at Full Value?

Sort of.

You are paying extra for the convenience.

As mentioned above, the average offer is estimated at .22% under the fair market value, and fees average around 1.3% more than you would pay listing traditionally.

Is 1.5% worth the convenience? For at least a fraction of buyers, the answer is yes.

Be sure to consider some of the non-itemized costs of selling a home, however, like holding costs, opportunity costs, and the risk of market volatility.

But I don’t want them getting rich off of me!

Unlike your Realtor, an iBuyer actually buys your house and therefore takes on a lot of additional risks and expenses that an agent doesn’t. The house could drop in value. They have to carry insurance. They have to pay property taxes. It could be vandalized. They might have been wrong about what it was worth.

These are expenses that you are not paying for when you sell to an iBuyer, but would if you were selling traditionally. The net sheet that agents provide doesn’t show your holding costs like insurance, taxes, utilities, or mortgage payments.

Be sure to keep that in mind when comparing offers.

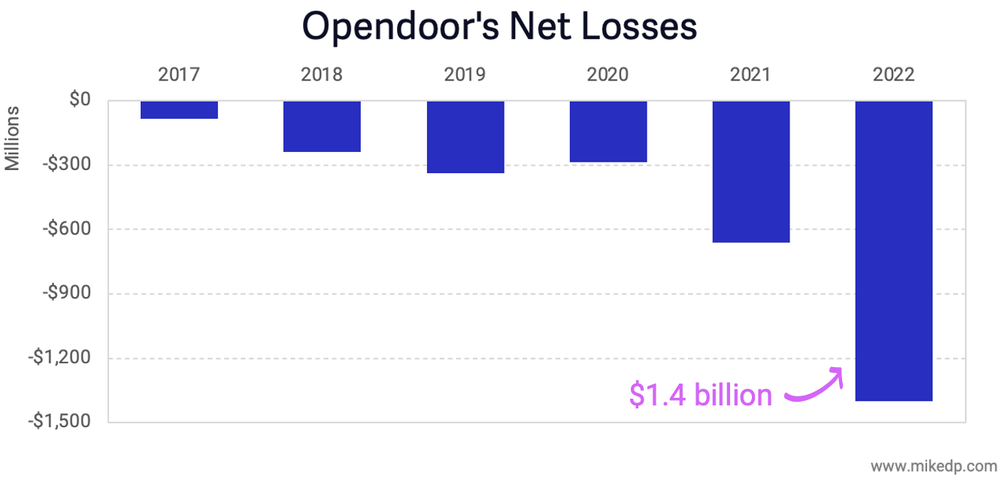

And before you get too angry at iBuyers “making” money off of home sellers, remember: they’re all losing money (so far). As of this writing, both Offerpad and Opendoor stock prices are a small fraction of what they once were.

Will They Buy My Home?

Maybe.

First, they have to be working in your area. That does not include most of America, yet.

And unlike other flippers, iBuyers aren’t looking for homes needing a lot of work, or distressed sellers. They have some fairly specific criteria that may exclude your home.

That criteria varies from iBuyer to iBuyer, but some common reasons they might say “no thank you” to your home include:

- Outside their min-max price range (generally $150,000-$600,000 or so, though higher in affordability-impaired states like California)

- Too old (too many possible hidden surprises like old wiring)

- Too unique (rural, artsy, or other “strange” homes that are difficult to value)

- Located in a gated community (coordinating repairs too difficult)

- Condos (some iBuyers work with them while others don’t)

- Septic and Wells (possible repair headaches)

Shopping different iBuyers and Power Buyers

There are several systems that exist like Zavvie and Zoodealio that can help you compare your options.

These are tools designed to be used by real estate agents to present all the options to homeowners at the listing table. They can sometimes help prepare submissions for offers to both Opendoor and Offerpad, and compare apples-to-apples to what an agent estimates you can get selling your home traditionally.

Future of iBuyers

The CEO of Knock estimated that by 2029, half of all residential home sales will be facilitated by iBuyers.

Since then, over half of all the iBuyers launched have shut down and Opendoor is scaling back its purchasing. Knock, itself started as an iBuyer model, pivoted from an iBuyer model to a power buyer model and eventually a mortgage company.

Opendoor ($OPEN) and Offerpad ($OPAD) are both public and have crushed investors who were hopeful about the new business model.

As if things could not get worse, Opendoor had to pay millions of dollars in fines from the FTC for deceptive trade practices.

The most concentrated iBuyer market has approached a 10% market share of all transactions.

At this point, there is a very real question as to whether iBuyers will exist as a business model a year from now. Opendoor relied on Softbank for funding which has infamously missed on several other investments and ultimately exited their Opendoor position entirely.

Many of these models have tried to survive by pivoting to adjacent services like mortgages or more capital-light models like power buying. Mortgages are where the money is in residential real estate.

iBuyers have been good for home sellers. But it’s an open question as to how much longer they will be an option.

My Personal Experience

I worked for Zillow and Offerpad. I’ve personally sold not one but two homes to Opendoor.

I can personally attest that, at both Zillow and Offerpad, we tried to make fair offers on homes (and sometimes, when we failed to accurately price a home, it was to the benefit of the homeowner!)

I also have experience on the other side of the transaction. When my father passed away, we sold his home in 2016 to Opendoor, then just a one-of-a-kind new startup in Dallas.

Being a Realtor, I had worked with investors and thought I knew what to expect – 70% of full market value minus repairs. Instead, we were shocked by how generous the offer was compared to other investor offers we solicited. We accepted right away.

I still thought they would drop the offer by $10,000s after they inspected the home. And they did drop the offer. But only by about $10,000. It was a far better deal than I ever expected and we accepted.

In 2021, we moved and sold our house to Opendoor again. It took us much longer to move than we expected, and we were able to extend our stay after closing by a whole week for very little. The convenience was incredible.

Opendoor sold the home for about $20,000 more 6 months later, which, given what the real estate market was doing during that time, was a fair increase for what they offered. They probably ate a significant chunk of that in holding costs alone, and didn’t make much money on the transaction, I would guess.

Conclusion

I love pricing and the work I did with iBuyers. I’m incredibly sad to see them struggling the way they are and hope both Opendoor and Offerpad can figure it out. As a customer, it is an excellent experience compared to the alternatives. I believe the problem is tractable and the company that figures it out will be a trillion-dollar behemoth.

In the meantime, if you are a real estate agent, you are doing your sellers wrong if you are not presenting iBuyer options side by side with your traditional listing option. Many iBuyers offer agent commissions to work with them.

If you are a seller, it is worthwhile submitting your home and getting a no-obligation offer to see what you can get for it.

Updated April 18, 2024; Originally published February 22, 2019.

Have you ever heard of a company called Wedgewood when it comes to Ibuyers?

I have not previously. Looking them up, however, it looks like they are more an investment company like AH4R or Mainstreet Renewal? I would consider that model different from “iBuying” in that ibuyers are not generally looking to convert a significant portion of their purchases into rentals, and are often not targeting distressed properties but retail homes on which they generally try to make fair market offers. It looks like Wedgewood would be more in the former category?

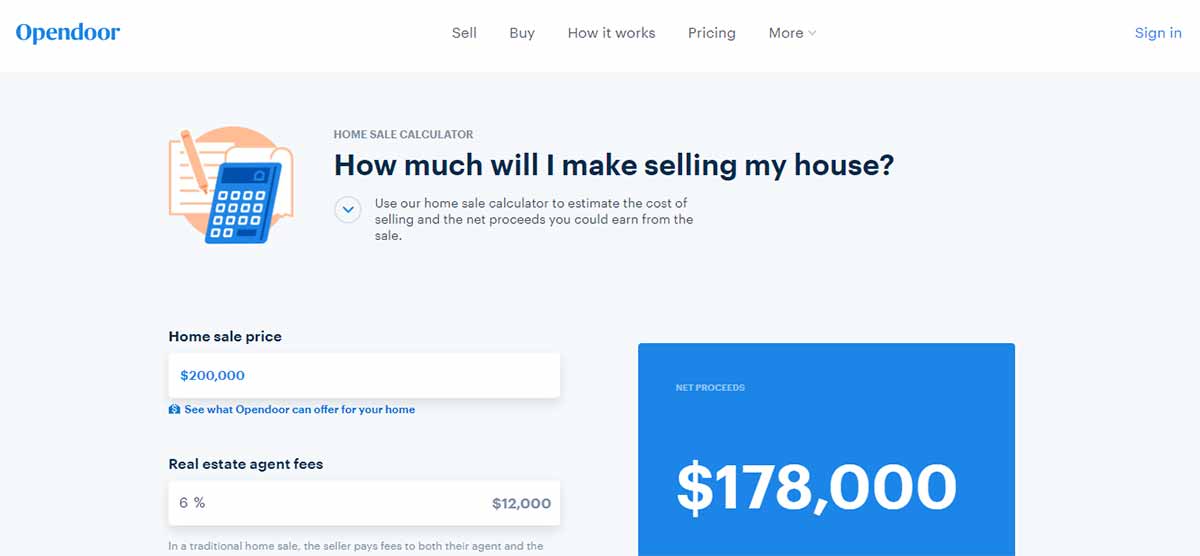

Excellent summary! I’m new to the US housing market and I’m trying to understand the fees involved. Say I wanted to sell my home at $200,000. Typically, I would have to pay 2.5% to the selling real estate agent and 2% to list on the MLS, totaling $9,000 in fees. This $9,000 margin, is this what a company like Opendoor is looking to earn for itself by disrupting the market?

Not exactly. First, Opendoor pays a cooperating brokerage fee – so whatever percent it is to list in the MLS (probably 2.75-3%) they are still paying. So, if they are just disrupting commissions, it is just the 2.5% commission in your example. Even then, Opendoor is a brokerage. Instead of commission, they are collecting a fee and guaranteeing your sale by buying it themselves. Doing so costs more than those expenses incurred by a traditional listing agent. There is market uncertainty (seeing plenty of that now!), holding costs, and financing costs that a traditional agent would not be on the… Read more »

We will be selling our home soon, and I am foreseeing a lot of stress. So, this iBuyer concept intrigues me. I just saw a commercial for Homelight Simple and was wondering if you’ve had a chance to compare them with the others.

Ah, so Homelight Simple is not an iBuyer. Instead, they offer an app/service that will submit your information to multiple iBuyers depending on your location and can then compare the resulting offers for you. It is a similar service to Zavvie. I have not seen or used one, but I think something like that would be a great way to shop for the best deal. It might be Opendoor, or Zillow Offers, or even a smaller local broker outfit with a similar model who is the best option and you would ultimately still be working with another company.

At what time are you locked into an ioffer? I’d like to compare offers and realize they need to fine tune with an actual inspection – which could definitely change the offer totals. Would hate to pick the “best offer” only to find out it really wasn’t after inspection. How often do they just drop the offer and walk away? I’m about 1/2 hour north of Charlotte in a small townhome community on a golf course. Seems like properties have definitely increased in value here.

I can’t advise as I’m not a lawyer and it may depend on your state, but generally when a seller signs a contract there are very few outs for the seller. What usually happens with iBuyers is they will make an offer, you accept, and they then conduct their due diligence just like a normal buyer. Frequently they will drop the price (though sometimes raise it!, depending on the iBuyer) after the inspection or cancel the contract completely. Most of the time they do not walk away from the offer, especially if your home is in fair condition and in… Read more »

So basically one needs to compare offers before any inspections and choose an ibuyer? It seems once a seller accepts, they are locked in? What if after inspection the price is really lowered? Does the seller have any options or do they have to go through with the sale no matter what final price the ibuyer comes up with? Not too worried as my home is in a desirable area and in good shape, but just want to be an informed seller.

If they seek to modify the offer based on the inspection, you do NOT have to accept their modifications. It would essentially open up negotiations again. If you are unwilling to accept a change, they would presumably terminate the contract and you would be free to explore the other options again. The only terms you agree to are the ones you’ve signed to in the original contract. They cannot unilaterally modify it.

Excellent post. I was looking for more information as I’m interviewing with some of these companies. Thank you

Hello have an offer from ibuynowre.com are they ligit

They appear to be a website belonging to USA REI group. I know nothing about them but what is on their webiste, which looks more like a traditional flipping company like Homevestors rather than iBuying.