My Terrible, Awful, No Good, Very Bad Predictions for Real Estate in 2022

Since I wrote my last predictions, eXp had a new logo reveal!

My prediction was just a year ahead of schedule! Looks good, eXp! Great work!

Going into 2022, the general sentiment seems to be turning. There is more pessimism as a white-hot market cools and interest rates threaten to go up. Agents are getting nervous. Do the good times continue? Or are we on the brink of historic turbulence in our industry?

But first, let’s look at how my 2021 predictions panned out.

My 2021 Predictions Revisited

2021 was a crazy year! In a way, it wasn’t as crazy as I expected, but then far crazier in other ways.

The Emperor Has No Clothes: Compass Falls out of the Top 3 Largest Brokerages

eXp Realty has been the darling brokerage of 2021. They’ve seen tremendous growth, and setting an obnoxiously big hairy audacious goal of half a million agents in 5 years (that would be 1 in every 3 Realtors).

But they haven’t caught Compass yet on transaction volume alone. Compass reported excellent 3QTR results and revised their 2022 guidance upward. Their 3QTR transaction volume of $69B beats eXp’s $46.6B.

Not everything is rosy in Compassland, however. Since its 2021 IPO, the stock ($COMP) has fallen by more than half, trading at just $9.96 as of today versus its $20.15 debut.

Feelin’ Hot Hot Hot: National Home Prices Will Be At Least 4% Higher

Never has being so very right felt so very wrong.

It’s hard to remember that in 2020 everyone still feared a COVID driven housing downturn. So points to me for getting the trend in the right direction.

But home prices in December were up 14% year over year. A measly 4% prediction sure does feel wrong.

What Goes Down Must Come Back Up: Interest Rates Hit 6%

Never has being so very wrong felt so very right.

Interest rates are nowhere near 6%. At the time I wrote that, rates were 2.9%. They’re now 3.12%. I don’t know what I was thinking. Even if interest rates rose dramatically, 6% would have been insane.

But you know the saying! A pessimist is someone who is right, eventually. I think I got all the mechanics right, and inflationary pressures are the talk of the town. 2022 will almost surely see interest rate hikes and corresponding increases in interest rates for borrowers.

I bought a home myself in 2021 in fear of rising interest rates and market prices and am feeling really good about that decision.

Virtual Vanishes: No More than 2% of Austin Zillow Listings have Virtual Tours

As of today, there are 3180 listings in Austin city limits for sale or pending, 395 of which have a 3D tour when filtering for that feature in Zillow, over 12%.

Whoops.

The term “Matterport”, the 3D tour technology, is at an all-time high when looking at Google Trends.

Clearly virtual is a bit stickier than I imagined. It appears it is increasingly a best practice for listing agents.

Google Gets Greedy and Goes Gangbusters: Google Lists Homes For Sale on Google Maps

What are you waiting for, Google? This opportunity is obvious!

There are still no homes for sale on Google Maps.

It would take almost no effort and Google would immediately be the number one player in home search.

It would make CoStar’s acquisition of Homesnap and Homes.com look like little children playing dress-up on “Bring Your Kids to Work” day.

iBuyers Go on Their Honeymoon: Opendoor and Zillow Raise More Capital

This prediction was looking good just a few months ago!

Then this happened.

Needless to say, the shuttering of Zillow Offers does not qualify as a “honeymoon”.

2022 Real Estate Predictions

Given a track record like that, you’ll be excused for being disinterested in my 2022 predictions.

But if you give me a moment, I think have some good ones!

I won’t include easy predictions, like Zillow launching a Power Buyer in 2022 to keep alive the Zillow 2.0 dream. That’s obviously happening.

There are also lots of great articles on the direction of the market. I think the inventory shortage will overcome rising interest rates and prices will continue to grow.

Two Power Buyers Join Forces

It’s the Trulia-Zillow of 2022!

Why compete when you can team up!

Who are the power buyers who might be looking into some M&A action in 2022? Off the top of my head, there is:

- Knock

- Ribbon

- FlyHomes

- Orchard

- Homeward

- Reali

- EasyKnock

iBuyers Opendoor and Offerpad also have power buyer elements to their offering, since Opendoor’s recent launching of Opendoor Complete.

Why would they join forces? I dunno. I kinda just feel like there are a lot, now, with nearly identical business models.

These models benefit from scale. They are also harmed by too much competition via adverse selection. So fewer and bigger is probably a win-win for these companies. These companies also don’t have a lot of brand recognition, so combining into a single or even a new brand won’t cost a lot in brand recognition. Orchard completely changed their name just a year or two ago (originally called Perch).

With the increased skepticism of pure iBuying after Zillow’s exit, all eyes turn to power buying. It’s the new, sexy real estate 2.0 in a winner-take-most model. A couple players are going to calculate that the best way to get a head start is to M&A.

Condo Demand WON’T Take Off

I have the benefit of writing this after Redfin published their own 2022 predictions. And I disagree with one of them.

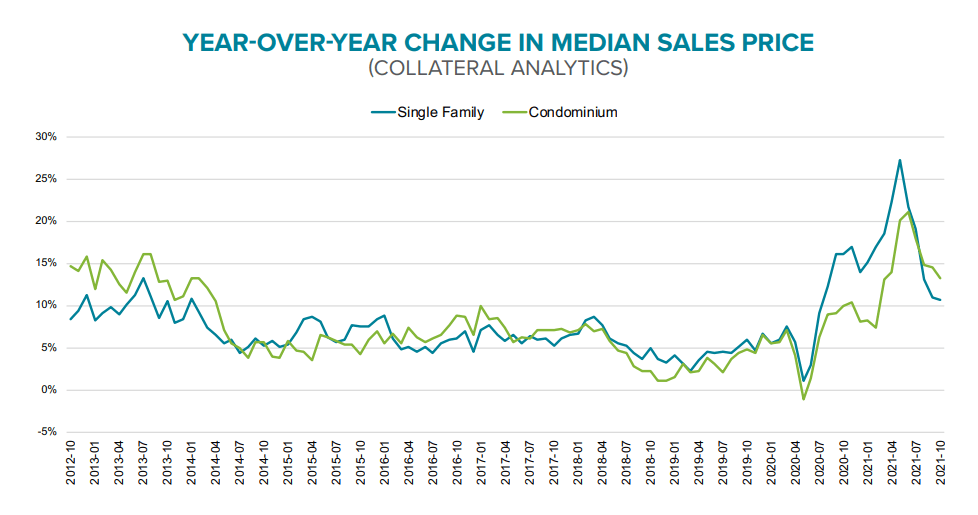

Despite a historically strong 2021 real estate market, condos lagged behind in the past two years. The work from home trend favored bigger houses, single family homes (SFH), and the suburbs.

I think that will continue, even as workers begin going back to the office in larger numbers.

Redfin’s logic is seductive. Especially as home costs skyrocket, it seems natural that many home shoppers will be forced into compromising into condo living. But I don’t think this shift has played out yet!

SFH continues to be the place to be.

I am looking at reports from Black Knight for my prices. You can see that historically condos and single families have tracked pretty nearly, with a big disparity arising as COVID took off.

As of the most recent information in October, condos appreciation surpassed SFH. I think this is a blip as SFH falls back to earth, and the trend will remain in favor of SFH.

I predict when revisiting this chart at the end of 2022 that YoY condo appreciation will surpass that of SFH in none of the intervening quarters.

Unemployment Trickles Up

Not exactly a real estate prediction, but clearly unemployment will affect all industries, ours included.

There has been a lot of ink spilled about the Great Resignation. On the surface, this trend seems like a positive. People have enough resources to be confident in leaving the job market rather than accepting below market pay.

But inflation will start eating into Americans’ budgets.

As things get more expensive, the pressure will be on to begin earning more money. The Facebook tech worker who decided to take a gap year and travel (as much as one can in the COVID world) will suddenly find their savings falling short of expectations.

The supply of job seekers will increase, meaning higher unemployment.

This also means that NAR’s agent count will see significant increases in 2022 as more people reenter the workforce trying to make ends meet or launch new careers. It will be a good time for brokerages, teams, and real estate tech vendors. I don’t think “there will be more Realtors” is bold enough for its own separate prediction.

As of today, the workforce participation rate is 61.8% and USA unemployment is 4.2%. I predict they will be over 63% and over 5.5% respectively by end of year 2022.

SFH Build-to-Rent Stocks Skyrocket

American Homes 4 Rent (AH4R) is one of the nation’s largest single-family (SFR) REITs, buying up 10,000s of homes to turn into rentals.

By 2016, the low-hanging fruit of the post-Recession hangover were all picked. AH4R dealt with the inventory shortage by making a major pivot into building homes themselves. It’s my understanding that they now almost exclusively build homes for their rental portfolio.

It’s rather ironic, given the 2021 summer conspiracy theories about how institutional investors like Blackrock and Zillow were trying to corner the market and drive up prices with institutional buying. The popularity of the build-to-rent model blasts a huge hole in that narrative, as institutional dollars are being sucked into creating more housing inventory, which should only help keep home prices affordable.

This new model, called build-to-rent, had a huge 2021 and is becoming wildly popular. D R Horton, Lennar, and Pulte, some of the largest homebuilders in America, have begun building homes to turn them immediately into rentals.

It is essentially no different than building apartments, except you are developing an entire community of single-family homes. These communities have advantages over apartments, like longer-term and more affluent tenants. And, especially with the downturn of condos I discuss above, SFH rentals are more attractive than apartment buildings.

As of this writing, AH4R is already trading near its all-time high of $42.10 a share, set in September ($AMH). I predict it sees a 25% gain in 2022 and is trading at $52.70 or higher by the end of next year. Note: I don’t own AMH (though I’ve almost talked myself into buying some) and this is not intended as financial advice. I don’t recommend for or against any securities. I’m just trying to pick a metric that will keep my prediction accountable.

25% isn’t meme-stock territory, and actually less than its 42% growth (!!!) in the past 12 months, but is still a strong year for an established real estate player!

The Rich Get Richer: Luxury Housing Continues Upward

Like Build-to-Rents, 2021 was a good year for luxury!

2022 will be better.

I think the market continues to go up in all categories, driven by inflation and inventory. But I wouldn’t be surprised to see some holes and setbacks. First time homebuyer demand may slacken as interest rates go up. Foreclosures could increase as people who overpaid in the summer of 2021 aren’t bailed out by appreciation. Some white hot markets like Charlotte or Tampa could experience a bit of a hangover.

But not so for luxury!

My theory is this: inflation.

As the federal reserve concedes that inflation is stickier than had once been hoped, it’s past time to start thinking about what that means for the market.

Inflation primarily hurts the poor and middle class. People’s incomes are hardest hits, as wages are sticky and don’t always catch up to the declining value of the dollar.

Rich people, on the other hand, tend to be disproportionately invested in inflation-resistant assets. Most conspicuously: stocks and real estate.

Meanwhile, inflation will shrink their debts, giving them lots of equity, disposable income, and borrowing power.

The political ramifications or fairness of this trend aren’t the scope of this article. It is merely to say that you would do well to expand your SOI to include some of your more affluent landlord neighbors when lead-generating in 2022.

I’ll defer to the stats generated by The Institute for Luxury Home Marketing for my metrics, whose most recent report in November shows 15,880 luxury SFH homes sold, up 35% YoY. I predict in a year there will be at least another 35% gain in total sold for 21,438 or more November sales.

Their definition of luxury is fluid, and it’s possible that luxury gets defined up over the year. But part of my prediction is that the tail end of the distribution gets fatter, which shouldn’t be too affected by their moving benchmarks.

DOJ v NAR is a Nothingburger

The Department of Justice (DOJ) is investigating the National Association of Realtors (NAR) over buyer practices.

It looked like the essential elements of this action were over, until DOJ withdrew from an agreed settlement with NAR.

Frankly, the DOJ in my opinion is playing small ball.

It’s actually surreal to me. It feels like some high up DOJ lawyer with no connection to the real estate industry sold a house, was grumpy about paying a buyer’s agent commission, and decided after five minutes of self-education to “fix” things with a lawsuit.

How agents set commissions is not the problem in real estate.

There have already been improvements implemented, spurred by this action. Agents and portals can now advertise buyer agent commissions (and should!).

But I would guess the effect of this would not be to put downward pressure on commissions. Quite the opposite, I wonder how many homeowners will recognize that their competitors are offering agents more and wonder who duped them into being a cheapskate.

True, the unprecedented seller’s market we are in might not spur that revelation, but as the market cools, I think the impact on commissions of greater transparency in commissions will be negligible.

Oh, and Realtors can’t say their services are “free” anymore, which, duh. Nothing is free. You shouldn’t have been saying that, anyway.

The real problem in real estate are the MLS-association local monopolies. If DOJ knew what they were doing, that is where they would spend their attention.

As it is, what they are chasing isn’t a big deal. I don’t know why the fell out of a settlement over the summer, but I predict that nothing more substantive comes from it going forward.

Conclusion

Admittedly a lot of my predictions are essentially that the trends we’ve been witnessing continue and don’t recede. Maybe that doesn’t make for very bold predictions, but given how many people seem to be predicting a regression to the mean in 2022 and a sort of post-COVID hangover incoming, I feel like I’ve put something out there controversial enough!

What do you think? More importantly, what did I miss? Share in the comments below! Or hit me up on Twitter at @hooquest.