Ultimate Guide for Realtors Working with Investors | 2024

Repeat business! Capturing the buyer and seller side of a transaction! Vicariously living the fast life of fix and flips with your local investor!

Building your real estate business around investors can be appealing. But I can say from experience that it is hard work.

Unlike traditional deals, you are relying on repeat business. A single sour deal risks destroying business relationships.

Therefore, the most important thing you can do as an investor-friendly agent is to be a really good agent! That is the only reason successful real estate investors will continue coming back to use your business.

This isn’t about commercial real estate agents, although you may graduate to commercial real estate if you like. I found many of my multi-family investors eventually were doing well enough that they wanted 20-unit complexes or more, or have connections interested in larger units.

Pros and Cons of Working with Investors

Working with investors takes a commitment to understanding their needs. Don’t jump in because you think you have to. Instead, decide if working with investors is right for you. If not, find an investor-friendly agent you can refer investor leads to and focus on your own business.

Here’s what to weigh before deciding on investors as your lead generation strategy of choice.

Pros

- Repeat Business. Having a buyer or seller who can do 5 or 10 (or more) transactions a year instead of 1 is a huge advantage.

- Good Pathway to Get Into Investing Yourself. If investing in real estate appeals to you, becoming an investor-friendly real estate agent is a great way to earn a living working with retail clients while still learning and networking in your areas’ investor community. A real estate license is a very common route to getting investing experience before making the leap yourself.

- Well Suited to Analytical Agents. On the DISC profile, the Ds and Is get a lot of love in real estate. Cs, not so much. If you are good with numbers and think analytically, working with investment properties may be more appealing than hosting open houses and dialing FSBOs for hours every day.

- Countercyclical. Real estate will go down and up. Are you prepared to weather it with at least one pillar of your business set to thrive in a down market? Investors often increase spending when the market falls, especially rental property models, and having existing investor connections during these times might save your business.

- Perfect for Property Management. If your brokerage has property management, an investor-friendly strategy is symbiotic with growing and monetizing your property owners.

Cons

- Lower Price Points. Depending on the acquisition strategy, most investors are looking at either dirt cheap prices or, at most, prices in the middle of the market. In a business built on commission percentages, that means your dollars per deal will be less than it would with more traditional clients, even before any commission concessions you may make to appease an investor.

- Demanding Clients. This, of course, depends on the investor. Many are very easy going. If things are running smoothly and the numbers work, they can be very chill folks! Many are not, however, and can be very involved in your business with inflated expectations. Not only do they suffer few fools, but they can also be demanding of your pocketbook. They want champagne service on a tap water budget. You’ll likely need to learn to defend yourself and your value proposition.

- They May Outgrow You. Successful investors may choose to try to bring more of their sales operations in house. You and your commissions are a big expense for them, and if they are doing enough deals, it may make financial sense to get a licensed agent on staff and paid a salary instead.

- Eggs in One Basket. When your business is built on just a few clients or even, in extreme cases, a single client, it hurts a lot more when you lose that client. Investors change strategies all the time. Some institutional investors will buy hundreds of homes in a year and then stop completely or will move to a new market. If you are working with investors, be sure you are still diversifying your business so that you can thrive even if you lose some of your clients.

If working with investors doesn’t appeal to you or your style, consider and compare it to other lead-generation strategies.

How to Work with Real Estate Investors

Source Deals

You may think that finding investors is the most important part of becoming an investor-friendly agent.

I disagree.

If you can find a deal, the investors will come. It’s not hard to find people with money for a deal.

When you find a deal, you can easily advertise it on forums like Bigger Pockets, Facebook groups, etc. That’s the easy part.

How do you find deals?

- The MLS. Yes, the best deals never make it to the MLS. But, in most markets, a studious agent should be able to find opportunities, especially for buy-and-hold investors. Set up a hot sheet and check on it every morning and afternoon, sending off potential deals when you find them.

- Target distressed sellers on your website. Create some hyperlocal content targeting keywords like “cash offer [your city]”.

- Start a property management company. Not only will you automatically be networking with investors for every landlord you pick up, but you can also offer your property management services to other buy-and-hold investors you are already working with. Many investors like to keep things consolidated, and if they can trust the same broker for buying, selling, and managing properties, all the better. If your broker already has a property management wing to the business, get with your broker to see what it would look like to be more involved there. Perhaps you can work on sending current owners market valuation reports.

- Yellow Letters. I’ve done this and it works. I have no idea why. I hate those pieces of junk mail. But simple and cheap direct mailings like this can absolutely turn up some offer market deals.

Find Investors

- Local REIA. Most cities will have one or multiple local real estate investing groups and networking events. You can search online or check out Meetup and local Facebook Groups for events. Often these will feature other real estate noobs or established investors pitching a product. You may have to kiss some frogs before finding your way to a good group. But this can be a great first step to just learning more and immersing yourself in local investment real estate.

- Bigger Pockets Forums. Joining Bigger Pockets is free. You don’t need a Pro account, although being able to set alerts by your city keywords is a great tool. Answering questions in the forums about your town’s real estate is perhaps the #1 method I recommend for connecting with serious investors. You can guest post your own articles about investment properties in your area as well.

- At the Auction. You can link up with a well-heeled and experienced investor spending cash at the auction. Some are flippers, but most are probably buy-and-hold investors. Just a few names and emails from here is enough that you’ll have a solid buyers list for any deals you come across.

- Title companies. Title companies tend to learn the names of folks who close multiple times a month. Talking with your favorite title rep about possibly connecting you. On that note, selecting a title company that is willing to work with investors and get a little creative with things like double closings is always a good idea.

Institutional Acquisitions and Dispositions

“Acquisitions” and “dispositions” are just fancy, institutional words for “buying” and “selling”. Institutions acquire properties and “dispose” of them later when they sell them.

Institutional firms like REITs or private equity often have relationships with brokerages in different markets for sourcing and selling their properties. They may have an exclusive relationship, or they may be open to working with you if you can show gumption and source some deals for them.

One benefit to working with institutional investors, other than the massive volume, is that they often work on thinner margins. A deal that would not work for a small time flipper might meet the numbers for an institutional investor. Some investors even pay over full market value if the rental value and market trends are right.

They’re not likely interested in working with new agents, so begin working on a track record to showcase your capabilities and knowledge, and then consider reaching out and pitching your business and lead gen.

Partnering to Make Cash Offers

A potential benefit to working with investors is to offer your own sellers a genuine cash offer option.

You can already do this by working with iBuyers if available in your area. You can help would-be sellers submit and navigate the iBuying process. If selling to an iBuyer isn’t the best option (and most homeowners do not accept their iBuyer offer), you are there and ready to help them list their home!

Working with investors is a natural extension of this model. There are many home types that iBuyers are not interested in, and having other cash buyers on hand in your investor network can help give these homeowners more options.

In particular, iBuyers usually eschew homes that need too much work. Nor do homes like those often make great listings. But they’re perfect for the local investor who is set up to rehab a home in exchange for a discount.

Tips for Working with Investors

- Know your numbers. Agents are notorious for not understanding the math that makes a good deal. A $10k discount to FMV (fair market value) is not an “investor special”. You need to have at least a basic understanding of cap rates, cash flow, ROI, and how to do basic real estate math for your investor. Investors don’t want their time wasted with you pitching them 2% cap rates and not knowing it.

- Know your acronyms. I created a list of common investor acronyms to brush up on!

- Add a website page for “Investor Friendly Realtor”. Investors might search something like “investor-friendly real estate agent + [your city]”. If you have a page on your website that is optimized for those keywords, you have a chance of ranking for that low-hanging fruit on Google. Fill the page with content describing what you offer investors.

- Get really good at pricing real estate. Pricing is hard. When you’re wrong on a CMA with a traditional client, you might list too low or too high. But the market will figure things out after a bidding war or a few price drops. But when you goof on the price for an investor, it can blow up their deal. A $10k miss can wipe out their profit, or they might get outbid by the competition. Learn how to make a killer CMA, use lots of comps, and be diligent when creating your investor CMAs.

- Build an airtight vendor list. Many investors may have a contractor already lined up. But they probably don’t have photography, pest inspectors, and all the other people essential to making a real estate transaction close smoothly. Investors are not very patient people, so an airtight vendor list of folks who can deliver quality on time is essential.

- Set expectations on low ball offers. An investor eager to low ball every MLS listing on their block is not a serious investor. Feel empowered to simply say “no” to anyone asking you to do that. That said, the low ball has its place. If the listing advertises itself as “as-is” or is clearly distressed, or if it has been on the market a while, use your judgment. A low ball may be welcome news to that agent and homeowner. Make sure the other agent knows you’re working with an investor and that’s just the numbers that will make it work. There’s no reason for them or their seller to get offended about it. They can simply decline.

- Know your value. Most investors will ask for commission discounts. It’s up to you and your market to determine what you are comfortable with. But especially for new agents doing their first few deals, I recommend staying firm on the commission. Acknowledge the possibility of coming to a future deal on commissions but that they first need to demonstrate that they can deliver the volume to make it worth your while. And you should especially hold your ground at the lowest prices. I’ve seen an agent discount their commission on a $30,000 deal for an investor. They walked away with less than $500. Come on!

Examples of Successful Investor-Friendly Real Estate Agents

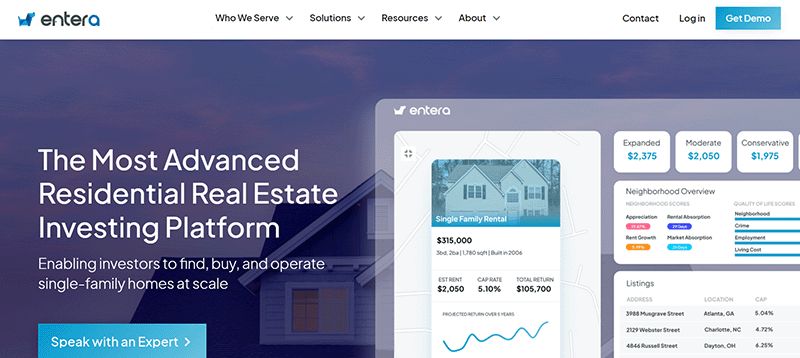

Entera

Entera is a brokerage whose sole focus is serving institutional clients.

As of this writing, they have 141 employees per LinkedIn, featuring acquisition managers, software engineers, analysts, and transaction coordinators.

Their primary business model is sourcing single-family homes from the MLS and linking them up with institutional partners like Invitation Homes or AMH (formerly American Homes 4 Rent). They’ve developed proprietary software to help quickly analyze homes, though it’s nothing that a diligent agent couldn’t do themselves manually in their own market.

The Short Term Shop

Avery Carl specializes in short-term rentals. It’s a niche business that had enough deal flow to land her on the RealTrends 1000 list.

The Multifamily Guy

Florida agent Jeff Copeland had gone all in and committed to the multi-family scene. His site is dedicated exclusively to multi-families and complexes.

He’s active on Bigger Pockets and has even hosted webinars there.

Vista Real Estate

Vista Real Estate is a brokerage in my neck of the woods that works with a few large investors in Texas and California to purchase buy-and-hold single-family homes in Central Texas.

This unassuming brokerage and its owners are regularly bidding on homes at the auction, often walking away with 5 or 6 properties, and have grown significantly in the past 5 years.

Victor Steffen

Resources and Training

Remember, here at Hooquest, I believe in spending as little money as possible. I don’t recommend purchasing coaching, training, or advertising until your business is already working.

The investor space is uniquely rife with scams of overpriced fluff. Avoid it all! I am 100% convinced that you can hustle your way to success as an investor or investor-friendly agent with the education available both for free and from just doing it.

YouTube Help for Investor-Friendly Agents

The Short Sale Queen has a real estate channel with a focus on short sales, preforeclosures, and handling investors.

Online Publications

These are some solid sites to check out and follow if you are wanting to learn more about real estate investors. The content targets investors, though it will give you likewise an idea of what investors are looking for and the methods they use to source deals:

Podcast Episodes

If you are interested in content marketing and blogging, I recommend checking out the podcasts at:

The following are some podcast episodes featuring Realtors talking about their experience and recommendations working with investors.

- The Obsessed With Real Estate Show: Ep 27: How To Be An “Investor-Friendly” Agent with Vicky Oberoi and Sid Bobba

- The Investor Mel and Dave Show: Investor-Focused Agent in Florida! – The Action Agents Show

- Real Estate Rockstars. 1144: Systems for Scaling Sales as an Investor-Friendly Agent – Caleb Drake

- Real Estate Rockstars. 918: Vacation Rentals, Airbnb, and Investor Clients with Avery Carl

- Real Estate Rockstars. 911: The Best Buyers in the Business: Real Estate Investors with Adam Whitmire and Jared Garfield

- Real Estate Rockstars. 885: How to Win Investor Clients and Maximize Repeat Business with Matt Bell

- Real Estate Marketing Dude. Working & Leveraging Investor Referrals for Listing Client Generation – with Chris Craddock

- Real Estate Marketing Dude. Embrace Investors & Become A Better Agent – with Andrew Greer

- GSD Mode. How Realtors Can Benefit From Leveraging Relationships With Investors!

- Hyper Fast Agent. Episode #156 How to Get More Investor Business with Chris Clark

Tools and Software

Some potentially useful programs you may want to consider depending on your investor niche might be:

- foreclosure list service (companies and availability will be different by state)

- probate lead service

Foreclosure.com

$39.80/mo. Foreclosure.com aggregates distressed properties nationwide, including short sales and preforeclosures, rent-to-own. They offer a 7-day free trial

Conclusion

I’ve wholesaled a property, flipped a home, and own rentals myself, all while helping flippers and buy-and-hold investors in my market. Investors made up 1/3 of my business. Working with investors was probably the thing I’ve done best at as an agent.

Even then, working with investors as a Realtor was a tough game, with many ups and downs. It’s definitely not for everyone. But very lucrative for those who make it and put in the effort long-term.