Why Landlords Are Good, Actually

Landlords get a bad rap.

So much so that some people ponder whether landlord and evil are not synonyms. After all, how can it not be evil to collect a monthly piece of someone else’s hard work that requires no work on your end at all?

But what if I told you that landlords weren’t evil? Not even a necessary evil. But actually…good?

It turns out, landlords provide a valuable service to both the tenants they serve and society at large. And I don’t mean property managers, who are clearly necessary stewards of properties and resident relations. I am talking about landlords who own the properties and, ostensibly, just sit back and collect rent checks.

They are good!

Don’t believe me? Let me show you.

Arguments Against Landlords: Debunked

They Make Money Doing Nothing

Real estate investment is passive-income. Landlords do no work to earn the rewards. All the landlord does is buy real estate and then charge people for access to it.

The above is, in principle, no different than earning interest on money you’ve deposited in your bank.

Depositors put their money into an asset – an account – and charges their bank interest in order to allow the bank to lend the money out with fractional reserve banking.

Is having a savings account wrong?

The Real Work of Speculation

More importantly, real estate speculation is not as passive as meets the eye.

I’m not talking about property management, which is clearly a very active form of real estate activity. Coordinating maintenance, advertising vacant units, pricing rents, asset management, those are all very real 40 hour/week jobs that few would deny is real work.

I’m talking about the landlord. Yes, merely buying, owning, and selling the real estate is work.

Even if the landlord builds nothing, and does nothing else with the property, their speculation is an economic benefit. It is “work”. This video does an amazing job of explaining why:

Landlords provide at least these important services:

- they accept risk

- they speculate, which:

- creates liquidity

- creates price signals

- allocates land to its highest and best use

The video quotes Malte Tobias Kahler, who says:

Each speculator possesses a piece of disperse, subjective, and oftentimes tacit knowledge and reveals this information through his buying actions, which ultimately determine prices. In doing so, multitudes of market participants reveal data that otherwise could not be gathered.

Second, speculators suffer losses whenever they predict a rise or drop in price that ultimately does not occur…. Due to this financial incentive, every investor will boldly search for as much information as possible. The result is that the capital market as a whole delivers very accurate signals about competing investment opportunities.

It’s the Speculators, Stupid

Speculation means buying or selling assets, which make prices go up or down, which then signals producers to produce more or less. Via the price mechanism, speculation efficiently communicates valuable economic information with no central coordinator.

But there is a fixed supply of land!

Some people, especially Georgists, complain that the benefits of speculation do not apply to land. Their theory is that land is fixed. Higher prices do not create more land. Therefore the benefits of speculation do not apply to land.

But this is false.

Firstly, it is only productive land that matters. We create more productive land out of unproductive land all the time!

There is a fixed amount of oil in the world, too. But price signals are what signal when to bring more or less of that oil into production. Real estate is no different.

Secondly, speculation is not only a signal about when to increase or decrease production. It pertains to how the land is used. More expensive land should be reserved for the higher purposes that make it expensive.

Spencer Heath is a former Georgist who complained that Georgists dismiss the intellectual activity of allocating real estate.

Wherever the services of land owners are concerned [a Georgist] is firm in his dictum that all values are physical. … In the exchange services performed by [landowners], their social distribution of sites and resources, no physical production is involved; hence he is unable to see that they are entitled to any share in the distribution of physical things and that the rent they receive … is but recompense for their non-coercive distributive or exchange services. … He rules out all creation of values by the services performed in [land] distribution by free contract and exchange, which is the sole alternative to either a violent and disorderly or an arbitrary and tyrannical distribution of land.

Spencer Heath, Progress and Poverty Reviewed, pp. 9–10

Landlords make determinations about the highest and best use of land, and suffer the risk of consequences in opportunity costs when they are wrong.

Is that benefit worth the tons of money landlords earn? Well, they don’t earn as much as you think….

Guaranteed Money

Investing in real estate is easy money. Real estate is guaranteed to go up in value even if you don’t do anything.

You don’t have to look very far at any given time to find someone losing a lot of money on real estate. For example, in 2024:

And here in America, everyone older than a high schooler remembers this:

Heck, companies can lose $100,000,000s in a good market, like my own former employer not too recently that you may remember:

If you want someone to be grumpy at, consider the Gordon Geckos on Wall Street, not poor real estate.

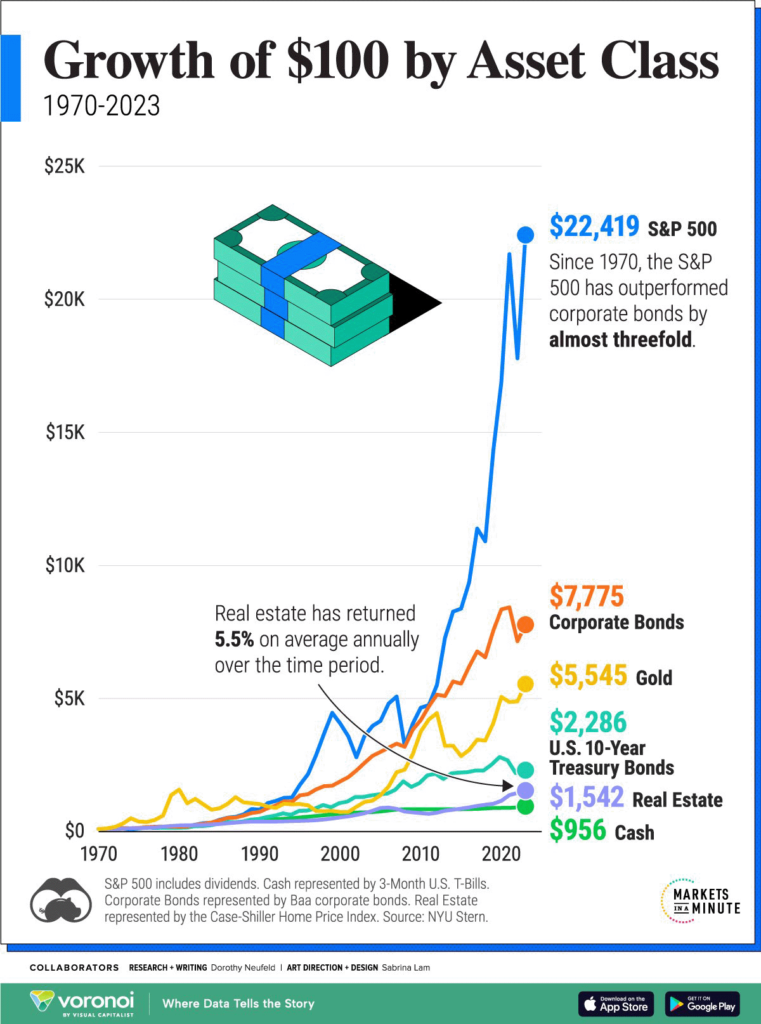

Real estate returns are pedestrian in comparison to the alternatives.

And lest you are tempted to conclude this is only residential real estate and that the smart money is in commercial, retail, and industrial real estate, making huge returns for their owners, think again.

Residential real estate is actually doing significantly better than commercial at the moment, as the pandemic and work from home trend drove sky high vacancy rates in downtown office buildings and the surrounding retail that relies on it.

These investors and landlords took risks that workforce habits would remain largely unchanged, and they are the ones paying now when the risk doesn’t pan out.

One cannot deny landlords the reward for correct speculation on future trends while making them pay for the risks of their investment.

The Annualized ROI

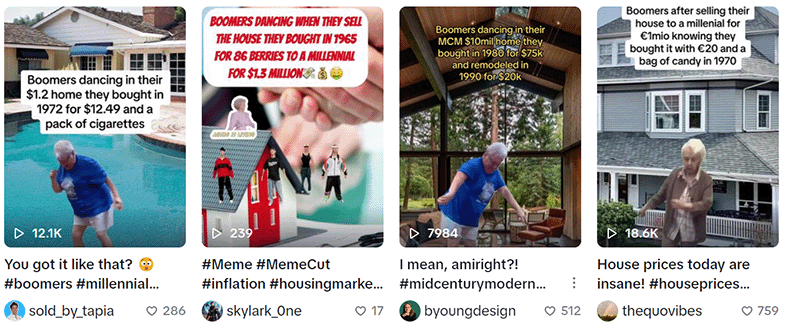

There are lots of stories about parents who bought their home for $30,000 in 1980 and whose homes are worth $550,000 now. Hold any investment long enough and the nominal return might look eye poppingly large. It’s a whole meme!

But what is the rate of return on that “free money”? Turning $30,000 into $550,000 in 44 years is an annual nominal return of just 7%. That is before inflation! It also does not count the money spent on mortgage interest, maintenance, and taxes, meaning the real return for many of these assets is close to 0 if not negative.

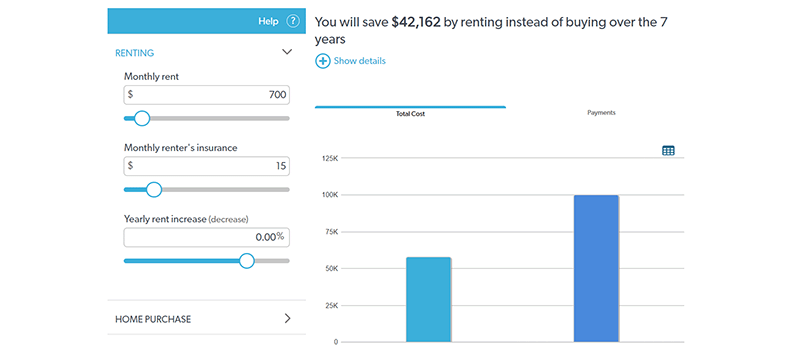

Obviously, these assets, unlike stocks, have utility as residences. We can look at tools like the rent v own calculator discussed later to truly compare the purchasing option to that of renting. For anyone with very long timelines they expect to be in their home, the benefits of ownership are tremendous. But they begin diminishing very quickly the shorter your holding period.

But we are talking about landlords, not owner occupants.

Investors have these same expenses but without the roof over their head, subsidized interest rates, or tax breaks.

Real estate investing is, on average, a low margin business in which people sometimes do well and sometimes do poorly. It is not an exceptional asset class in that respect.

But, if you are still not persuaded, consider buying some of your own!

REITs are required to disburse 90% of their profits to investors. These investors aren’t exclusively rich people. You can buy shares of REITs yourself like any other stock! You don’t need a $20,000 down payment or to start a multi-family syndication on your own. REITs make access to real estate returns accessible to all!

My Personal Experience

I am especially innoculated to the “real estate is easy money” crowd.

I cut my teeth as a Realtor in the Killeen, TX market. That market, for most of the past 20 years, has been flatter than a Texas prairie.

I worked with sellers who had bought their home for $115,000 in 2004. 11 years later, my CMA recommended a sales price of….$115,000. And that was only after they made some necessary repairs.

I’ve worked with sellers who were underwater on their mortgage because of 100% financing with the VA loan, transaction costs, and a zero-appreciation market. Some were willing to spend money in order to sell their home.

And then there is my personal real estate.

I own two rentals in Lawton, OK. I bought them in 2009 and 2011.

I’ve been cash flow negative the entirety of that holding period because the rent is not enough to cover the mortgage, maintenance, property management fees, and capital expenditures (they both got new roofs in 2022).

Over a decade later, in 2024, after the recent home price surge, they are each worth about $10,000 more by my estimation.

I likely would have been better off taking the few hundred I was spending monthly and putting it into an index fund.

For many homeowners like me, housing is a major source of wealth not because it is lucrative with high returns but because they act like giant piggy banks that we are forced to put a little money into every month when paying off principal on the mortgage. Because that equity is very illiquid – I have to sell or refinance the home to get it out – it is hard to spend and accumulates over a long holding period.

Whether that is good or bad is not for me to say. But it is not a massive windfall for property owners.

They Crowd out Homeowners

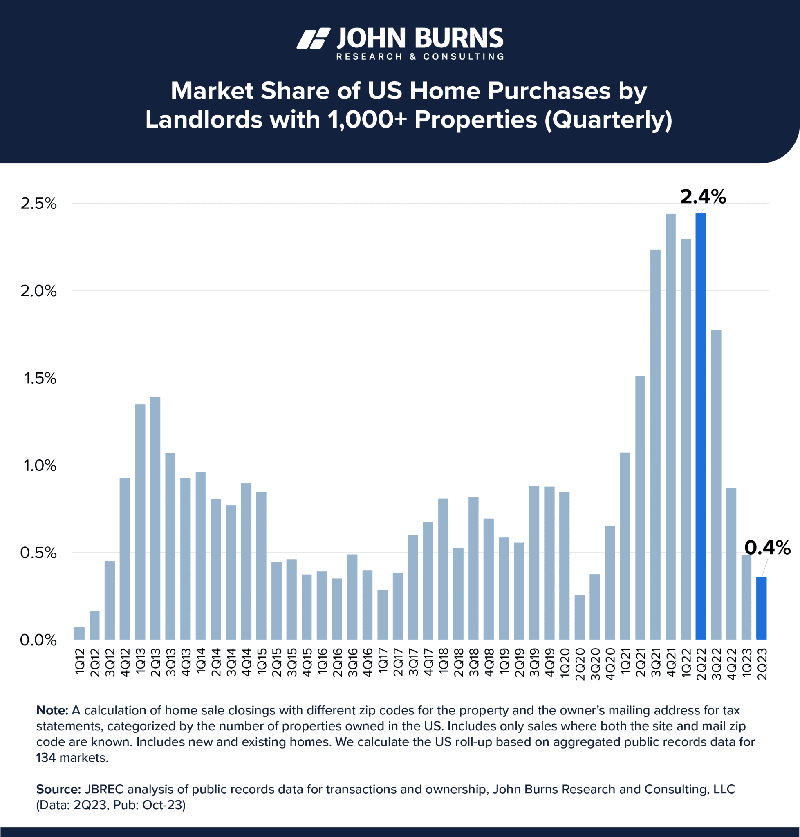

Investors bought 1 of every 4 homes in 2022, stealing opportunities for homeowners and driving up prices!

This is factually untrue.

The real number in 2023 peaked around 2.4% of single family home purchases. And in fact, some institutions have since become net sellers, selling more homes to retail homebuyers than they are buying homes.

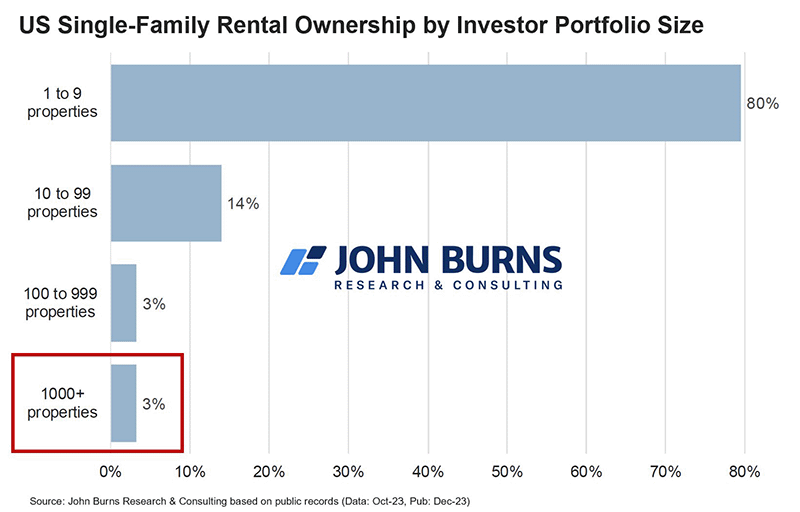

The big guys are a tiny fraction of home purchases. Most rentals are owned by mom-and-pop landlords.

It’s true that the institutional landlord business, especially in single-family rentals (SFR) has ballooned since the Great Recession sent home prices to bargain basement levels. All the major players in the single family rental (SFR) space date their beginning to that time.

Before then, investor activity eschewed single family homes because of their “scattersite” challenges of managing homes in different buildings, streets, neighborhoods, and even cities. Investors preferred multi-family apartment complexes that are easier to manage, maintain, and price.

But the surge in the SFR business model does not crowd out homeownership.

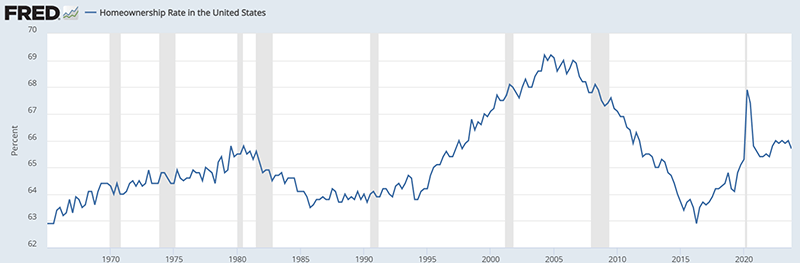

To the contrary, the homeownership rate has increased in the past decade.

The rate is below the loose-credit spending surge that led to the banking crisis, but still above the historical average, even if it erodes in 2024 under higher interest rates.

The percentage of Americans in multi-generational homes has indeed increased, which would be represented as homeownership households. The theory here is that Millennials living with their parents is a reason the homeownership rate hasn’t plummeted, not that homeownership is still accessible.

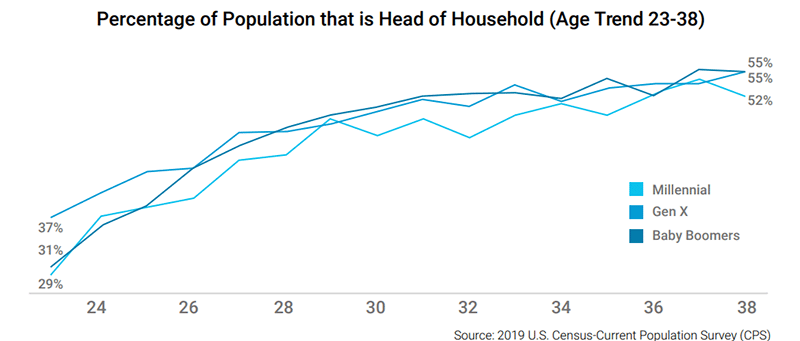

It’s true that, as of 2019, Millennial homeownership lags that of other generations, each of which has successfully become more renter-focused. But it is a modest difference. And most of that difference is likely due to the Great Recession, the effects of which are beginning to dissipate as Millennials become much better off than they may complain.

Landlords Sell Homes

Lastly, landlords have found plenty of ways to craft win-win deals with homeowners, too. Invitation Homes partnered with Pathway Homes to offer rent-to-own options for Invitation tenants, pioneering what may be a new and better business model of “rent-before-you-buy”.

Landlords are not interested in a “you will own nothing” economy. They are interested in profiting by giving people what they want. Sometimes that means a rental. And sometimes that means a home for sale.

In a free market, there will be a natural, equilibrium rate between people who, based on their unique circumstances at the moment, prefer renting to buying and vice versa. The market will naturally gravitate to this equilibrium. Currently, which higher market prices, landlords are selling homes because the buyer demand is attractive. When that reverses and rentals are again in higher demand versus what landlords can get for selling homes, then they will turn back to buying rentals.

Land speculation drives up prices

It’s basic supply and demand, right?

When you add investors to the pool of people looking to buy homes, demand goes up. Higher demand means higher prices. It’s as simple as that.

Everything we do is speculative. All human behavior is speculative.

When I turn a door knob, it is because I am speculating that it will open the door. When I put money in my retirement account, it is because I am speculating I will need it in 30 years. When I buy real estate, I am speculating that it will satisfy some need, either personal or financial.

But this complaint is about financial speculation, whose definition is buying and selling a product without adding to its productive capacity with the goal of profitting.

If not for these speculators, there would be fewer buyers and therefore less demand, right? A basic supply and demand graph says that prices would consequently fall.

But very few landlords do not rent out their property (more on that in a moment). The supply is unchanged. If a landlord buys a house, the supply of houses has not changed. If he converts an owner occupied house into a rental, the supply of rental homes goes up and supply of for sale homes go down, basically offsetting one another. To the extent that is a good or bad change depends on the local demand for rentals versus owner occupant homes.

Bubbles vs Speculation

It’s definitely true that bubbles exist as a result of both homeowners and investors alike overpaying for real estate.

But that is bad speculation for which landlords eventually pay up when prices pop.

We see that very effect in China at the moment. China’s problems, however, are self-inflicted, and not the result of speculation itself. Rather, China forced regional governments to hit certain GDP targets, creating a cascade of unintended consequences that made real estate the only “safe” place to park your savings. Until it wasn’t.

Had China actually allowed for open market reforms and not forced governments to cook their books, speculation might have saved them. Free market forces would identify the bubble, begin shorting or disinvesting, driving prices down, and curing the bubble!

The solution to bad speculation is good speculation. That is the price discovery process in action, for which speculation is absolutely necessary.

A Feature, not a Bug

For correct speculation, driving up prices is a feature, not a bug. That is exactly the mechanism by which the free market works.

Higher prices signals to producers to make more. In the case of real estate, that means more housing! Higher prices gets builders building and, in the long run, returns prices to an equilibrium.

The alternative, if prices were fixed and did not go up, means that the incentives to build more supply would be artificially reduced. But if demand continues to go up with artificially reduced supply, then you will either get even higher prices, or you will get shortages and increased homelessness.

Higher Prices are Creating More Supply!

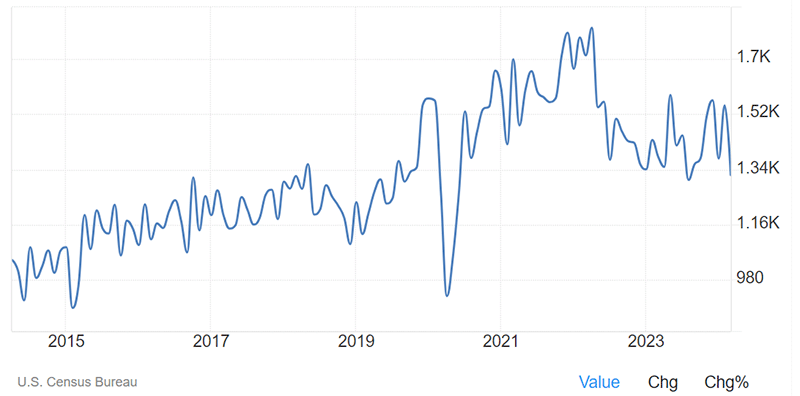

So, is this happening in the real world? Are investors building more because of higher prices?

Of course!

The build-to-rent model (BTR) is all the rage among major single family investors like Tricon, Invitation Homes, and AMH! As existing home prices went higher and higher, it became harder for these companies to find good deals. So what do they do? They go build their own homes!

Invitation Homes built 7500 homes with Pulte Group and continues to purchase and stimulate builder activity.

US housing starts continue inching up, with the only major impediments being the uncertainty during the early months of the COVID pandemic and the 2023 era of higher interest rates dampening buyer activity.

Landlords capture increases in wages by increasing rent

The rent of land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give. — Adam Smith

An Inquiry into the Nature and Causes of the Wealth of Nations, Book I, Chapter XI “Of the Rent of Land

This is a bit more esoteric, but some objections to landlords are that they capture increases in the wages of their tenants by increasing the rent.

If you get paid more, tough luck. Because landlords have a collective monopoly on land, which has a fixed supply. You have to live somewhere! They will just raise your rent.

This, and the labor theory of value, are two things that Karl Marx and Adam Smith actually agreed on!

Unfortunately, they are both wrong.

Land is not a monopoly. And it has little to do with how wages are set.

Land is not a Monopoly

Buy land, they aren’t making any more of it!

Mark Twain

All the land in the USA is owned by someone. All of it.

The only place I am aware of with free homesteading land is Russia. And, well….

And yet, we make more economic land all the time!

Putting that aside, a monopoly means a single owner. We have millions of owners in the USA. It’s true that any given piece of land has a single owner. But so does your shirt, and yet you would not say that the shirt industry is a monopoly. That is just a description of private property.

Real estate is one of the most fragmented industries in the world, especially in America. Blackstone is the largest real estate asset manager in the USA with $1T in assets under management. But they do not directly own all of those assets. That is 0.7% of the estimated total value of all real estate in the USA at $142T.

Yes, when in a lease, a tenant can’t go anywhere without significant costs. It’s not free to move homes and a massive nuisance. The landlord has a “monopoly” of the real estate you specifically occup at any given time.

But landlords also incur massive turnover costs when tenants move, too! They hate it like the plague! Tricon, recently purchased by Blackstone, has a program called “self-governed renewals”.

At the core of Tricon Vantage is Tricon’s long-standing practice of voluntary self-governing on rent renewal increases, which caps annual rent increases for existing residents at rates typically below market rent. Our self-governing program means that residents who renew with Tricon can often save more each year they renew with Tricon, with a large group of our current residents saving $300 or more on their monthly rent, depending upon how long the resident has lived in a Tricon home.

Tricon 2021 ESG Report

Tricon has a habit of reporting significantly less renewal rent growth than their peers, AMH and Invitation Homes, but significantly higher retention rates that avoid turnover and, according to them, entirely make up for it.

But what happens when someone has a piece of prime real estate suited to a single purpose and holdout to capture the full, unearned value?

Well, this happens.

Life finds a way. There is no land in America so special that its ownership constitutes a monopoly. There are always other options, like building around it or somewhere else.

If land is not a monopoly, and landlords are as afraid of turnover as you are, then its very unlikely that they, as a matter of course, are able to force you to pay whatever you can bear.

And we can see it in the data.

Landlords Aren’t Stealing Our Salaries

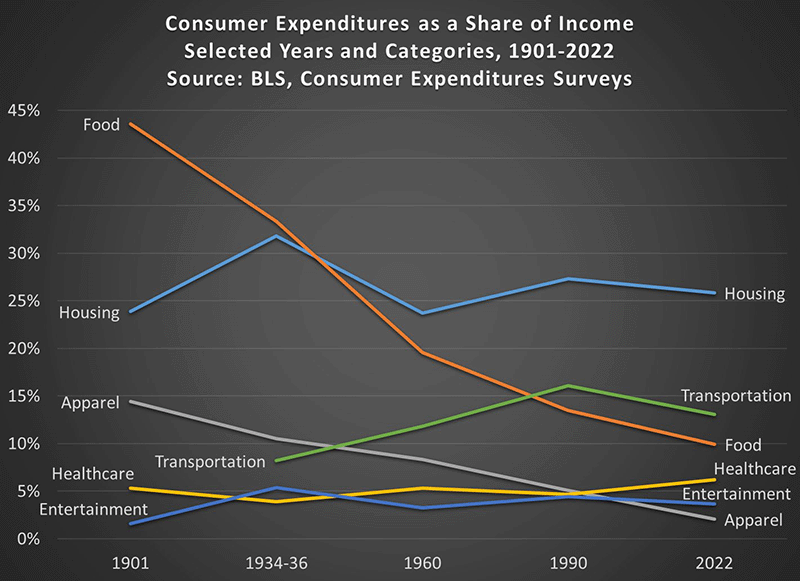

If Adam Smith were right, we would probably expect the portion of money spent on real estate related activity like housing to consume an increasing percentage of expenditures as productivity takes off. And yet, it has been very stable during the last century of unprecedented productivity growth.

Credit: Jeremy Horpedahl

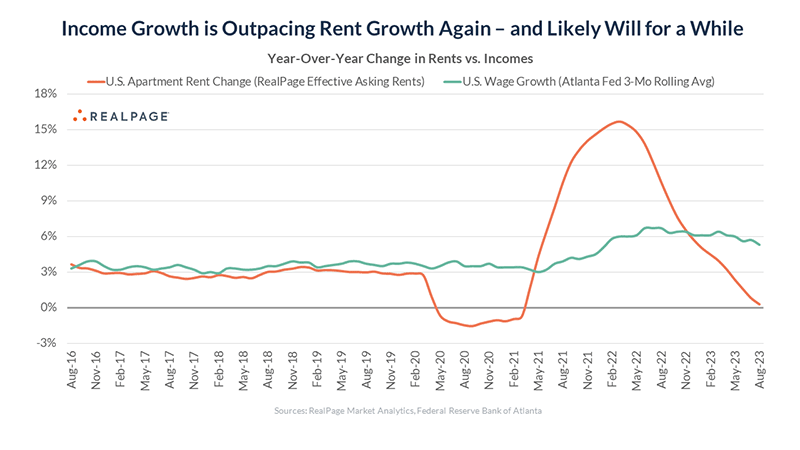

Despite the doomerism popular in places like Twitter (or X), wages are outpacing rent growth, after the pandemic surge in real estate prices.

It is true that increased wages might lead to increased demand which may correlate with an increase in prices. But that is a far cry from what was posited: that landlords can utilize monopoly power to extract these wages from their tenants.

Nobody would have to rent if we didn’t have landlords

If we abolished landlords, everyone would own their home! We have no need for the landlord class!

There appears to be a community that sincerely advocates abolishing landlords. And also, apparently, Subway. Perhaps it is a Jared Fogle thing?

Perhaps we should look to the times in history when countries have indeed abolished landlords. I think it is a fair assessment to say the track record has been poor.

Leaving historical ignorance aside, we can also look at people’s circumstances and conclude that landlords are necessary.

Renting makes sense for a lot of people.

There are pros and cons to renting. Some pros include:

- No down payment needed

- Purchasing power not dependent on interest rates

- Don’t pay for capital expenditures (e.g. new roofs) or maintenance

- No risk of decreasing value (yes, home values do decrease sometimes)

- Easier to move

- Renting is often cheaper than buying

- Much lower transaction costs

- Much lower out of pocket costs

Freddie Mac has a helpful calculator to help you make the rent v buy decision.

It’s quite clear that many people, especially those who do not expect to be in their home a long time, might be better off renting than buying. There is no reason to deny them this option.

If we can accept that renting is sometimes a good option for people, then we must accept that an industry that provides this housing type is likewise a good and necessary thing.

Single Family Home Rent Options

As an aside, it seems as though much of the landlord complaining is about single-family landlords. Fewer people complain that apartments are investor-owned.

I have no idea why that is, other than there is no reason for it.

Renters shouldn’t be limited to renting an apartment. Renters should be able to rent single-family detached homes if they want to!

Landlords Benefit from Keeping Homes Vacant

Not only do landlords increase prices by adding to demand, but they artificially restrict supply by keeping homes vacant. Higher demand plus lower supply equals sky high prices that benefit the landlord!

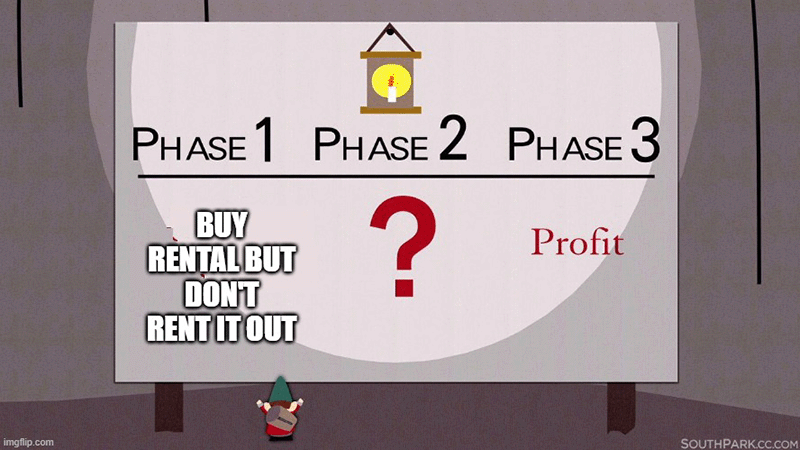

Anyone who has worked for an institutional landlord knows how insane this is. This is truly insane. 100% Underpants Gnome logic.

But let’s dig into it nonetheless.

A real estate asset is valuable because of its ability to produce income. Even anticipated gains of appreciation come exclusively from a property’s hypothetical, future ability to be productive.

A seller is going to sell based on its productive capacity. A buyer is going to pay the price for that productive capacity. If a buyer then neglects to apply it to that productive capacity, you are going to lose a lot of money.

Holding Cost Math

Let’s consider some very real world figures.

A vacant home is cash flow negative. By a lot.

It costs about $85 a day for every day a home is vacant.

The average asking rent is about $1900 as of this writing. Add utilities conservatively at about $300/mo, $250 for cleaning and minor repairs while vacant, another $80/mo in insurance costs for vacant homes, a conservative $20/mo squatter risk cost, and you are at $2550/mo in holding costs for a vacant home, or $85/day.

In order for these costs to be worthwhile, you have to imagine that your vacant unit is appreciating in value by more than $2550/mo merely because you are keeping it vacant. That is $30k a year, or 8% per year for an average home value of $250,000.

Plus, the supposed “benefit” of being vacant is an externality that, by definition, is nonexcludable. Its effect is dissipated and the effect on demand doesn’t affect just your own vacant unit.

Perhaps it is helpful to a landlord if someone else keeps their home vacant and loses oodles of money. But each individual landlord is incentivized to keep their units occupied for as long as they possibly can.

Landlords Do Not Keep Units Vacant

Vacancy is, in fact, the biggest cost to landlords, and savvy landlords seek to avoid them like the plague.

Let’s continue to pick on Invitation Homes, one of the largest and publicly traded single-family landlords.

You can look at Invitation Home’s public statements as a publicly traded company to get an idea of how many of their homes are vacant. They boast greater than 96% occupancy rates and are confident investors would be less than impressed by reduced numbers.

Our ability to successfully operate our business and implement our operating policies and investment strategy depends on many factors, including: …

Invitation Homes Annual Report to Security Holders 4/5/23

- our ability to maintain high occupancy rates and target rent levels;

Their average same-store occupancy rate is 97.7%. That means their average home is occupied 360 days out of 365 days a year.

If they benefit from vacancy, they are doing something egregiously wrong.

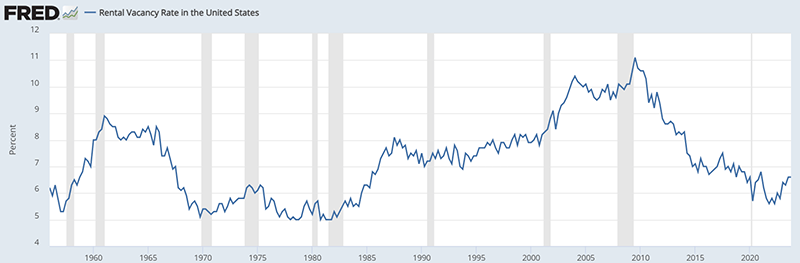

Indeed, vacancy rates today are around the approximate historical average in the postwar era.

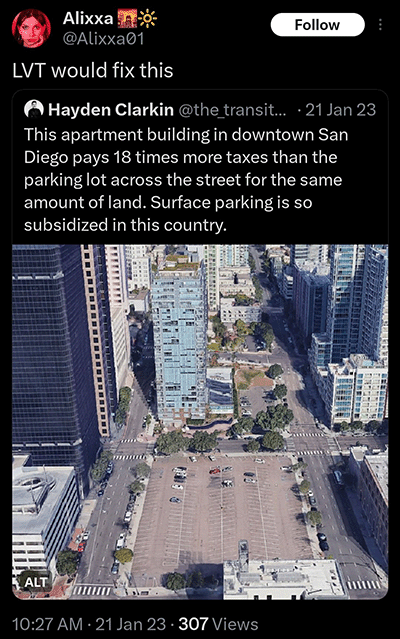

The Manhattan Parking Lot

The classic example of a landlord holding and benefitting from vacancy is the Manhattan parking lot (or, San Diego, in the case below).

The theory of the case is that the low tax burden means this parking lot owner gets all the benefits of appreciation, thanks to the positive externalities of surrounding buildings while contributing nothing of value themselves.

A full takedown of Land Value Taxes (LVTs) is a discussion for another post. But the answer to this kind of “profitting from vacany” objection is merely to point back to the reasons speculation is good.

If this landlord could make more money by building a skyscraper instead of a parking lot, don’t you think they would? If building would have a positive return, why would we need to force the landlord to build? They would gladly do so!

The answer is that there isn’t always demand for another skyscraper, just because your lot happens to be adjacent a skyscraper. As many are finding out the hard way in 2024.

Even if the demand exists, the costs of building, including the cost of regulatory compliance, may not make the effort profitable. That is not the landlord’s fault.

Institutional Landlords are Greedy and Bad for Renters

Institutional landlords are buying up rental real estate, possibly representing 40% of all rentals by 2030. These selfish for-profit companies only care about raising rents and extracting as much wealth from renters as possible!

Institutional investors aren’t displacing homeowners, as mentioned above.

It’s possible they are displacing mom-and-pop landlords.

That might sound bad, too. The mom-and-pop business is a time-honored American tradition. It’s the small businessman versus the corporate behemoth.

But in reality, institutional landlords are often (though not always!) better for renters.

Institutional landlords include companies like:

- Invitation Homes

- Tricon

- AMH

- Mainstreet Renewal

- Progress Residential

- Mynd

- First Key

Unlike mom-and-pop landlords, these corporate landlords present quite a few benefits for renters, including:

- Less likely to move back in. I worked in the Killeen, TX market with lots of military homeowners. Often they would move, rent their home out, and then PCS back to Killeen later in their career. They would often kick out their current tenant when the lease was up so they could move back into their home! Institutional landlords don’t want to live in their own homes and are much less likely to kick out a paying, happy tenant.

- More resources for compliance. There are nearly infinite national, state, and local ordinances pertaining to landlording, from rental registration, eviction laws, rent controls, and fair housing. Well heeled institutional investors are best equipped to comply with these regulatory benefits to renter consumers.

- More resources for repairs. It’s not unusual for a cash strapped landlord with a single rental or two to be hard pressed to afford needed repairs, even in emergencies. This is less often the case with larger, well capitalized investors.

- A reputation to maintain. Unlike a mom-and-pop landlord with a single unit, institutional landlords have a reputation to maintain. A bad tenant experience can impact their BBB and Google ratings. A bad tenant experience in Alabama may affect the propensity of a Las Vegas tenant to rent from them. They are therefore incentivized to treat tenants better than might a mom-and-pop landlord.

- Rent-to-own options. Unlike mom-and-pop landlords, institutional landlords are more likely to be open to rent-to-own programs like the aforementioned Invitation Homes Pathways program.

Clearly there are some fantastic small time landlords and this is not meant to disparage the part time landlord, nor am I putting institutional landlords on a pedestal. I would merely wager that, on average, the tenant experience is probably better coming from an institutional landlord.

Who Are the Landlords?

I imagine the word “landord” conjures an image of Ebenezer Scrooge evicting the poor on Christmas.

Perhaps such people exist and are indeed landlords. But here are some interesting stats about who is a landlord.

The average landlord earns $69,085, and over 16 million American households report rental income on their taxes.

Even institutional landlords aren’t just a bunch of fat cats on yachts.

Some of the largest investors in real estate funds include state or union pension funds. Nearly $1T in pensions are invested in real estate. REITs, in particular, have dividend requirements, creating stable cash flow on what is perceived as a relatively low risk investment.

It’s quite likely that you, dear reader, have invested in rental real estate already through one of these companies, even if not directly!

“Greedy” landlords, in these cases, are retirees (or future retirees) who don’t personally own or evict or raise rents on anyone.

Conclusion

Landlords are no different than any other industry. There are good ones and bad ones.

Like any other industry, they serve a purpose. When done well, they make our society better off.

Like any other industry, the poor ones fail eventually, and, in the creative destruction of capitalism, are eventually replaced by the more competent ones.

I’ve worked for institutional landlords and I am proud of it. The vast majority of my colleagues and I are sincerely trying to do the right thing for the benefit of investors and tenants alike. I get how easy it is to malign landlords. I try not to begrudge anyone their grumbling. But we are providing real value to society.

If this can contribute at all to helping soften the Dickensian image of landlords in America, I will have done my part for this honorable profession!