All Realtor Health Insurance Options in 2021

Update November 17, 2020; Originally published September 8, 2020

2021 open enrollment from the ACA Healthcare Marketplace runs from November 1, 2020 to December 15, 2020.

Do Realtors get health insurance?

Well, most do. But they mostly get it from outside their real estate job.

This is one of the most frequent gripes I’ve seen leveled at the National Association of Realtors from NAR members: the lack of a good group healthcare program.

In a world dominated by independent contractors, it’s not a surprise that insurance coverage might be spotty. A startling 21% of Realtors report having no insurance (although that is below the national average of about 28% of Americans without insurance).

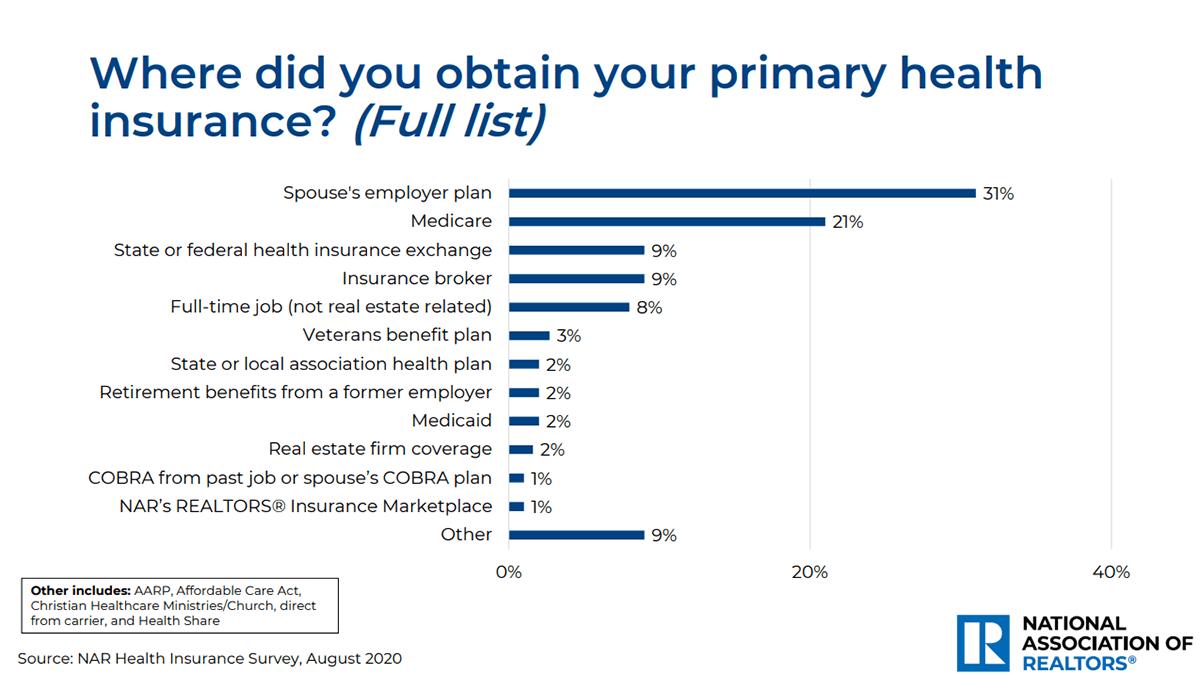

NAR has a 2020 survey that shows where most agents get their coverage.

- Spouse

- Medicare

- State/Federal Exchange (Marketplace)

- Second job

- VA (Tricare)

- Association health plan

- Pension/Retired

- Medicaid

- Real estate brokerage

- COBRA

- NAR Insurance Marketplace

- Other

Most agents are paying out of pocket, usually through the government Healthcare marketplace or directly to health insurance carriers.

If you are an agent looking to get health coverage for you and your family members, below is hopefully a good list to get you looking in the right direction!

REALTORS® Insurance Marketplace

There is no NAR health insurance.

But NAR’s perceived inaction on health insurance options for its membership does not extend exclusively from its own disregard.

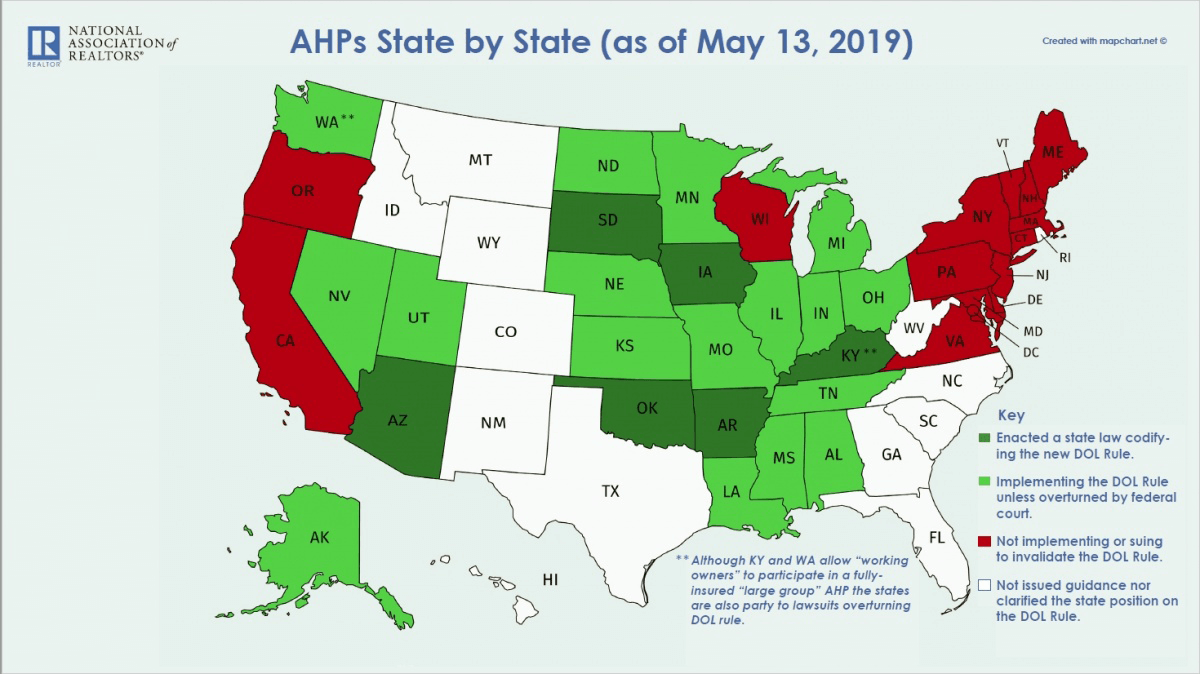

Rather, there currently exists legal ambiguity around Association Healthcare Plans.

In short, the Department of Labor implemented a rule that gave flexibility to associations to implement health insurance programs. Critics felt that the rule watered down the coverage intended by Obamacare.

NAR has been gun shy about launching an association health plan until the legal battle has run its course. But they have been supportive of local associations that seek to launch their own AHPs. NAR’s political advocacy is very pro-AHPs and has a visual so that you can see where your own state falls on the issue.

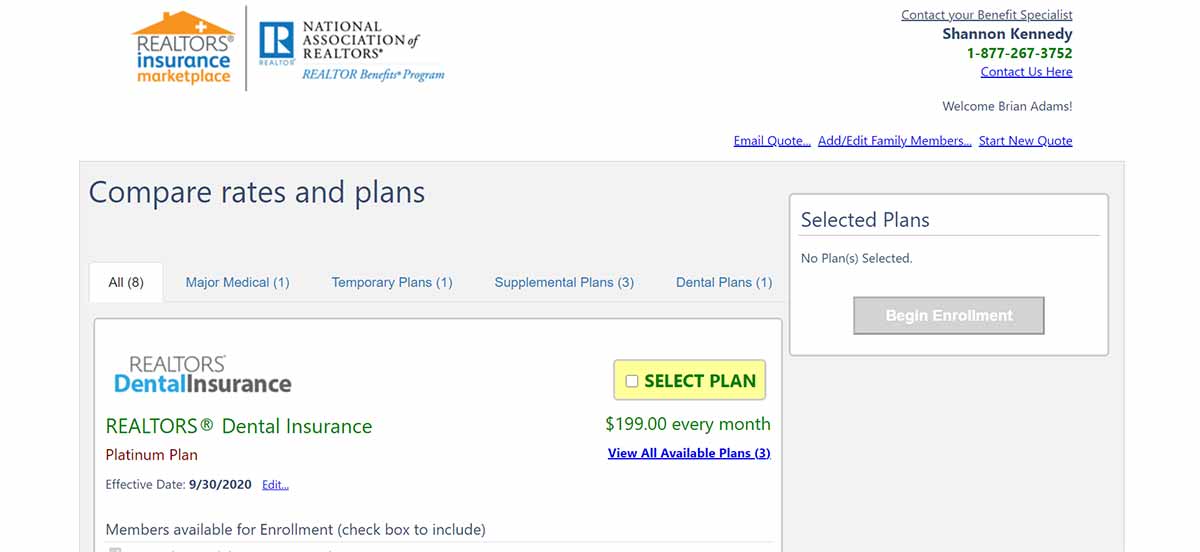

Meanwhile, NAR does have an insurance marketplace with a few third party vendors.

Judging from conversations on Facebook regarding the marketplace, its offerings are generally underwhelming as group plans go. It may be a useful starting place, however, to begin looking at plans.

The site offers a variety of different plans not just for basic healthcare needs but Realtors dental insurance, Realtors vision insurance, a prescription drug plan, and accident protection.

I logged in with my NRDS ID and requested a quote. comparing it to my current insurance through my employer.

The primary health plans had over twice the premium I currently pay. The available plans had similar or even less favorable deductibles. I won’t be switching, needless to say.

Then, when clicking on View All Available Plans, the default tab references Affordable Care Act plans (i.e. Obamacare, i.e. Healthcare.gov). I imagine most folks browsing here would end up on these ACA plans.

Be mindful: The REALTORS Core Health plan described is oddly named, as it is not major medical health insurance per the ACA minimum standards. Rather, it is accident insurance and fixed indemnity plan, which are supplemental insurance.

Lastly, be careful not to get scammed by folks pretending to be insurance providers during open enrollment season.

State and Local Associations

NAR does not have an AHP, but several states and local associations have moved forward with their own, nonetheless.

Some include:

- Baldwin County Association of Realtors

- Greater Las Vegas Association of Realtors

- Kansas City Regional Association of Realtors

- Nevada Realtors

- Tennessee Realtors

Some associations like the California Association of Realtors have offered healthcare options for some time, but not with the same leverage that would be possible with an AHP.

If you are pondering health insurance options, it may be worthwhile to check in with your local association to see what the latest is.

The Marketplace

AKA “Obamacare” or “The Exchange” or “The Affordable Care Act (ACA)” or “Healthcare.gov”, the healthcare marketplace is a frequent destination for agents’ healthcare options.

They feature a variety of big-name insurance provider plans. Based on your family information and income, you may be eligible for a subsidy that reduces your monthly premium. The subsidy is based on your estimated income.

When you file your taxes, you may owe or be owed money based on how near your estimate is to your final adjusted gross income.

Don’t assume you’re “too rich” to qualify for a subsidy. People up to 400% of the federal poverty level qualify for premium support. That means a six-figure salary qualifies for a family of 6.

At the average agent salary, an agent would definitely qualify for a significant subsidy.

It is worthwhile to shop and compare plans here to your other available options.

Brokerages

Brokerages have begun stepping up and taking their agents’ health insurance access more seriously. Several prominent brokerages have begun adding group plan options.

Obviously, it doesn’t do you a lot of good if you aren’t members of these brokerages. But that is why they do it! To attract you to their team!

Not all of these programs amount to full-blown insurance offerings. Some are just discount programs. Be sure to investigate each before signing up on any misunderstandings about what each program provides.

Some brokerages with some version of healthcare plans include:

- eXp Realty

- HomeSmart

- Fathom Realty

- Compass

- RE/MAX

- KW Wellness Program

- Realogy (BHGRE, Century 21, Coldwell Banker, ERA, Sotheby’s)

- JP & Associates

Some of these programs are new and perhaps haven’t caught on yet. But judging by the modest 2% of agents who report using their firm’s plan, it seems possible that other options like the Marketplace might still be superior options.

Salaried Roles

Most brokerages that pay agents on a salary instead of commission have healthcare benefits, like Redfin.

If you’re looking for salaried real estate roles, don’t forget to think outside the box a little. For example, iBuyers Zillow and Opendoor both are brokerages and employ licensed real estate agents.

Directly from Carriers

Presumably, this is the same as going through ACA but not getting a subsidy.

However, if you know you aren’t getting a subsidy through the Marketplace, then you likely want to search healthcare providers outside the Marketplace. Not all healthcare providers participate in Healthcare.gov.

You will want to be sure your plans conform to ACA requirements or you may face tax penalties.

There are insurance brokers who can help you shop and compare private plans.

Small Business Insurance

If you a team or brokerage with at least one non-owner W2 employee, another option might be small business health insurance plans.

The Small Business Health Options Program (SHOP) offers coverage options for employers with 1-50 employees.

Medicaid and Medicare

Medicare and Medicaid cover approximately 35% of Americans’ health insurance (17.8% of Americans are on Medicare, and 17.9% of Americans on Medicaid).

The Healthcare Marketplace will generally route you toward Medicaid options if you are expected to qualify based on income and household size.

Medicaid is not a monolithic program, with some states running the program slightly different than others.

Medicare is designed for Americans 65+ years old. It has Medicare Part A which is premium free, and Medicare Part B which still includes a monthly premium.

“Medishare”

“Medishare” programs do not offer health insurance. Instead, they are communities whose members share health costs amongst one another. These can be very cost-effective plans for those on a budget. A few examples include:

Be sure to consider the pros and cons. The programs may not cover preexisting conditions as well. You also generally can’t use an HSA to pay for Medishare costs.

Conclusion

I hope you’ve found some suitable options to find yourself health insurance coverage for you and your family, and without breaking your bank.