How to Handle Multiple Offer Situations on a House

It’s 2021.

Somehow, COVID unleashed a rip-roaring housing market that is not abating. I’m working with buyers who offered $5k over, then $10k over, then $20k over, and $35k over, and losing out to higher offers.

It sucks for buyers agents and we want a magic bullet that gets our offer accepted.

Meanwhile, listing agents have it easy, sticking a for-sale sign-up and promising your homeowner that you’ll review all the offers Sunday afternoon. But there’s a difference between “easy to sell” and “top-shelf experience and price”.

Read on to learn how to set your client up for success in a multiple offer situation.

- How do Multiple Offer Situations Work?

- Multiple Offers for Listing Agents

- Multiple Offers for Buyers’ Agents

- The Future of Multiple Offer Situations

- Conclusion

How do Multiple Offer Situations Work?

When multiple buyers are interested in a home and submit offers, the buyers and seller are now in a multiple offer situation.

What happens next is completely up to the seller. Sellers can:

- accept the best offer

- wait for more offers

- give parties a deadline to submit “highest and best” offers

- counter an offer

- decline offers

Multiple offer situations are nice for the seller’s agent and their client. But buying a house with multiple offers is frustrating.

The resulting bidding war is not a transparent process. As a buyer, you are guessing what the other offers are and trying to offer more without offering too much.

It is not the job of the seller’s agent to select offers. They will present all offers to sellers and make recommendations based on the differences and what is important to the seller. Ultimately, it is always the seller’s choice on what to do.

Once they’ve chosen an offer, they counter or accept. When executed, the listing agent will inform the losing offers that they were not selected, allowing them to move on and try their luck on another home.

Multiple Offers for Listing Agents

How to Handle Multiple Offers

- Set a due date for highest and best. It is really frustrating for buyers when the seller accepts an offer 12 hours after going on the market, or a second offer without letting buyers have the opportunity to improve their original offer. Coach your seller clients on expecting to not accept anything for at least 72 hours. If you get multiple offers, give everyone a deadline to submit so agents don’t have to rush their offers and everyone feels treated fairly. If your deadline is sooner than some scheduled tours, inform those agents you are expecting to decide on an offer before their showing and they need to either offer sight-unseen or reschedule for sooner.

- Ensure scheduling for tours is really easy. If it is a popular home in a hot market, chances are you are going to get a lot of showings in the first 72 hours. Using a service like ShowingTime should make scheduling easy for real estate agents. I’ve recommended and had sellers get a hotel for the first 3 days so that the home is vacant and very easy to schedule. And use the e-boxes like a professional and not combo boxes.

- Disclose the number of offers? The answer is up to your seller. A savvy buyer’s agent will ask how many offers there are to gauge the market. Should you tell them? You are not required to, but a seller might choose to in order to signal the level of competition and earn more aggressive offers. The downside? You might scare some offers away (if you have a lot) or get a lower offer (if only a few).

- Consider Ribbon. Ribbon is a startup that makes its bones as a lender offering noncontingent financing to buyers. Essentially this allows them to pay cash. As part of their platform, they have tools and offer a platform for managing multiple offer situations.

- Try out Coming Soon. I know Coming Soon is a controversial topic in the industry, but I am very much in favor of it. Give buyers a heads up of what is happening and a chance to start scouting your listing before you’re ready to go live.

Selecting the Right Offer

Don’t forget that this is your seller’s choice.

Remember what is important to them.

- Highest Price. Do the net sheets and pick the best net! Too easy.

- The Sure Thing. Weigh more heavily cash offers, preapproval letters, good lenders, appraisal addendums, and chunky option/earnest money fees.

- Easy Transition. A temporary seller’s lease, ideal closing date, no option period might be worth more than a great price.

Obviously a seller will likely want a combination of the above, though one may be a more important consideration.

Should you counter the best offer?

I’ve seen sellers counter offers during highest and best with a higher price. That seems crazy to me! Presumably if you are countering our offer, you already think we are the highest and best? Other than changing a few details like closing date or title company, why would we modify our price?

Obviously sellers can do whatever they want, but I think it’s tacky to counter on the price for a highest and best.

Common Mistakes for Sellers

- Accepting the first offer. “It was exactly what we were looking for and my seller’s are ready to get it started!” That is 100% your seller’s prerogative, but I would strongly recommend better expectation management. In a market where multiple offers are not uncommon, it’s perfectly fair to advise prospective buyers that you will be reviewing offers after 48 hours or so. This gives any prospects enough time to get better offers in. The first offer might be “good enough”, but I signed up to give my sellers the best.

- Forgetting scheduled showings. Did you receive an offer? Great! Do you have 3 showings scheduled tomorrow and 2 more on Saturday? Notify them! It’s a courtesy to let them know they are now in a multiple offer situation, and to advise them of a deadline, especially if that deadline is before they have already scheduled to view the home. Showings are a great excuse to also delay responding to your first offer. “Thank you for the offer. We have more showings scheduled and will be able to get back to you by tomorrow at 5” or something like that.

- Forgetting to do your seller’s net sheet. I know it’s a pain, but I recommend completing a seller’s net for each offer you get. It’s about more than the price, and the seller should have a complete picture of how each offer affects their bottom line.

- Getting cocky about marketing. It’s true that homes are selling fast and easy, even listings with subpar photography. But marketing still makes a difference. 10 offers are better than 5 and materially impact your results. Plus, a real estate agent should want more listings in a market like this. Your 12 MLS photos with your phone in portrait mode aren’t going to win at the listing presentation.

- Presenting Home Buyer letters. In hot markets, home buyers are sometimes inclined to write letters to the seller hoping to persuade them to accept their offer because their love of the home is truer than all those letterless offers. The problem is that these “love letters” invite fair housing problems. While I am not aware of any lawsuits stemming from a home buyer love letter, I’m inclined to agree that it’s a bad practice to share these with your seller. That said, it is not your choice. You must present such material to your seller unless your seller declines to see it. I recommend recommending they decline.

- Taking too long. It’s good to give 72 hours or so from list to set an offer deadline. But a week or more? I’d guess you’re as likely at that point to have more buyers drop out than adding any new ones.

- Lying. I don’t think this is a “common” mistake. But I often hear fears from my frustrated buyers that listing agents might be lying about other offers. That is natural, given how little transparency this nerve-wracking process has. I advise my buyers with these fears that listing agents would be, at a minimum, violating the Code of Ethics and be risking their Realtor designation and more if being dishonest during multiple offer situations.

Multiple Offers for Buyers Agents

How High Should You Go?

So you probably need to go over asking in most cases.

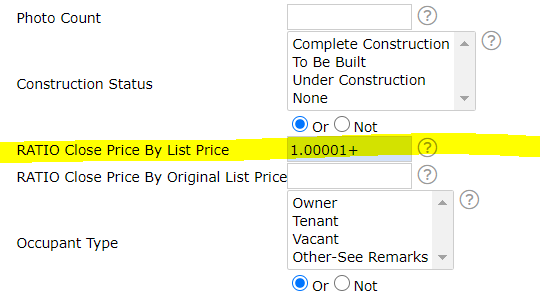

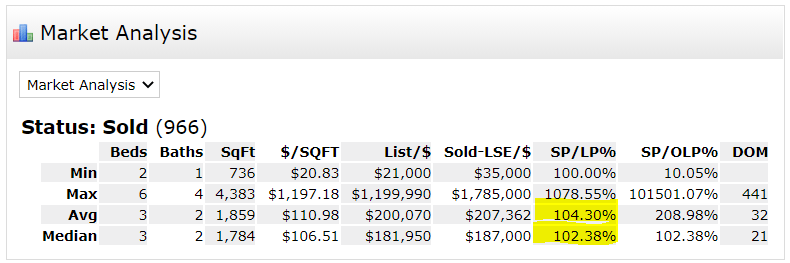

But how much higher? How about giving your buyers some data-driven insights. I looked in the MLS for every home in the past 90 days that had sold at or over 100.001% of list price (e.g. over asking). I was able to look up the stats for these homes and relay to my buyers that, on average, the winning bid was 4.3% over asking. This was a great way to benchmark where we needed to be to be competitive, although not a replacement for other signs of a hot house like being priced under market, dozens of other offers, etc. Below is what this looks like in Matrix.

Obviously, this isn’t a guarantee that 4.3% over will be a winning offer. You need to take into account where the list price is versus the CMA, how many other offers there are, home “wow” features, the home condition, etc.

The price range of the home will also have a major impact. Homes in the top percentile of a market are fewer, less likely to have multiple offers, and may behave different from homes nearer your market’s average price point.

Ways to Strengthen Your Offer

Note, I am a Texas agent and my experience is specific to Texas. But most of these are applicable to the wider United States. Share other ways you can make your offers strong in your State in the comments!

- Cash offers and contingencies. Sellers like cash offers because a) shorter escrows without lender paperwork, b) no appraisals, and c) no financing contingencies. Cash offers are so powerful that it’s not unusual for a cash offer to beat out an offer with a higher price that is financed. Don’t have cash or can’t offer without a contingency to sell your own home? There are new companies springing up throughout America that offer to extend noncontingent financing that works like cash, like Homeward, Properly, Ribbon, Knock, and EasyKnock.

- No seller-paid closing costs. Asking for closing cost concessions is the same as lowering the price, from the seller’s point of view. Either pay for these out of pocket or raise the price more to cover them (although you then are at higher risk of under-appraising). For nonallowables like the VA loan, you can get a lender who is willing to cover those or cover them yourself as an agent, or remember to have at least the minimum number of concessions from the seller to cover those amounts.

- Seller’s Temporary Lease. A big pain point for sellers is timing the closing with their next move, whether they are buying or renting their next home. A temporary lease, even if just a few days, can be a lifesaver. It might be worth asking the listing agent if the sellers are looking for a lease if it isn’t already requested in the MLS listing. You may also want to make the seller’s lease “seller-friendly” by skipping on deposits or rent.

- Appraisal Addendum. Low appraisals become a bigger pain point in hot markets. If you can’t swing a cash offer, an appraisal addendum may help a lot. These allow you to pledge to make up the difference, to a limit, should there be an appraisal shortfall. Sellers can then have the confidence they won’t likely be renegotiating the price when that likely event occurs.

- Compromise on the “Soft” Stuff. You get your earnest money back at closing! So, theoretically, you lose nothing by offering more earnest money. This can be a great signal that you are serious about the home. Other items that may be meaningful to the seller but cost little for the buyer are negotiating on closing dates, option periods, going with the seller’s preferred title company, etc.

- No option period. These are surprisingly common in the hottest markets. These buyers are in-it-to-win-it from the whistle. These are very strong offers if there is a lot of earnest money on the line. As a buyer’s agent, the dangers of having no option period are obvious. I recommend having in a written email the pros and cons of this course of action to your buyer, and perhaps recommending only doing this on newer construction (no more than 10 years old?) where latent defects are likely less serious.

- Solid lender. If the listing agent is experienced, they will know the good lenders from the “meh” lenders. Having a strong lender can be a significant method of getting a listing agent and their client excited about your offer.

- Preapproval instead of prequalification. I get these confused myself. Many use “pre-approved” and “prequalified” synonymously. But they mean different things. Preapproval is better, which means a lender has actually verified details and income and gone through most of the lending process with a buyer. This significantly reduces the chances that the lending will fall through and can increase seller confidence in the buyer’s ability to perform. Prequals, instead, are usually based just on reported financial details and haven’t been verified yet.

- Do what the listing agent asks. In many MLSs, there is a place to advertise a recommended earnest money, option fee, and title company. Agents may write in the private remarks more instructions like if a temporary lease is desired. I know everyone is loyal to a title company, but this may not be the time to negotiate on title companies.

- Escalation Clauses. These are not promulgated in Texas and can only be done with an attorney. But some states give agents more latitude to recommend and include escalators in contracts. These essentially agree to raise the price X amount over the highest offer with a cap. On the surface, it seems a great way to get around the lack of transparency about other offers and ensure that your buyer isn’t over-offering. But escalators can be tricky and backfire, so caveat emptor!

- A Love Letter. But wait! Above, for the sellers, I recommended NOT showing sellers buyers’ introduction letters! Yes, that’s true, as a listing agent I recommend against reading these. But as a buyer’s agent, I am advocating for my buyer, and if the seller reads them and falls in love with my buyer, all the better! That said, I generally don’t enthusiastically recommend these even to buyers, as I don’t think they move the needle much.

Common Mistakes for Buyers

- Forgetting to do a CMA. Just because there are multiple offers and you are almost surely offering over asking doesn’t mean you can skip the CMA. The CMA will tell you a lot in these cases like:

- Is the property underpriced? Maybe that is the cause of the multiple offers and you can be more aggressive without over offering.

- How likely is a low appraisal? Do your buyers need to be prepared to come up with the difference?

- How much equity will your buyers have? Just because your buyers are paying X doesn’t mean everyone else agrees that X is the fair market price. Are they going to be underwater on their loan until the market catches up?

- Cover your a**! Your buyers are possibly offering over the market if in a multiple offer situation. Don’t set yourself up for complaints that they overpaid in an opaque and tricky multiple offer process. You should always get initials from buyers on a CMA to CYA.

- Not talking to the listing agent. Don’t just send your highest-and-best and cross your fingers. Talk to the agent! Find out what their seller is looking for in a better offer. It may be more than a higher price. You can also try to get any information that can inform the competitiveness of your own offer, like asking how many other offers there are (which the listing agent may or may not share).

- Typos and contract errors. It’s especially important to have a “clean” offer with no mistakes. Everyone’s made a mistake – leaving the survey endorsement checkbox blank, accidentally checking there is an HOA when there isn’t, or leaving the wrong brokerage information on the receipt page from a previous offer. These mistakes raise questions about the contract and make it just that much more difficult for a seller to accept your offer as-is without at least a counter. Make it easy to say “yes”!

- Delaying. Home sellers can be fickle folks. Just because the home has only been on the market 4 hours doesn’t mean they won’t accept the first offer they get. I’ve had this happen personally where my client was the first to get an offer in on a home that was clearly priced under market and they accepted despite other showings scheduled later in the day. Even if they advertise a due date later in the week, there is nothing stopping them from changing their mind and accepting a great offer sooner. Get your offer in quick.

- Forgetting backup offers. In hot markets, sellers often don’t care about backup offers. If the current contract falls out, they will just find a great next offer. But they might see advantages to backup offers. Submitting a backup offer is worth a shot.

- Losing without takeaways. If you’ve lost a multiple offer situation, odds are that you will find yourself in the same situation in the next offer. Do what you can to learn about the winning offer and how it might help your buyer on the next effort. I have asked and received feedback on our offer versus the winning offer. For example, I learned in one case that the winning offer was indeed higher, but also had an appraisal addendum unlike my own (because my buyers were using the VA loan). Based on that insight, I knew to have a conversation about whether moving to conventional was worthwhile in order to submit stronger offers with appraisal addendums if that is what our competition is doing.

The Future of Multiple Offer Situations

Multiple offer situations are one of the most frustrating and opaque problems presenting home shoppers in the 2020s.

There exist numerous real estate startups aimed at making the transaction easier: Opendoor, Earnnest, or Endpoint. None of these address the awful experience that is the dreaded “multiple offer situation”.

Not only am I a licensed Realtor, but I also price homes for Zillow. Multiple offer situations are another bane for accurate information about home values.

The classic definition of the “market price” is what a willing buyer and seller decide on! But is that what is happening in multiple offer situations? Clearly not! The buyer is grasping around in the dark trying to guesstimate where a winning offer might lie. Might they have offered more if they knew what the competing offers were? Might they have offered less if they had known they were $30k over the next highest offer?

These are not efficient market transactions and are a serious distortion to home prices,. This effect plausibly contributed to previous housing bubbles like the 2008 Great Recession.

A tech company that can somehow disrupt this entrenched way of buying and selling homes in hot markets should be justly rewarded for providing both buyers and sellers a better experience.

Why Not Auction Style?

I’ve had this question from buyer and sellers alike. I was also in one very weird transaction where the seller tried to sell auction-style.

Selling via auction makes a lot of sense and includes transparency. The “losers” will know what the price was. The “winner” will be the person most in love with the home, demonstrated by their willingness to offer the most!

So why not handle multiple offers this way?

Well, maybe we can one day if this catches on in the industry. However, real estate is a very illiquid asset, and in normal markets, most homes do not sell with multiple offers. An auction-style arrangement wouldn’t necessarily make sense as the default method of selling.

Also, the laws may vary from state to state, but your real estate license isn’t an auctioneer’s license.

That said, you can check with your state and broker laws. In Texas there would be nothing prohibiting, at the seller’s instructions, sending notices to all buyers via the SELLER’S INVITATION TO BUYER TO SUBMIT NEW OFFER form with the new “best price” and do that over and over again until there is only one standing. That sounds like a painful and extremely lengthy way to manage a multiple offer situation, however.

Conclusion

Hopefully this has given you some ammo as a real estate agent to negotiation your way through next time you are selling or buying a house with multiple offers.

And I’m especially hopeful that maybe it inspires someone to come up with better methods of handling these situations that are transparent and better for the industry. Given the 2021 market, I’m hopeful the proliferation of multiple offer situations might spur innovation in this area.