21 Fastest Growing Real Estate Technology Companies in 2018

This list is from LinkedIn. With a premium subscription, you can view the employment trends of companies with at least 30 LinkedIn employees. From this, I’ve narrowed down on a few of the fastest growing real estate companies.

This isn’t based on profit, or revenues. Instead, it is just who has been hiring and growing the past two years!

If you’re a tech guy looking for a real estate company to work for, this list is a good place to start. Or check out some of their competitors who might be the next big thing, or enjoying second-mover-advantage.

If you’re an agent or broker, these are some of the tools, brokerages, and competitors that have been making a splash, and might deserve your business!

Who’s Not on the List?

This is not a list of fastest growing real estate companies in every category. I’m focused on real estate tech products designed for Realtors, commercial agents, brokers, and MLSs. Not included here are REITs, venture capital, developers, builders, and traditional brokerages.

It’s also not exhaustive. This is what I’ve found on LinkedIn. It’s also not based on revenue, but on which companies are hiring the most. Some companies grow revenues by cutting expenses. And some of the fastest growing companies are upside down on revenues.

Lastly, these numbers are from the insights with a premium subscription with LinkedIn. LinkedIn only has insights for companies with at least 30 LinkedIn employees. So sorry smaller startups and vendors, but this is just for the mid-sized folks.

These numbers are as of 10/5/2018.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last]

[/two_third_last]

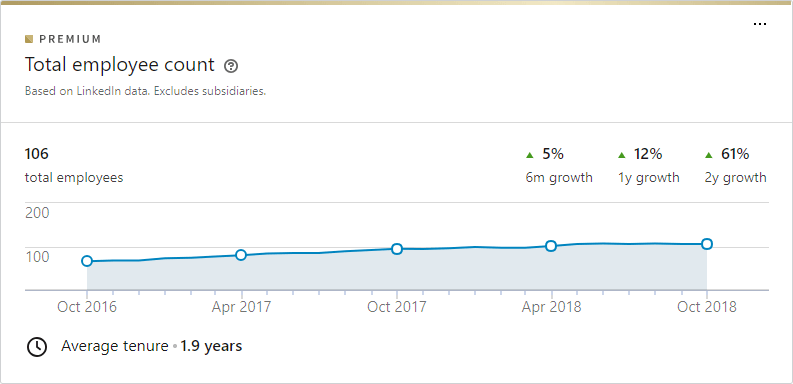

Skyslope – 61%

Skyslope is a real estate transaction management software. Skyslope is designed to be a complete backend, including digital signature and tools for real estate agencies. Headquartered in Sacramento, CA and begun in 2011, Skyslope was bought by the real estate tech giant Fidelity National Financial in 2017. Fidelty National Financial, in addition to many title services, also owns CINC and Real Geeks.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last]

[/two_third_last]

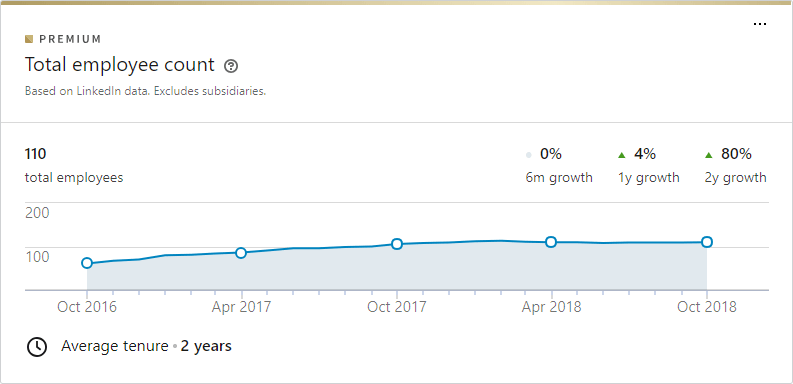

House Canary – 80%

House Canary is a data-happy real estate tech firm all about automated valuation models. They have their fingers in everything, with partnerships with industry giants like CoreLogic, NextDoor, and more. Founded in 2013, they raised $33M in venture capital funding in 2017. They are headquartered in San Francisco, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

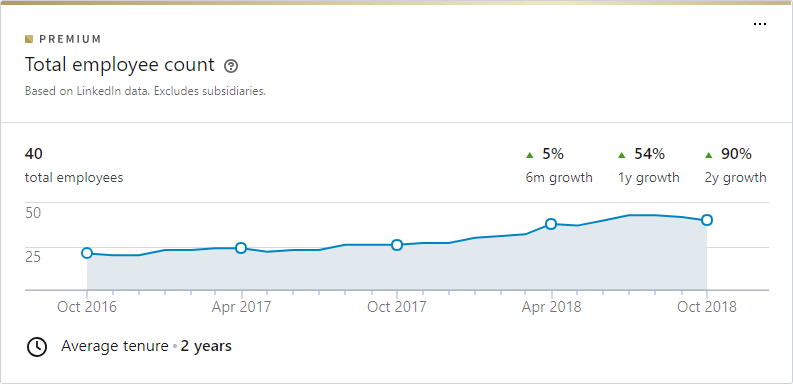

Real Geeks – 90%

Founded in 2009 by real estate broker Jeff Manson who was unhappy with the state of affairs with real estate websites, Real Geeks has seen significant success. They are particularly adept at SEO best practices. Like Skyslope, they were bought by Fidelity National Financial in 2017. Originally located in Hawaii, they moved their headquarters to Dallas, TX.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

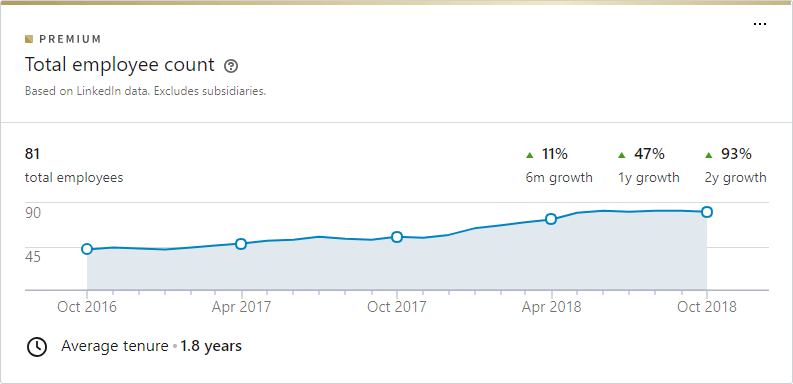

Virtuance – 93%

This real estate photography company based in Denver, CO has been growing a quick clip since its founding in 2010. You may have stumbled into them at your association trade show. They are continuing to expand their national footprint in delivering agents high quality, professional real estate photography.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

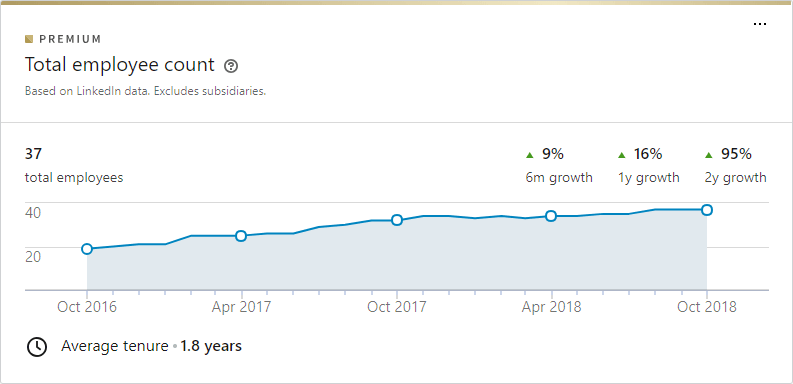

BoldLeads – 95%

BoldLeads is exactly what it sounds like – a buyer and seller lead generation company. They generate leads from digital marketing efforts like Facebook ads. Apparently they are doing something right because they keep hiring! Located and Chandler, AZ, the growing company was founded just in 2014.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

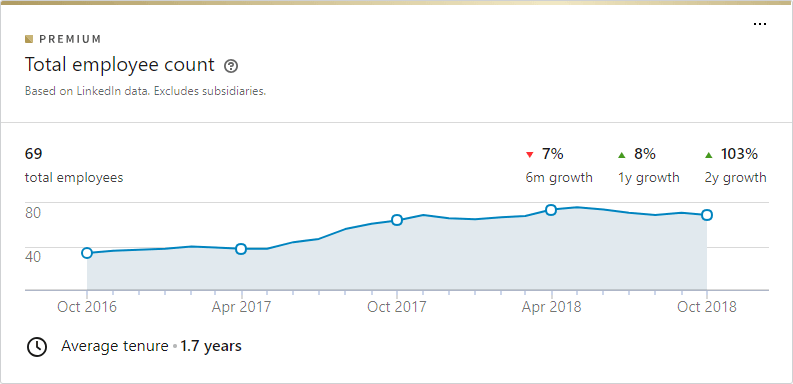

Agentology – 103%

Agentology is all the rage, it seems, on real estate agent social networking groups like Lab Coat Agents. They are a virtual ISA, calling, qualifying and setting appointments with inbound leads. The company is not sitting idle, raising $12M this year to take their development to the next level. Agentology is located in San Diego, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

Compass – 103%

ZZzzzzzzzz.

Not.

Anyone who’s been following real estate the past year is sick of hearing about Compass. The upstart real estate brokerage. Compass recently raised $400M, just a year after raising $550M in capital, and is now valued north of $4B. They’ve used some of that capital to buy other brokerages and reinvent how real estate is done. Founded in 2012 as “Urban Compass”, Compass is headquartered in New York City, and also has offices in Washington DC and Aspen, CO.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

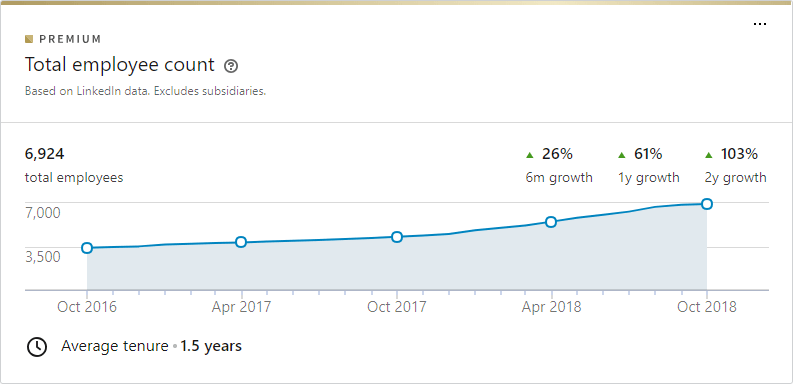

PurpleBricks – 114%

PurpleBricks is the British upstart brokerage who has crossed the Atlantic to reconquer their colonies. The new brokerage in just a few years became one of the top real estate brokerage in the UK. They’ve continued to expand to other markets like Canada, and expanding from their test market in California to new stomping grounds like New York. Founded just four years ago in 2014, PurpleBricks is headquartered in Solihull, UK.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

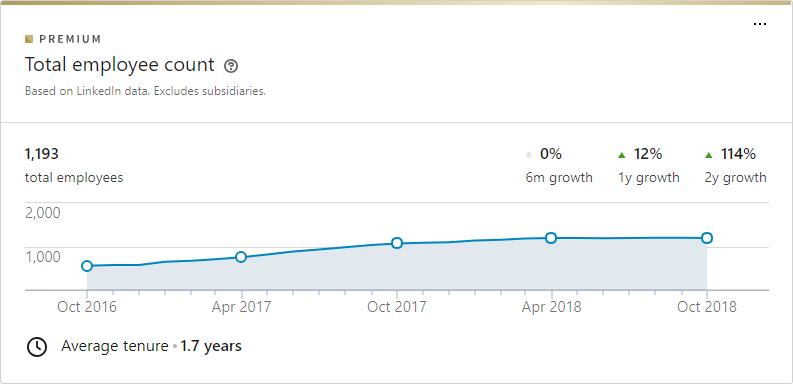

Workframe – 121%

Workframe made Forbe’s list of 10 Real Estate Startups to Watch in 2018. They build team tools for commercial real estate teams, emphasizing workflows. They raised over $9M earlier this year. Workframe was founded in 2016 and is located in New York City.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

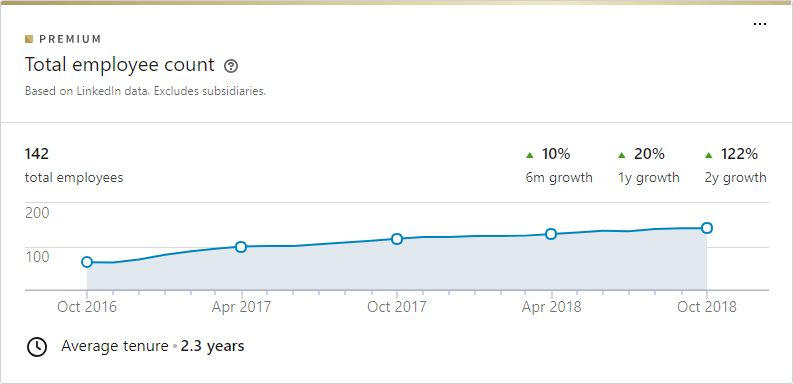

All City Real Estate – 122%

All City is a Texas flat fee brokerage startup that has gained agents quickly. They aren’t as much a tech company as an example of the growing trend of brokerages with fixed fees instead of commission splits that are upturning the real estate industry.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

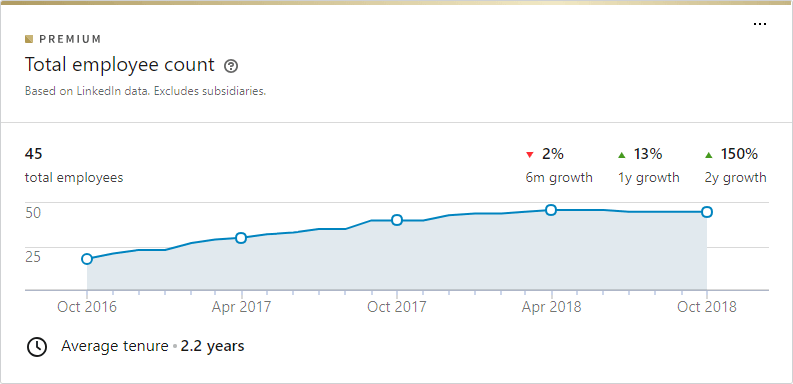

Curaytor – 150%

Curaytor is built on the personality of founder Chris Smith and has exploded since its founding in 2013. It is a real estate marketing platform, with a focus on Facebook and social media marketing, and owns the site GradeMyAds.com. They’ve even begun expanding their marketing platform outside of the real estate industry. They are located in Boston, MA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

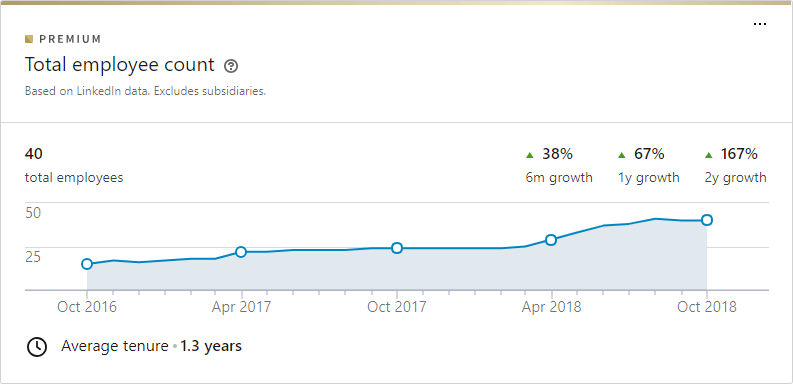

RentBerry – 167%

RentBerry is a strange concept of allowing tenants to bid on rental properties. Probably best for hot, crowded real estate markets, the idea has received attention in the form of $20M raised – in cryptocurrency. Founded in 2015, RentBerry is located in San Francisco, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

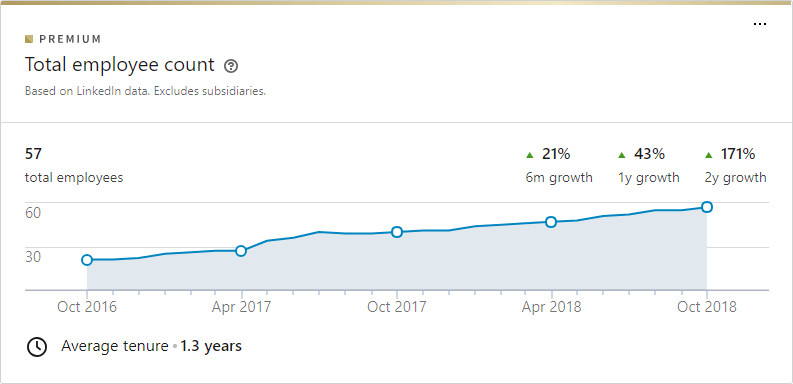

Reali – 171%

Founded in 2015 in San Mateo, Reali is an example of the “agent-powered-tech”, no commission brokerage model that rubs the old guard the wrong way. Reali’s most recent funding round raised $20M earlier this year. They recently released an AI tool designed to predict the likelihood that a home buyer’s offer is accepted.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

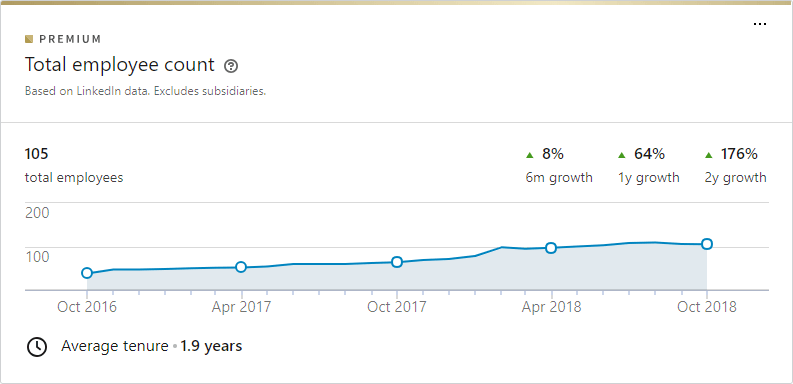

Inside Real Estate – 176%

Inside Real Estate is a family of real estate tools that include Kunversion/kvCORE, Circlepix, and Brokersumo. These are backend agent and broker tools like CRMs, lead generation, websites, and transaction management. Inside Real Estate is headquartered in Salt Lake City, UT.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

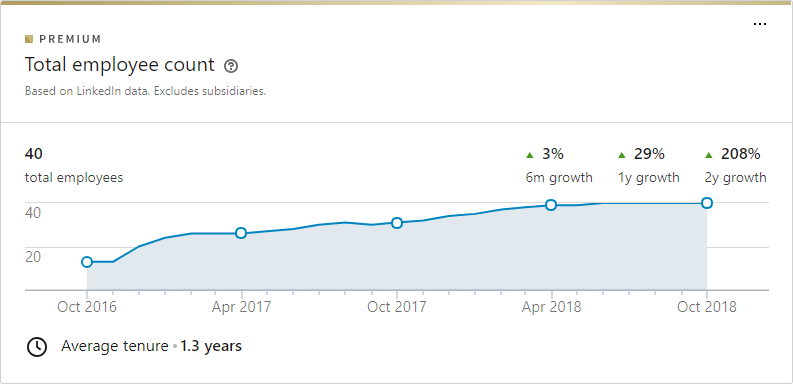

VirtuDesk – 208%

VirtuDesk is a real estate virtual assistant company founded in 2016 and located in Kirkland, WA. They have services for everything from administrative, transaction management, inside sales agents, and marketing. The small startup has had a dazzling first two years of rapid growth!

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

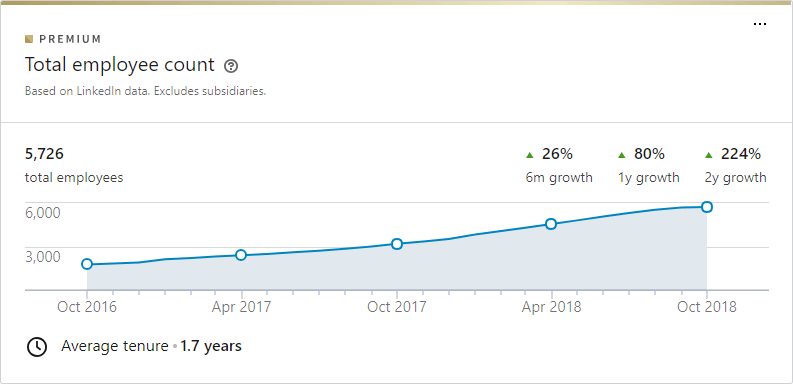

eXp Realty – 225%

Despite its size, eXp Realty’s e-brokerage model continues its strong growth. The brokerage has one of the most unique tools in a virtual online office that works like playing the Sims. Founded in 2009, eXp Realty is headquartered in Bellingham, WA, but most of its employees are remote thanks to the virtual office concept.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

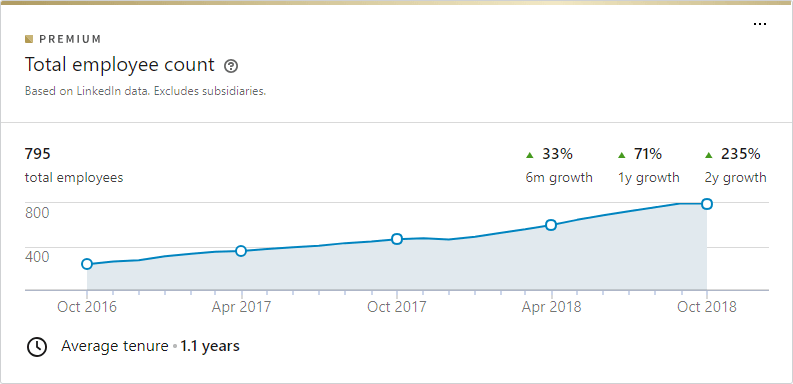

OpenDoor – 235%

OpenDoor needs no introduction. The well funded upstart makes its money by skipping the agent and buying homes directly itself. It then sells the homes. The model makes the process of selling about as smooth as imaginable, though sellers often sell at a discount of what they would get traditionally. The money seems to be worth it, as they continue to expand, raise money, and even acquire brokerages. OpenDoor was founded in 2014 and is located in San Francisco, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

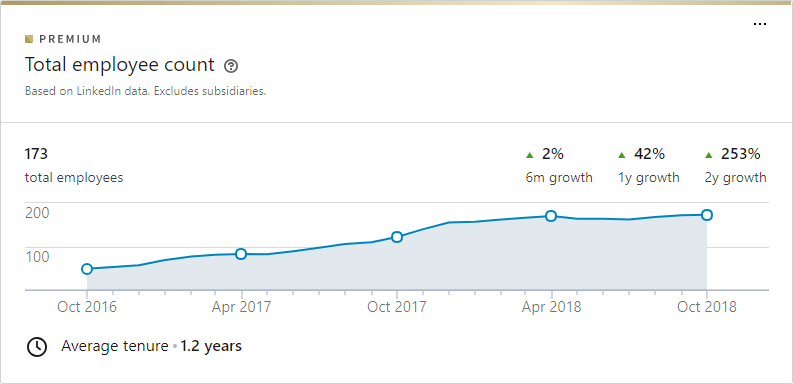

OfferPad – 253%

OpenDoor’s direct competitor is OfferPad, and the two have seen their employee growth nearly mirror one another. OfferPad originally had a deal with Zillow on their Instant Offer program. They’ve raised hefty figures, including a recent $150M fundraising round. OfferPad is headquartered in Gilbert, AZ.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

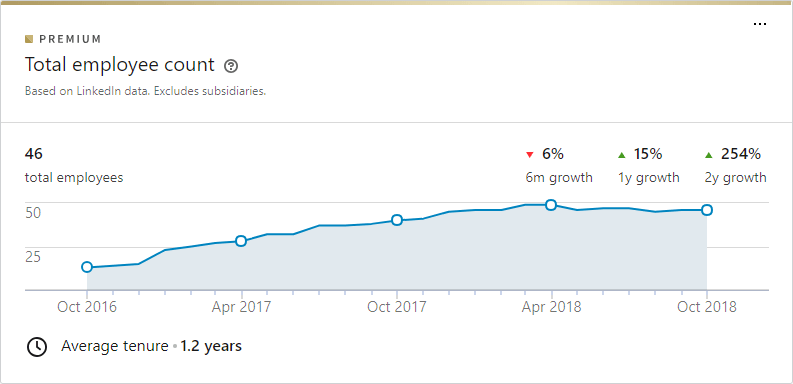

Chime – 254%

Chime is a real estate CRM that has grown its toolset aggressively as it has grown aggressively itself. It seeks to be the all-in-one backend for real estate teams. They are still a baby company, born in 2016, and located in Phoenix, AZ.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

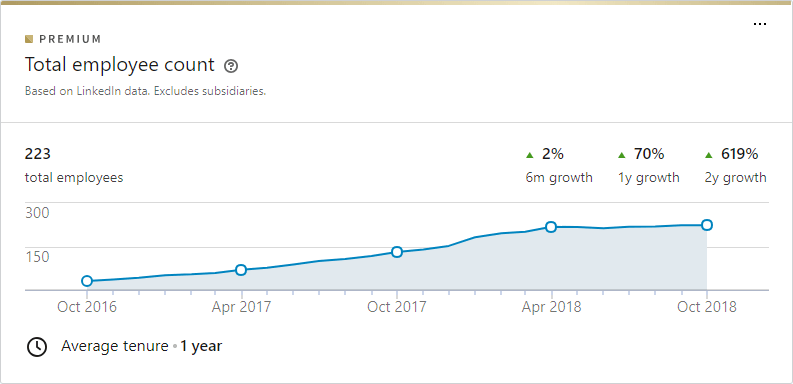

OpCity – 619%

OpCity is a lead generation and referral platform that was recently purchased by Rupert Murdoch’s NewsCorp for $210M. NewsCorp owns the Wall Street Journal, Fox Entertainment Group, and numerous other news magazine. But the relevant asset they own is Move. Inc., which owns Realtor.com, TopProducer, and other real estate products. OpCity will join those. Unlike other lead generation services that charge for the leads, OpCity gives agents leads in exchange for referral fees, letting the agents pay from their closings. They own other tools like Riley, the real estate texting platform. OpCity was founded in 2015 and is headquartered in Austin Texas. $210M ain’t bad for a three-year-old company!

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

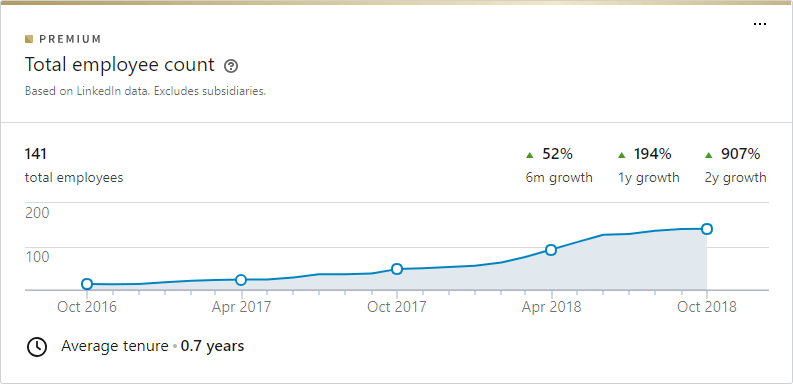

Remine – 907%

And our winner, with nearly 1000% growth over the past two years! Remine is a tool designed for MLSs to supercharge MLS data for agents. It’s seen an immense amount of adoption among MLSs which has turbocharged the company’s growth. They were founded just two years ago in 2016 and headquartered in Fairfax, VA.

Conclusion

You’ve probably heard of a few of these, but hopefully a couple new companies have popped on your radar. I had no idea some of these companies were doing so well! It’s definitely a credit to their business model. In some cases, it remains to be seen if the growth is just the result of heavy funding rounds, or if the core business model will be sustained over time.

These are companies that have also been hiring, and likely continuing to hire in the immediate future. If you are a real estate tech guy or gal, these are some of the top real estate companies to work for and being your job search!