23 Fastest Growing Residential Real Estate Startups in 2019

The real estate industry is an exciting space as we enter 2019. Real estate investment has swarmed the space, increasing over 10x in just a few years. The Old Guard like RE/MAX, Zillow, and KW (yes, these are “Old Guard” now) are making major pivots to technology. New data-driven business models are displacing old models like Opendoor, Redfin, and Reali. MLSs saw major changes with the demise of Upstream, while Broker Public Portal gains ground. Commercial real estate continues to grapple with and innovate with co-working spaces and copycats like WeWork, as well as new portals and tech startups aimed exclusively at rentals and multi-families.

Meanwhile, real estate vendors continue to battle for the hearts and minds of brokers, agents, MLSs, and franchisees. Predictive analytics leads companies are trying to displace traditional PPC advertising options. Newer CRMs like Chime and Brivity are making a splash with teams and brokerages.

Welcome to my list of some of the fastest growing and most innovative real estate companies in 2019!

Who’s Not on the List?

I generally don’t include brokerages, REITs, venture capital, or builders, Instead, I’m focused on real estate tech providers designed for Realtors, commercial agents, brokers, and MLSs, as well as real estate tech companies like Zillow and Opendoor.

It’s also not based on revenue, but on which companies are hiring the most. Some companies grow revenues by cutting expenses and letting employees go. And some of the fastest growing companies included on this list are actually unprofitable. Inc. 5000 has its own list that allows you to sort the fastest growing companies by category, though these numbers are based on revenue growth and not hiring.

This list is also not exhaustive. This is what I’ve found on LinkedIn from the companies I follow. These numbers are from the insights with a premium subscription with LinkedIn. LinkedIn only has insights for companies with at least 30 LinkedIn employees. So smaller companies and startups are left out.

Finally, keep in mind the past is not predictive of the future. These companies have grown a lot the past two years, but in some cases might have been juiced by capital infusions that may not keep pace. Some may have done their hiring and are now looking to stabilize their numbers. And some companies will begin making the transition from hot startup into long-term establishment player. Most of these companies probably won’t be on the list still next year.

These numbers are as of January 2, 2019.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last]

[/two_third_last]

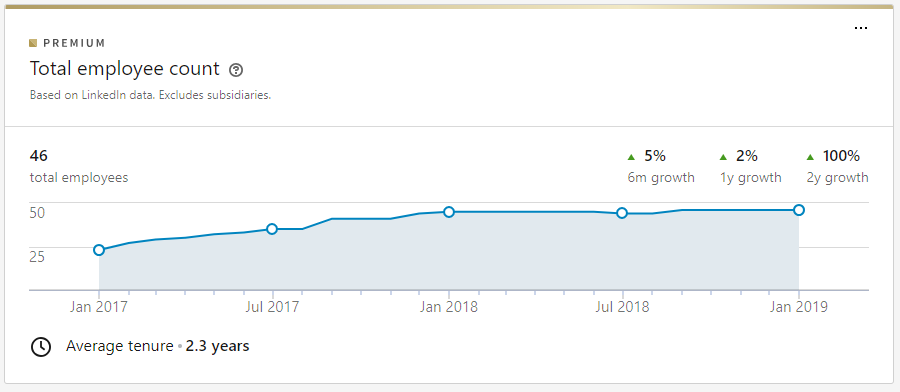

Curaytor – 100%

Curaytor is back from the last list, but has slowed down from the 150% growth is had gone through then. Curaytor is a real estate marketing platform built on the personality of its owner, Chris Smith, with a focus on Facebook and social media marketing. They own the site GradeMyAds.com. They are located in Boston, MA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last]

[/two_third_last]

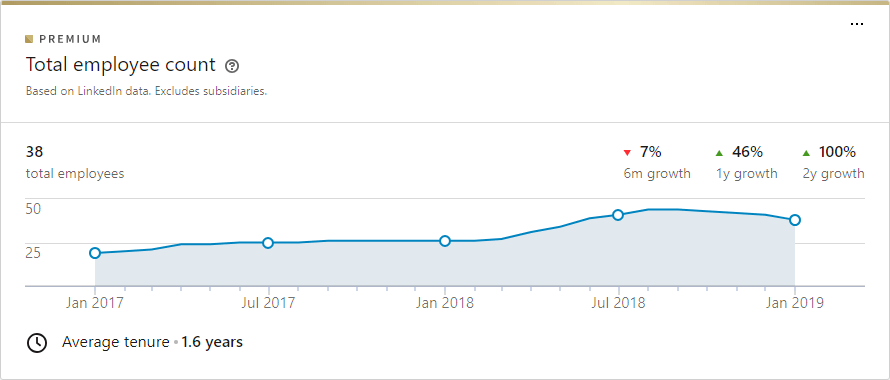

RentBerry – 100%

RentBerry also returns from last year’s list. Their growth appears to have plateaued or even dropped some since then. It’s possible their proof of concept is having trouble earning traction. RentBerry allows tenants to bid on rental properties. It’s a model most folks probably aren’t used to, but could stick in the competitive urban markets. The idea received attention in the form of $20M raised – in cryptocurrency. Founded in 2015, RentBerry is located in San Francisco, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

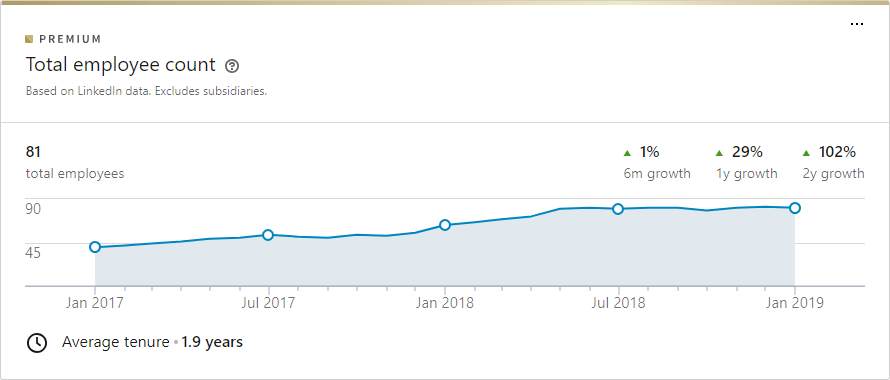

Virtuance – 102%

This residential real estate photography company based in Denver, CO has been accelerated its growth further since last being included. You may have stumbled into them at your association trade show. They are continuing to expand into new markets, delivering agents high quality, professional real estate photography.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

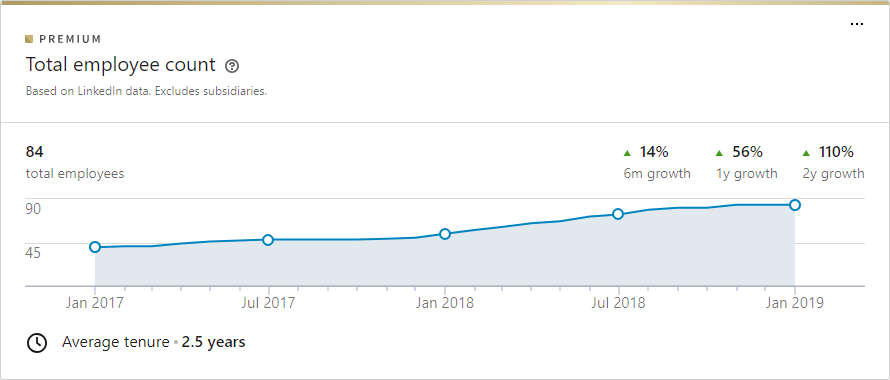

Homesnap – 110%

Homesnap is the consumer-facing brand of the Broker Public Portal. It is essentially the “agent-friendly” version of Zillow and Realtor.com. The company most recently raised $14M about a year ago, and was #4 on Inc 5000’s fastest growing companies by revenue in the real estate category.

Homesnap was founded in 2008 and located in Bethesda, MD.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

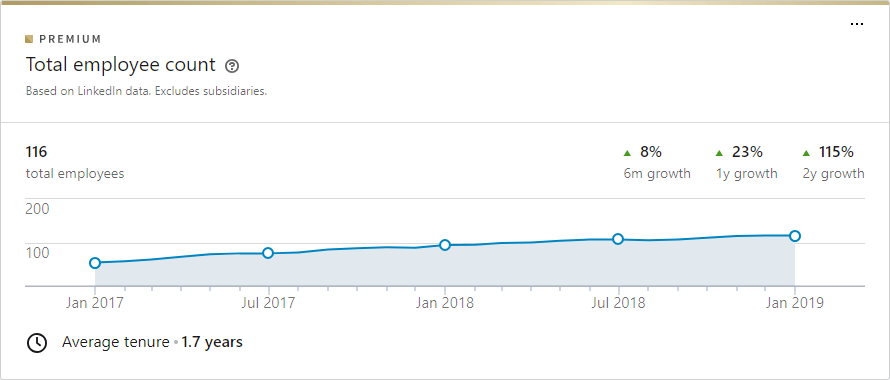

Roofstock – 115%

Roofstock came onto the scene in 2015, raising $7M in its most recent funding round in January of 2018. The site is designed as a kind of “Zillow for investors”, where landlords can sell their rental properties to one another. The company has seen steady growth, and if the model can stick, has untapped billions of dollars in monetization options.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

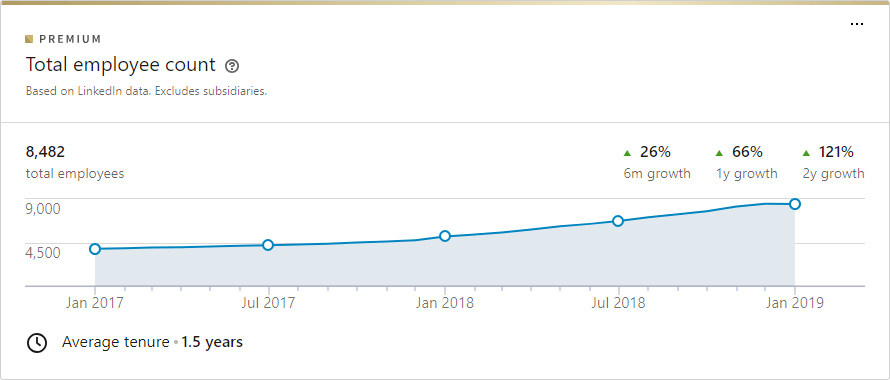

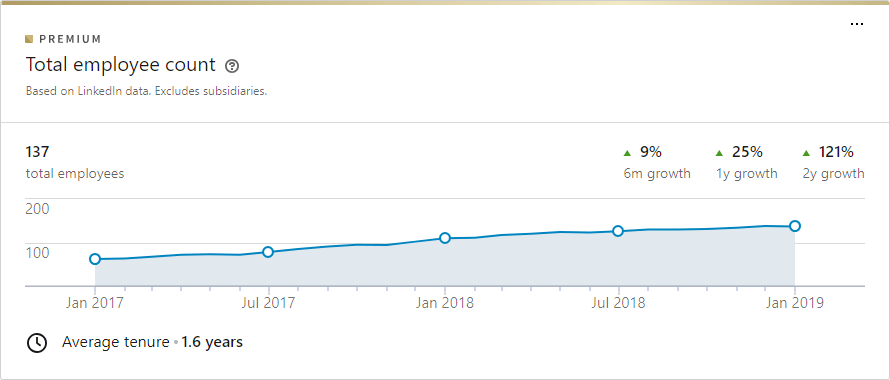

Compass – 121%

Compass has actually picked up the pace since last featured on my “fastest growing companies” list. The upstart real estate brokerage. They continue to use their capital to buy other brokerages and reinvent how real estate is done. Founded in 2012 as “Urban Compass”, Compass is headquartered in New York City, and also has offices in Washington DC and Aspen, CO.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

HomeLight – 121%

Homelight is the marketplace for Realtors. Buyers and sellers specify what kind of home they are looking to sell, and Homelight recommends agents. The recommendations are supposedly based on big data analysis of local agents’ production and reviews. It is free for agents to sign up, and they pay for the leads at closing in the form of a 25% referral fee.

This San Francisco based company launched in 2011 and last raised $40M in 2017.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

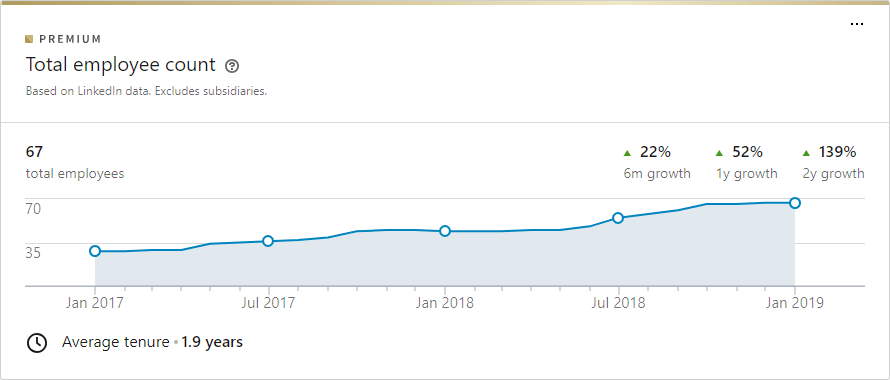

OJO Labs – 139%

OJO Labs promises a real estate AI bot that can act as an assistant, lead nurturing ISA, and even transaction manager. The application is also supposedly able learn a buyer’s preferences via machine learning and begin matching homes that fit their search for them.

The company recently acquired WolfNet and has partnered with Realogy.OJO Labs is located in Austin, TX, and launched in 2015.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

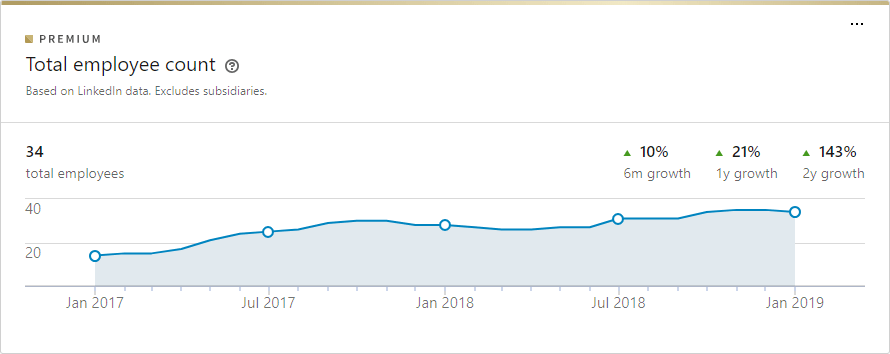

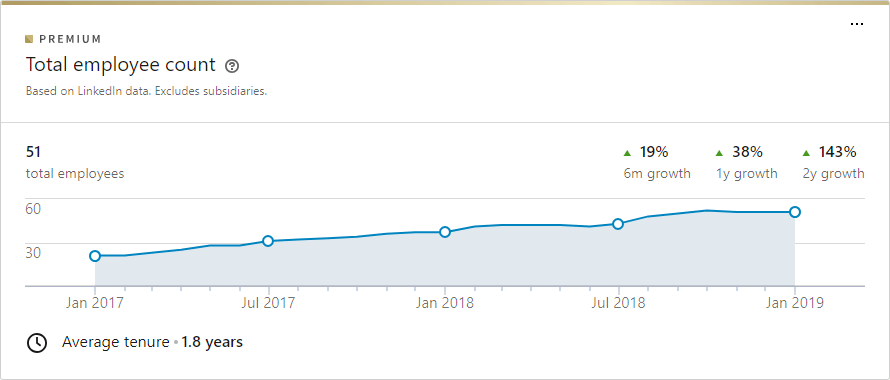

Amne – 143%

Amne is an iBuyer competitor to Offerpad and Opendoor currently located solely in the Austin market. Like the other iBuyers, it has seen tremendous growth although it’s only recently got off the ground buying and selling. Amne holds onto some of their single-family properties and rent them out via Airbnb.

Amne was founded in 2017 and is headquartered in Austin, TX.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

Modern Message – 143%

Modern Message is a cloud-based residents rewards service for apartment managers. The software is designed to manage and advertise resident incentives, lease renewals, satisfaction surveys, maintenance initiatives, and engaging your residents on social media. The idea is to increase renewals and resident retention.

Modern Message was launched in 2012 and is located in Dallas, TX.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

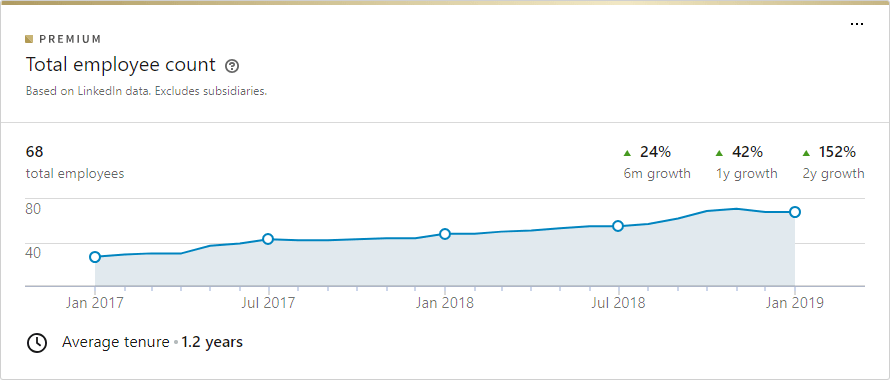

Reali – 152%

The feared disruptor – flat fees and agent-powered-tech. Reali is trying to disrupt the traditional model on the West Coast with their flat fee agent model. Reali’s most recent funding round raised $20M in July of 2018. They recently released an AI tool designed to predict the likelihood that a home buyer’s offer is accepted.

Reali was founded in 2015 and headquartered in San Mateo, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

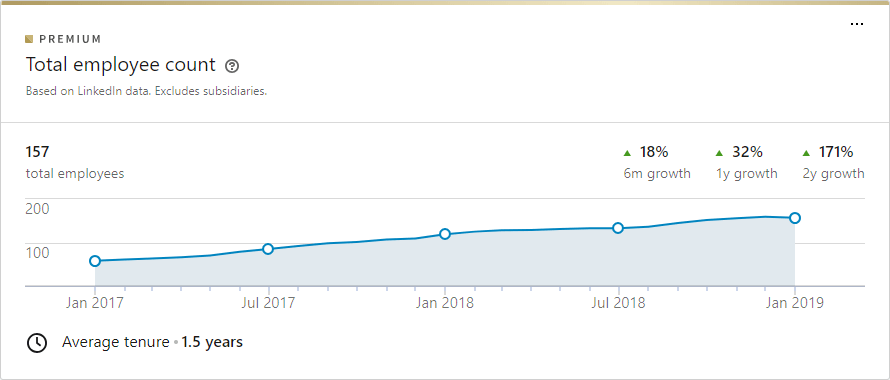

Zumper – 171%

Zumper is a rental searching tool for renters. The portal gets over 8M visitors a month. Zumper includes its own tenant prequalification tool and drives landlord adoption by making it free to post rental listings. They raised $46M in September of 2018 on the promise of numerous future monetization opportunities.

Zumper began in 2012 and is based in San Francisco, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

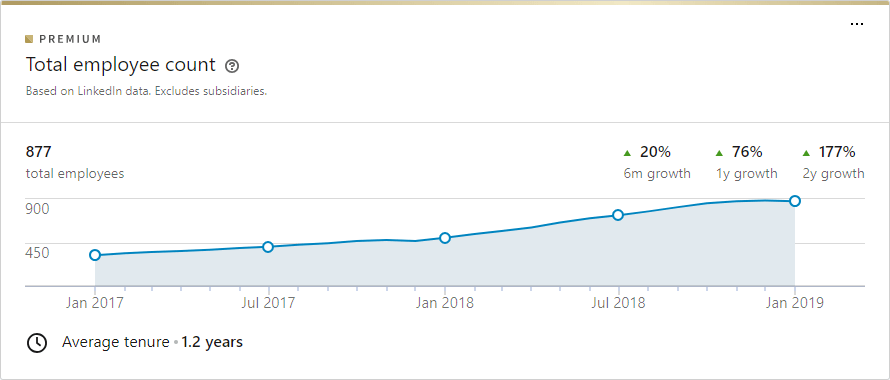

Opendoor – 177%

OpenDoor had a strong 2018 and continues methodically expanding to new markets as the current king of the iBuyers. They buy homes and then turn around and sell them. While they have most of the features of a flipper, their immense financial backing and technology tools allow them to work on tiny margins, giving homeowners competitive offers. They face numerous challenges ahead in 2019 from copycats, the most fearsome being more like a copy”lion” – Zillow.

OpenDoor was founded in 2014 and is located in San Francisco, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

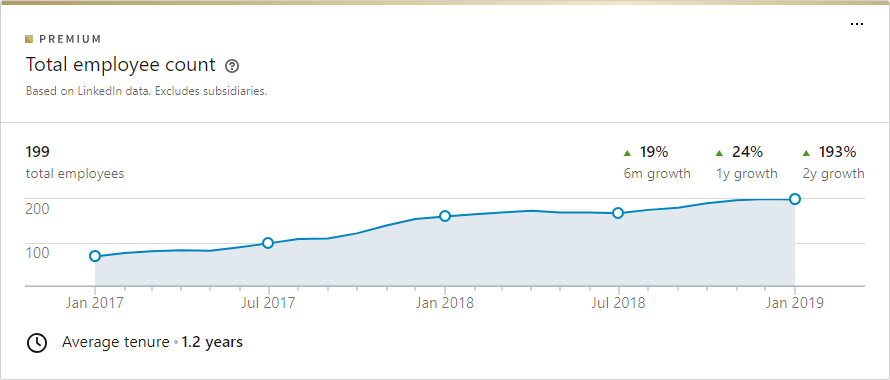

Offerpad – 193%

Playing catchup to Opendoor is Offerpad. OfferPad originally had a deal with Zillow on their Instant Offer program. They’ve raised hefty figures, most recently $50M in May of 2018.

OfferPad is headquartered in Gilbert, AZ.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

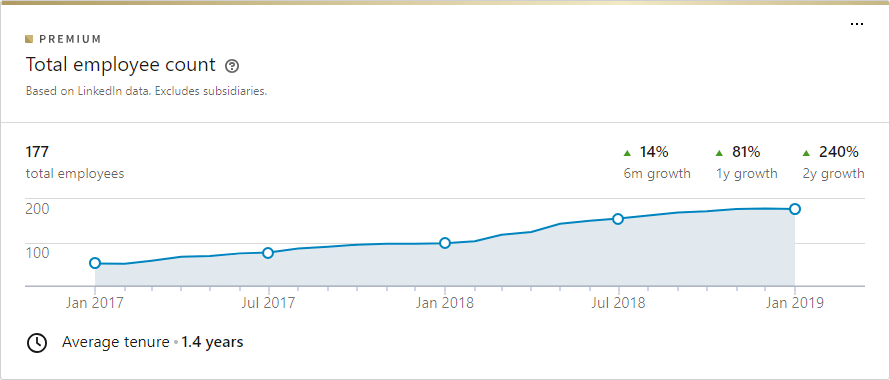

Total Expert – 240%

Total Expert is an online marketing platform for real estate and financial services, with Total Expert CRM as their flagship product. Their offering includes integrated real estate websites, easy lender comarketing tools, and print and digital marketing services.

Total Expert was founded in 2012 and is located in St. Louis Park, Minnesota.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

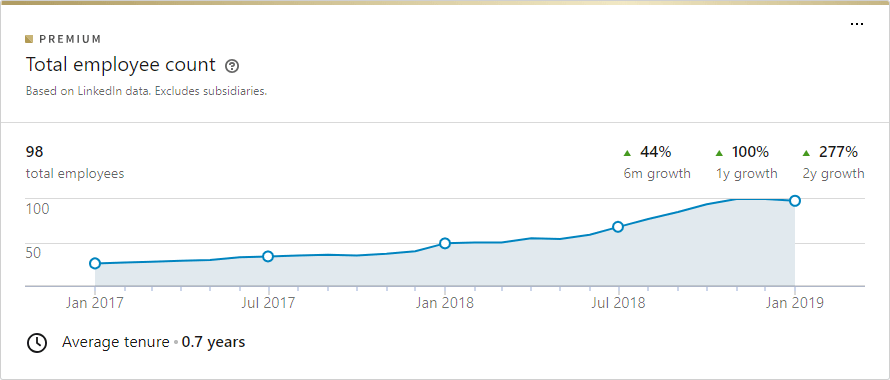

Bungalow – 277%

Bungalow is a rental portal currently in seven major cities that focuses on roommates. You use the platform not only to find living accommodations but shop “handpicked housemates” as well.

Founded in 2016, Bungalow is located in San Francisco, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

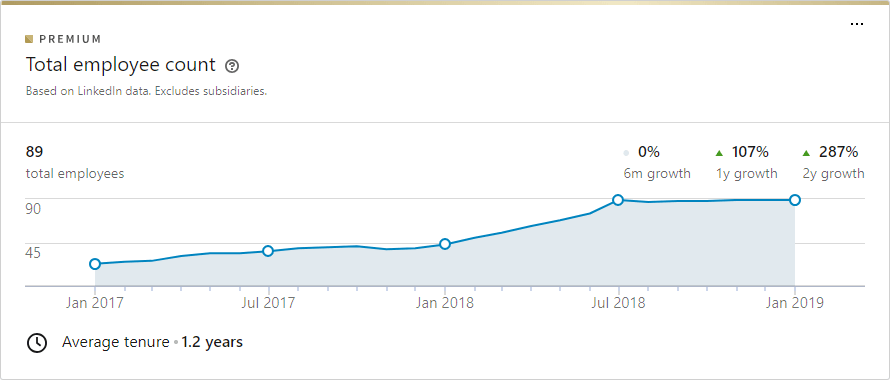

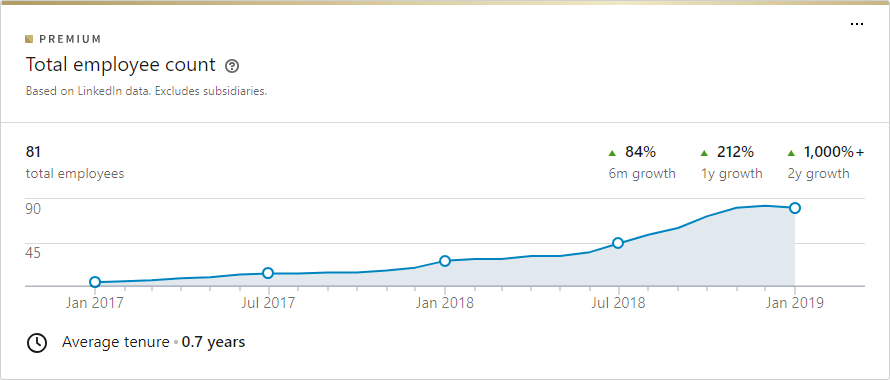

Knock – 287%

Knock is a company launched in 2015 that is similar to other iBuyers except they emphasize “trading” your home – selling one and buying your next home all within the same platform and process. They grew rapidly but appear to have abruptly curtailed hiring and growth for the last six months.

Knock is headquartered in New York City.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

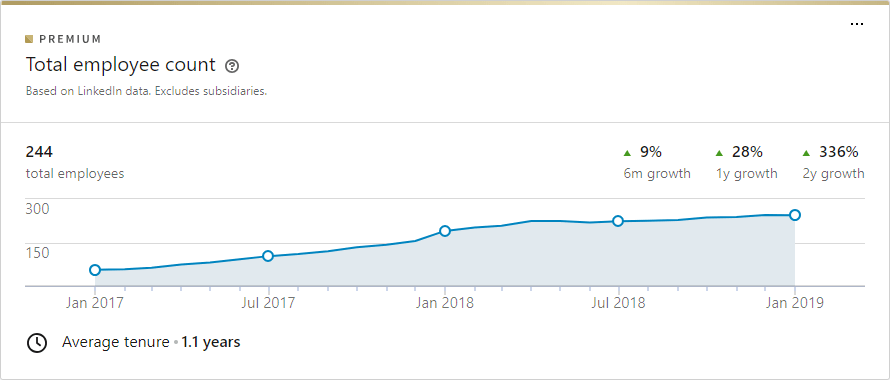

OpCity – 336%

NewsCorp recently purchased OpCity, the lead generation and referral platform, for $210M. NewsCorp, of course, owns Realtor.com, TopProducer, and other real estate products. Unlike other lead generation services that charge for the leads, OpCity gives agents leads in exchange for referral fees, letting the agents pay from their closings. They own other tools like Riley, the real estate texting platform.

Founded in 2015, OpCity is headquartered in Austin, Texas.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

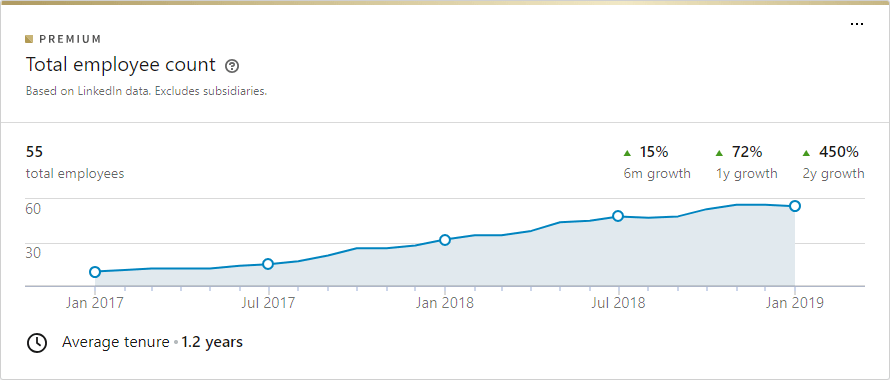

Propy – 450%

Propy is attempting to lead the charge on the use of blockchain for transactions in real estates. Specifically, they try to focus on the international market of buyer and sellers, accommodating numerous different languages and a common transaction platform that works in numerous countries.

Founded in 2015, Propy is headquartered in Palo Alto, CA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

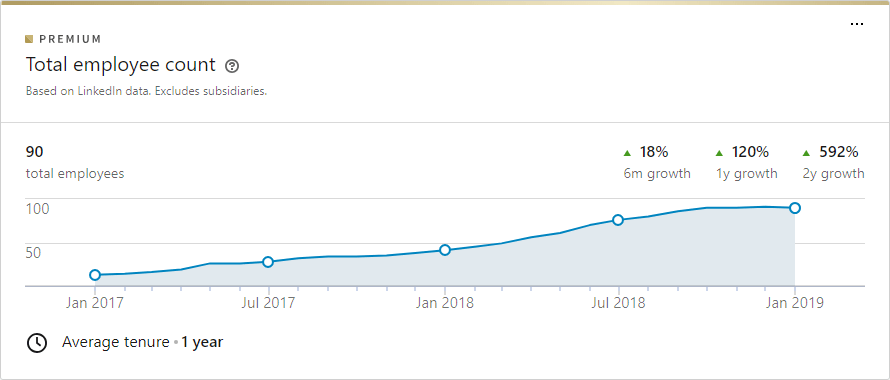

FlyHomes- 592%

FlyHomes is a new and unique concept. They allow buyers to make cash offers on homes. Instead of your traditionally financed home offer being unfavorably compared to other cash offers, FlyHomes let you be the cash offer. Quick closes, no financing contingencies or appraisals to blow up a deal.

The idea is enough to earn a $17M funding round in May of 2018. Founded in 2015, FlyHomes is headquartered in Seattle, WA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

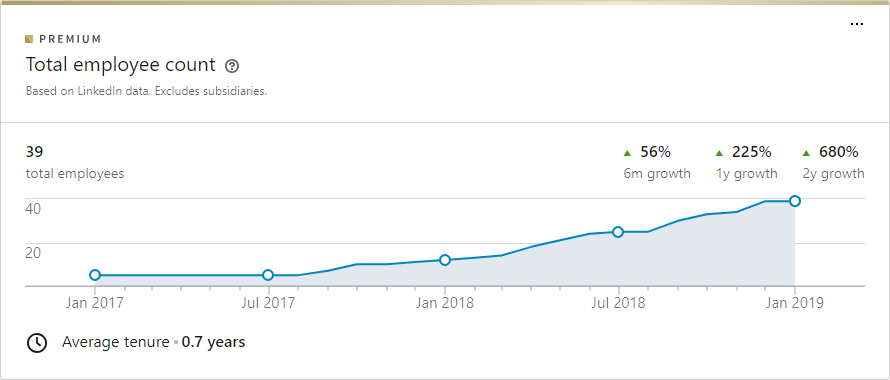

Perch – 680%

Perch is a tiny iBuyer upstart headquartered in New York City but with much of its operations in Texas. They are taking on Opendoor and Offerpad by making direct offers on homes, while also striving to work the buyer-side on the transaction. Perch was launched in 2017.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

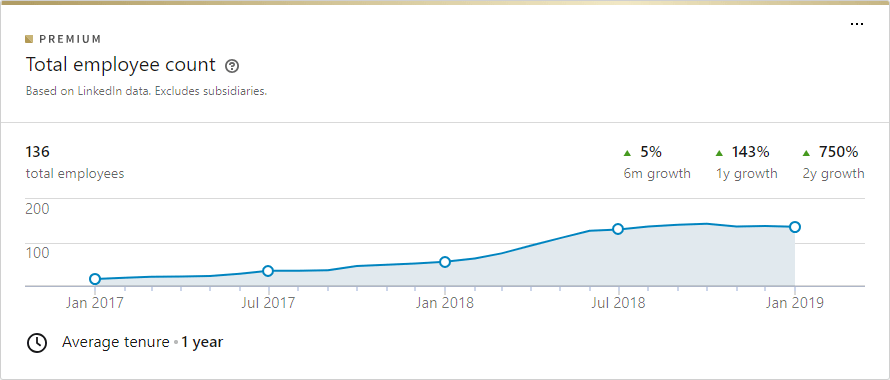

Remine – 750%

Remine is a tool for MLSs to supercharge MLS data for real estate agents. It’s seen an immense amount of adoption among MLSs which has turbocharged the company’s growth, having leveled off the past few months. They were founded in 2016 and headquartered in Fairfax, VA.

[one_third] [/one_third][two_third_last]

[/one_third][two_third_last] [/two_third_last]

[/two_third_last]

Bungalo – 8,000%

So, 8000% is pretty achievable when you were at only one employee two years ago. But nonetheless, Bungalo has hit it big, a project by Amherst Residential in Austin, TX. Bungalo bills itself as an “all-in-one” home buying platform that puts the search, transaction, and even mortgage process all in one place for the buyer. .

Conclusion

Hopefully, you learned something more about a few commercial and residential real estate startups that weren’t on your radar! Maybe some of these have real estate technology tools that will help you better serve home sellers and buyers.

These also might be companies who are hiring if you are a real estate tech guy or gal.