8 Sources for Pre-Foreclosure Leads in 2024

For both real estate agents and investors, pre-foreclosures offer potential win-win opportunities as a lead source and niche.

These homeowners are usually in a tight spot financially. Maybe they have equity but it is illiquid, tied up in their home value.

By consulting with homeowners in these situations, agents and investors can help them unlock that value by selling their home before the bank takes it, damaging their credit for years.

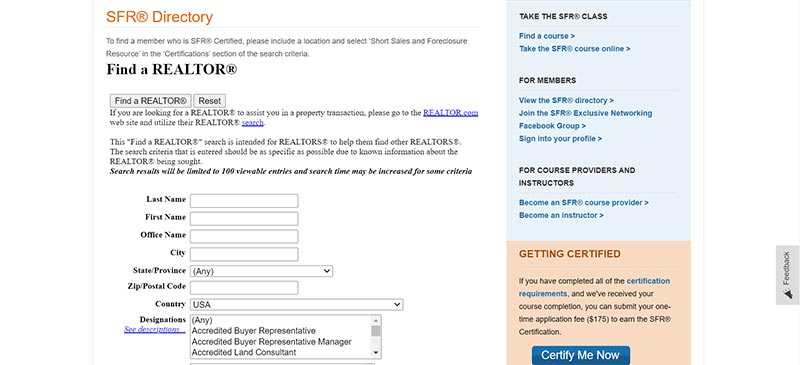

If you are behind on your mortgage, I recommend reaching out to local agents about solutions. Consider using an agent with the Short Sale and Foreclosure Resource designation who has training tailored for homeowners in these difficult positions.

Definition of “Pre-Foreclosure”

A house can be considered a “pre-foreclosure” as soon as there are missed mortgage payments.

A more narrow definition of the pre-foreclosure stage would be the point between the Notice of Default (or lis pendens) and the Auction (or trustee’s sale). This period might last from a couple of months to a year or more.

Foreclosure vs Pre-Foreclosure

Foreclosures are homes that have been taken back by the bank. Usually, these will either be sold directly to investors, put up for auction on sites like Auction.com, or listed with a traditional broker as REO (Real Estate Owned) listings. Some brokers specialize in partnering with lenders to list these assets for them, often in as-is condition.

Unlike a foreclosed property, pre-foreclosures are not yet owned by the bank. The current homeowner is still free to work with a real estate agent or investor to list it for sale or do a deal. However they may be behind on their payments and the process toward foreclosure has begun.

Steps of Foreclosure

- Payment default

- Notice of default (NOD) (lis pendens)

- Notice of trustee’s sale

- Trustee’s sale (i.e. the Auction)

- Real estate owned (REO)

- Eviction

A foreclosure process begins as soon as a homeowner is late on their payment. A notice of default will be issued. This is an opportunity to work with the lender on a payment plan.

Lenders do not want to kick homeowners out! It is much more expensive to foreclose on a homeowner than it is negotiate a deal or work to catch up payments.

However, if the homeowner fails to catch up payments or come to an arrangement, the lender may share a notice of trustee’s sale. This is a public notice posted with the county courthouse that all can see with an auction date, usually a month or two out from the auction date.

At the auction, a preforeclosure turns into a foreclosure. The lender or an auction bidder has effectively bought the home.

If the previous homeowner is still in the home, they are now trespassing and can be evicted depending on the laws of the local state and jurisdiction. It is very hard if not impossible to reverse the process at this point.

Pros and Cons of Pre-Foreclosure Leads

Pros

- Motivated Sellers. These homeowners are between a rock and a hard spot, and the clock is ticking. They are either going to find a solution or lose their home. If you can be that solution, then chances are you will get a deal done.

- Counter-Cyclical. A con to pre-foreclosure leads is that they are fewer in fast-rising markets. But that is a pro when the market turns! If you lived through the housing bust of the Great Recession and are keen to live through the next one, it makes a lot of sense to begin working now on a counter-cyclical lead generation pillar.

- Value Add Opportunity. While these can be difficult situations, they can also be excellent opportunities to deliver a lot of value for homeowners. Many homeowners may not realize what they can get for their home, or how quickly. They may be house-poor, and just need an option to get liquidity with a sale. As an agent or investor, you can educate them on the current market and their options, saving them from a credit and equity-destroying event.

- Great Referral Niche. These are specialized situations that not all investors or agents want to work in. If you develop a talent for it, it is an excellent opportunity to get referral leads from other agents who prefer to hand off their more difficult cases.

Cons

- Hairy Situations. Like those specializing in divorce or probate leads, walking into a pre-foreclosure situation means entering someone’s life at a challenging time. Hopefully, you are a solution that can reduce or even eliminate that challenge. But it is not a great lead source for those without the emotional maturity, empathy, or patience to give quality service to these homeowners.

- May Demand Creativity. While some homeowners may have more equity than they think and the solution is a quick and easy sale, many will likely be underwater on their mortgage. This will require creativity for investors, whether it is sub-2 financing or wraps. Realtors will have an even harder time working with such situations. An agent’s only tool in this situation is likely a short sale. As such, it is a good idea to be a short sale expert and investor-friendly agent who can link up these homeowners with a reputable local investor.

Sources for Pre-Foreclosure Leads

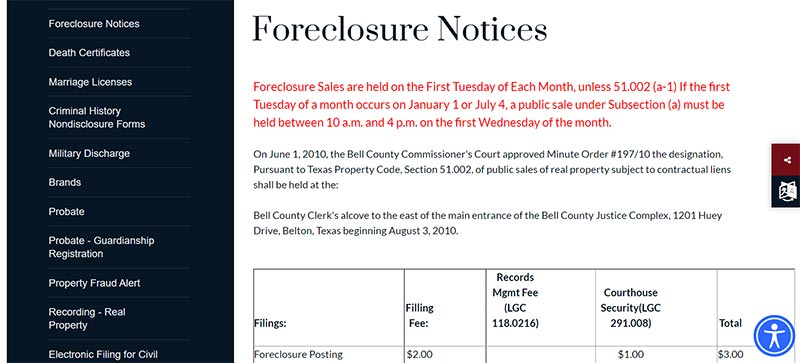

County Public Records

Counties generally publish their auction homes as public records that you can access for free.

These can be difficult to search efficiently, however. These are legal documents, and sometimes they only specify the legal description, not an actual address.

Online Lists

Because using the county websites is tedious, professionals tend to subscribe to list services instead. These companies hire people to comb through counties’ auction listings and assemble the information in a digestible format and offer them to Realtors and investors via subscription.

These are especially effective for investor-friendly agents who have a network of investors. You can serve as the real estate consultant and get a fix on the homeowner’s problems, and then present multiple solutions perfect for their situation:

- selling traditionally

- selling to an iBuyer

- selling direct to an investor

Examples include Foreclosure.com, RealtyTrac, or Roddy’s Foreclosure Listing Service.

Foreclosure.com

$39.80/mo. Foreclosure.com aggregates distressed properties nationwide, including short sales and preforeclosures, rent-to-own. They offer a 7-day free trial

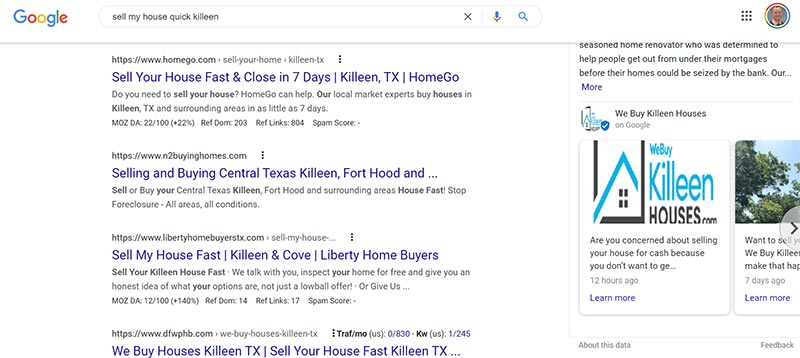

Search Engine Optimization on Google

One way to find motivated pre-foreclosure leads is to get them yourself before they even hit the pre-foreclosure lists.

Write a page on your site with resources for people in these situations in your local market. Target SEO keywords like “sell my home fast” that might be a common search term for distressed homeowners.

As you can see, lots of companies put some money behind these search queries with a Google Ads campaign. You can also promote these kinds of landing pages on Facebook.

You can put money behind your advertisement if you like and do some Facebook or search engine marketing as well.

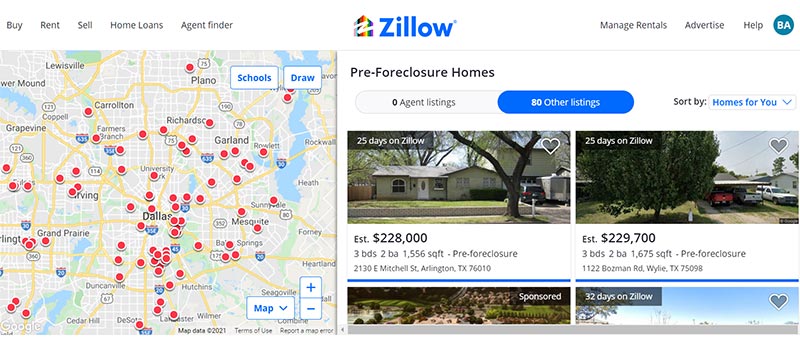

Real Estate Websites and Portals

Portals like Zillow and Realtor.com often have pre-foreclosures listed.

These do not show in the normal search on Zillow. You need to check the “Pre-foreclosure” box in the Filters drop-down. Depending on the MLS that Zillow is pulling listings from, not all areas have pre-foreclosure listings.

Real Estate Agents Referrals

As a Realtor, becoming the local agent who specializes in foreclosures and short sales in your area may produce great referral traffic.

Short sales and pre-foreclosures are often a pain for many agents. By making this your own niche and advertising as much throughout your market, you can begin earning business from agents who aren’t experts on this topic for a referral fee.

If you are an investor, these Realtors might be a great source for finding potential deals.

Real Estate Dialers

Some dialers also offer pre-foreclosure lists with contact information.

Often these are probably pulled from some of the above third-party list companies.

But they might be able to better marry addresses with a phone number.

Vulcan7 is an example of a real estate agent dialer that offers a pre-foreclosure list.

Vulcan7

$359/mo. Vulcan7 is a well-reviewed power dialer that also provides FSBO, expired, neighborhood, and probate lists. It also has a CRM backend, email and video marketing tools.

Paid Leads

Creating your own landing pages and promoting it on Facebook, Google, Instagram, or wherever is one way to earn leads.

But if you are not a marketing guru or don’t want to invest that time, there are lead generation services that specialize in sellers looking for cash buyers.

ZBuyer is one such service that advertises cash offers and sells those leads. You can consider signing up for their service!

zBuyer

$250+/mo. ZBuyer gets seller leads by advertising cash offers for homes. That may not seem so great at first, but many of these responders are better off listing traditionally, and just need an agent to show them the way. That said, it is also an option for investor-friendly agents or outright investors. The leads are reasonably priced, though you have to work them. Volume may be limited depending on your area, but it might be worthwhile in combination with your other prospecting strategies.

Local Investors

Networking with local investors and wholesellers may be a good way to find out about distressed homeowners. They are often doing their own marketing strategies like bandit signs or yellow letters that are turning up leads looking for an exit.

Some of these deals won’t work for a particular investor, but might for you. Or, perhaps selling to an investor is not the best choice and you as a Realtor can pick up a listing instead to help them the traditional route.

How to Reach out to Pre-Foreclosure Homeowners

This video from reipro does a good job of reviewing the process of marketing to pre-foreclosure listings.

Reaching pre-foreclosures can be difficult. You won’t often have a correct phone number. You generally have three options:

- Door knock

- Phone Call

- Direct Mail

You’re likely to find people in fragile financial situations and it’s important to be sensitive.

Conclusion

Specializing in pre-foreclosures is a natural niche for investor-friendly real estate agents, and a great way to find properties to fill your funnel while helping homeowners out of a bind.

If interested, be sure to read my Ultimate Guide to Being an Investor-Friendly Real Estate Agent.

Updated March 26, 2024; Originally published November 19, 2021