Fastest Growing Real Estate Companies in 2020

2019 saw historic sums of money flowing into the real estate industry and “proptech” (property technology). The result was a lot of companies hiring, supercharged on easy cash.

What’s more, it may have been the height of the cash infusions, as real estate money is likely to be a lot more cautious in 2020 after the WeWork debacle. Companies who raised funds before that collapse probably did well for themselves.

Welcome to my list of some of the fastest growing and most innovative real estate companies in 2019!

Who’s Not on the List?

I generally don’t include commercial companies, institutional investors, or builders. Nor am I looking at “small time” brokerages. Instead, I’m focused on real estate tech providers, franchises, MLSs, portals, and new business models.

It’s also not based on revenue, but on which companies are hiring the most. Some companies grow revenues by cutting expenses and letting employees go. And some of the fastest-growing companies included on this list are actually unprofitable. Inc. 5000 has its own list that allows you to sort the fastest growing companies by category, though these numbers are based on revenue growth and not hiring.

This list is also not exhaustive. This is what I’ve found on LinkedIn from the companies I follow. These numbers are from the insights with a premium subscription with LinkedIn. LinkedIn only has insights for companies with at least 30 LinkedIn employees. So smaller companies and startups are left out.

Finally, keep in mind the past is not predictive of the future. These companies have grown a lot the past two years, but in some cases might have been juiced by capital infusions that may not keep pace. Some may have done their hiring and are now looking to stabilize their numbers. And some companies will begin making the transition from hot startup into long-term player. Most of these companies probably won’t be on the list still next year. I count about 7 who remain from last year’s list.

These numbers are as of January 13, 2020.

Honorable Mentions

These fellas aren’t on the top 24 list, but have been growing at an impressive clip the past 2 years!

They include some notable names like venture capital firms (who don’t usually go on hiring frenzies) Techstars and Fifth Wall, the latter fueled by the announcement of their $500B proptech fund.

Meanwhile, huge, billion-dollar industry leaders like DocuSign grew their headcount at 62%??? That’s incredible.

I also see some of the CRMs and platforms that are currently capturing agents’ hearts and businesses expanding, like Follow Up Boss, Real Geeks, and Ylopo.

- Techstars – 47%

- Skyslope – 50%

- PropLogix – 54%

- Blend – 55%

- Box Brownie – 56%

- New Western Acquisitions – 56%

- Roofstock – 57%

- Fathom Realty – 58%

- Fifth Wall – 58%

- Tenant Cloud – 60%

- Inside Real Estate – 61%

- Real Geeks – 61%

- DocuSign – 62%

- Appfolio – 64%

- Offerpad – 66%

- Follow Up Boss – 74%

- Zentap – 79%

- Homelight – 81%

- Amherst Holdings – 82%

- Zumper – 85%

- Ylopo – 86%

- Door.com – 91%

- Avail – 100%

- Radius Agent – 106%

- Homeday GmbH – 109%

- Opendoor – 113%

- Rhino – 116%

- Total Expert – 121%

- Mynd Property Management – 122%

Fastest Growing Real Estate Companies in 2020

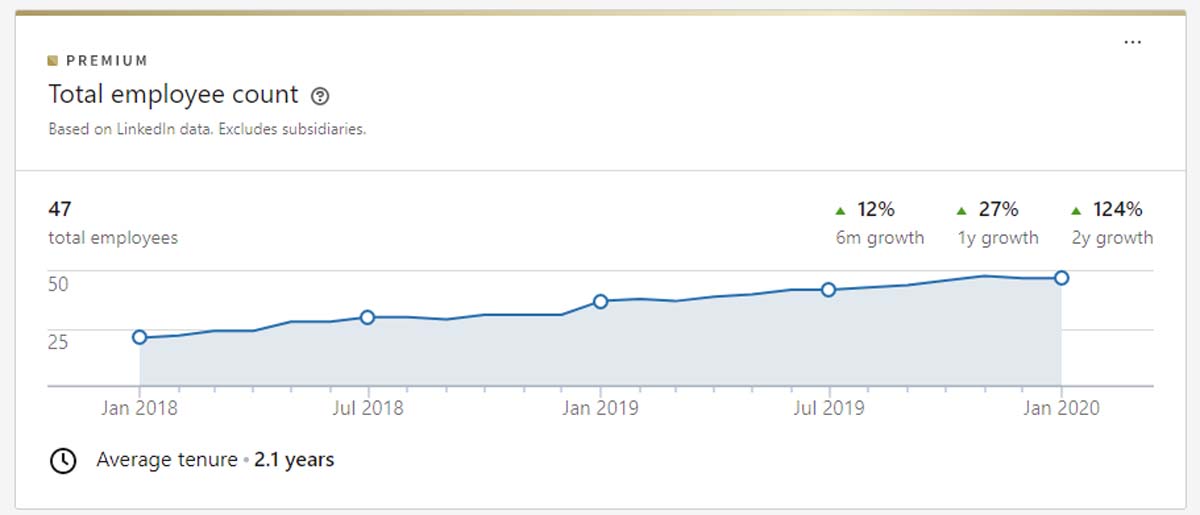

DLP Capital – 124%

This is a fascinating family of companies. Similar to Ben Kinney’s little empire, Don Wenner has a network of real estate companies and services grown from the bottom up. Included is DLP Capital Partners. He also has a lender, property management, brokerage, media company, and builder. This is a fascinating model for how an independent real estate broker can build an empire in all the verticals.

DLP Capital is the investment wing, and has apparently met with some success based on its steady record of hiring.

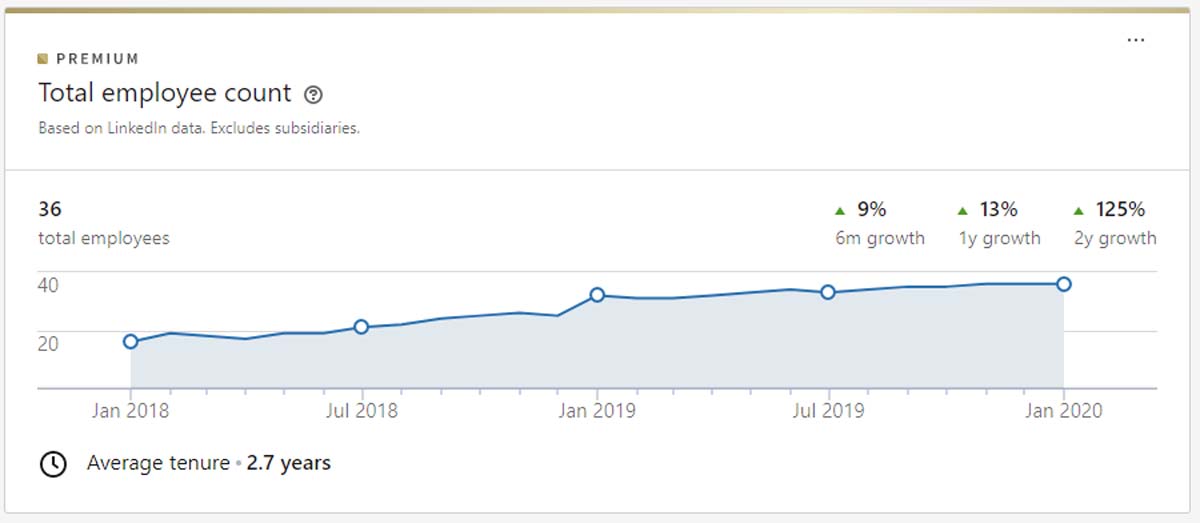

Homespotter – 125%

Homespotter kicked off 2019 with a new CEO and an acquisition! The bought Spacio, an open house app. If that wasn’t juicy enough, the company partnered with Better Homes and Garden to offer their agents their social media marketing tools.

Homespotter is a dynamic marketing automation tool that helps promote your listings and capture leads.

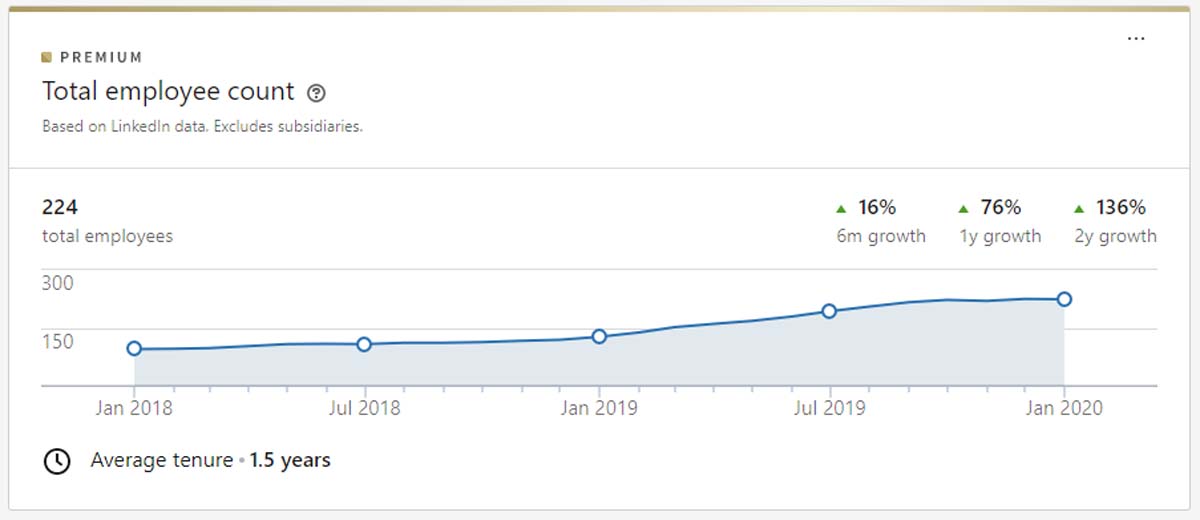

REX – 136%

REX Homes is a bold flat fee brokerage player that… doesn’t use the MLS! Instead, they strategically advertise their listings on the portals and social media, going direct to the buyer. That is bold! And, of course, the model has its naysayers.

Well, the naysayers are going to have to wait to claim victory, as REX continues to grow, fueled by big new investments, expansion to new markets, and an entire corporate move from California to the Lone Star State.

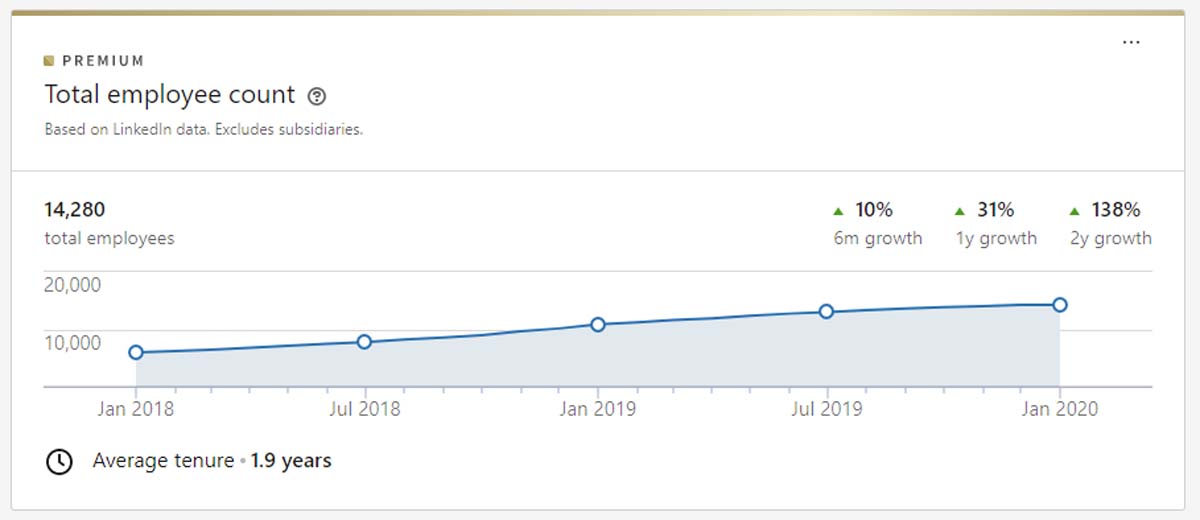

Compass – 138%

Compass (and Opendoor above) had a little bit of a scare in 2019 with all the trouble their SoftBank cousin WeWork went through. Did WeWork kill Compass’s chance at an IPO in 2020? And, full disclosure, they’ve “endured” some criticism on this site from yours truly as well.

It seems like agents are on a carousel of brokerages and, for the moment, Compass seems to be on top. Can they “break the wheel” and maintain their agent counts? We’ll find out! In the meantime, they continue full speed with new funding and more agents.

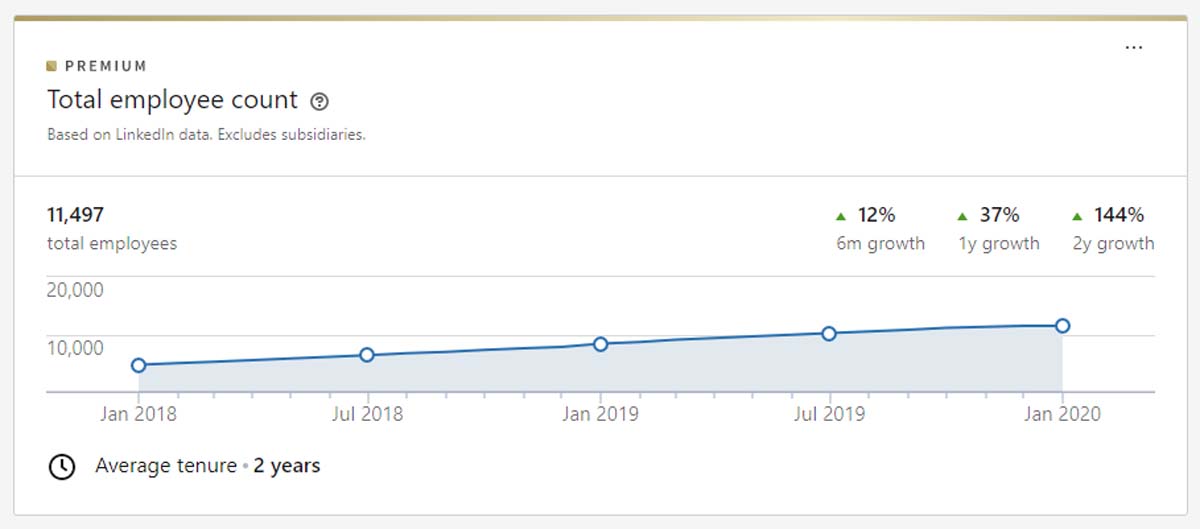

eXp Realty – 144%

eXp Realty had a busy year, growing to over 25,000 agents with its very unique virtual reality tech platform and low commission splits. The company also got a new CEO, while launching its own iBuyer-lite program.

All that effort has translated into one of the least talked about but fastest growing brokerages in America.

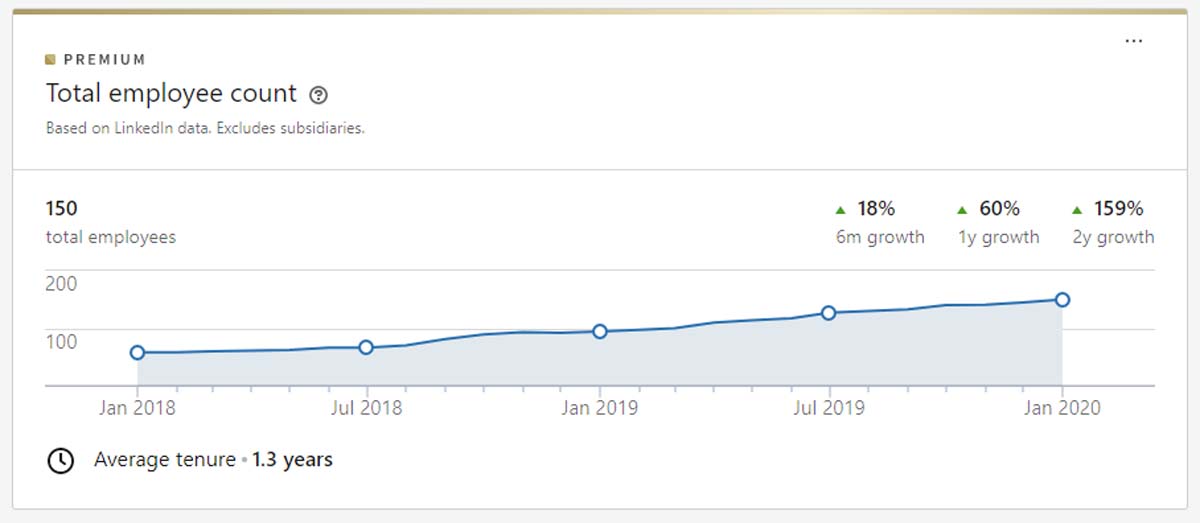

Reali – 159%

Reali makes our list again! Reali is another flat fee “discount” brokerage that apparently is resonating at least a little with buyers, sellers, and investors.

Not only are they raising lots of money and continuing to expand markets, but they’ve also launched their own trade-in program, similar to Knock. Oh, and they bought a lender. All that translates into some pretty aggressive growth and dreams for the four-year-old upstart.

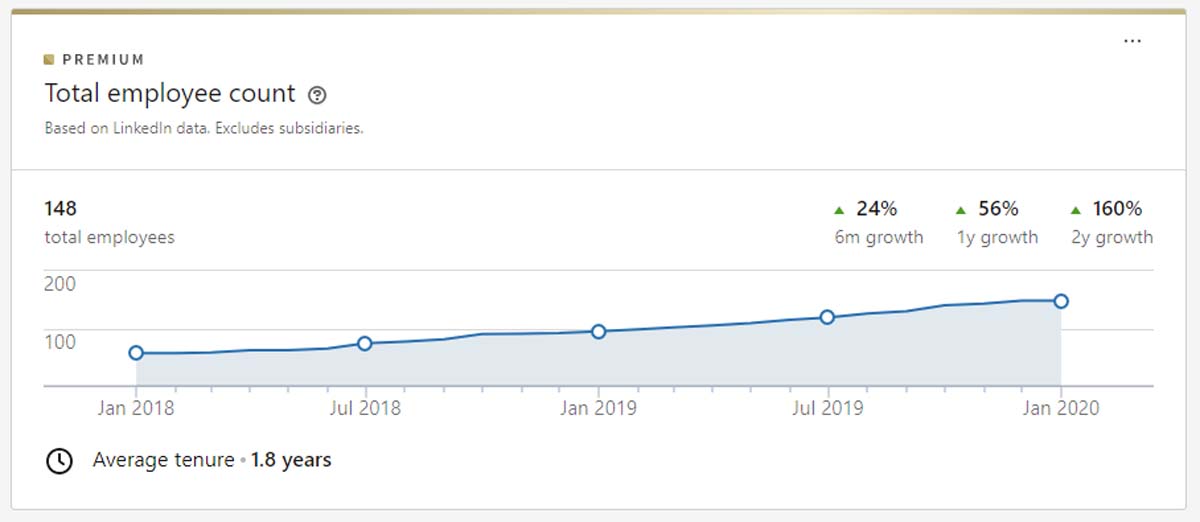

OJO Labs – 160%

OJO Labs went on a “hiring spree” after a major fundraising round in 2019, accelerating their impressive growth from the year before. The company provides AI “personal assistants” to both buyers and real estate agents.

They put that money not only into new personnel but a new office in Austin and then went and bought RealSavvy, the real estate platform.

Knock – 209%

Knock launched 2019 with a massive fundraising round (debt and equity) at $400M and turned around and launched in Phoenix. That said, Knock has been more patient than other “iBuyers”, currently operating in just 5 markets.

Knock is different from other iBuyers in that they don’t buy your house. Instead, they finance your next house with a listing agreement on your current house. It’s essentially a bridge loan.

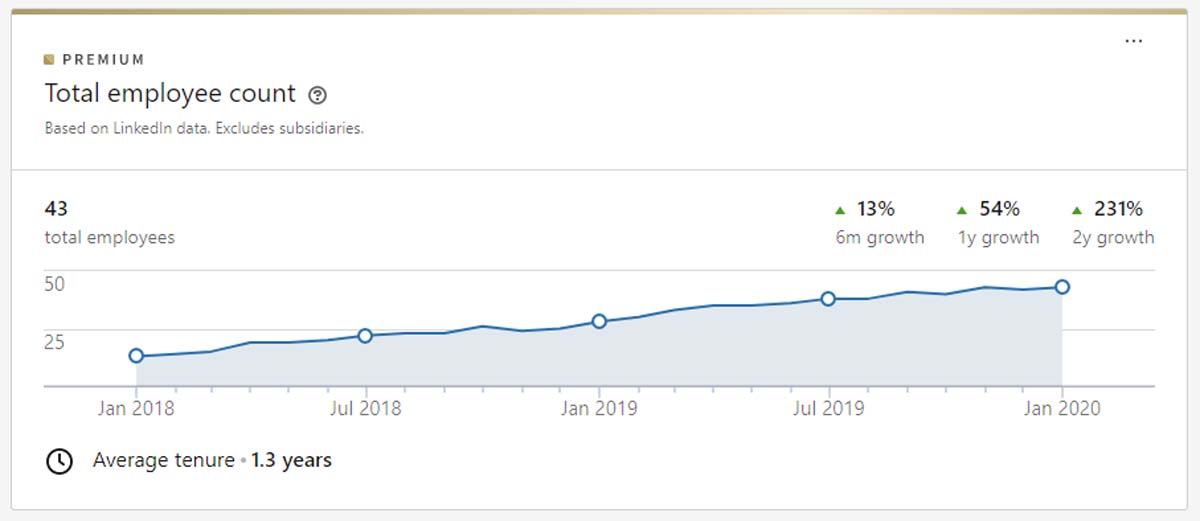

Homebot – 231%

Homebot.ai is an app targeted toward real estate agents and lenders. The app helps track a homeowner’s equity, and serves to keep lenders and agents top of mind and drive repeat and referral business.

They’ve expanded their toolset to include an iBuyer comparison tool, and have partnered with organizations like AIME.

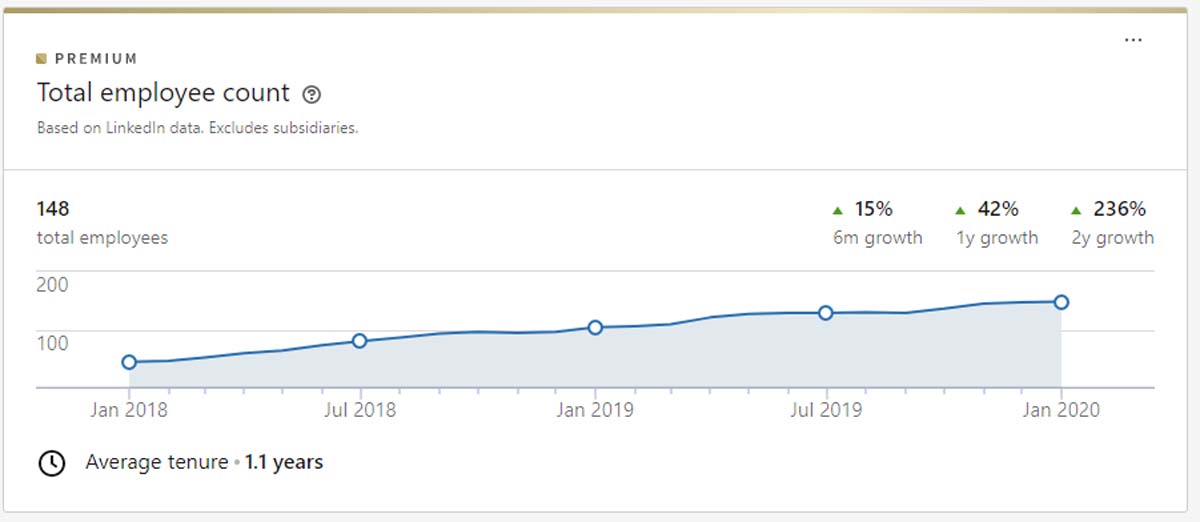

Flyhomes – 236%

Flyhomes continues its growth, fueled by multiple capital raises in 2019. They spent 2019 expanding into several major metropolitan areas.

Their service provides buyers with cash offers on homes, allowing their offers to be more competitive in hot markets. They make an offer on your old home. But you still list traditionally for 90 days to try to make more than their offer. It’s similar to Knock and other “iBuyer Lite” models except this one lets you make a cash offer.

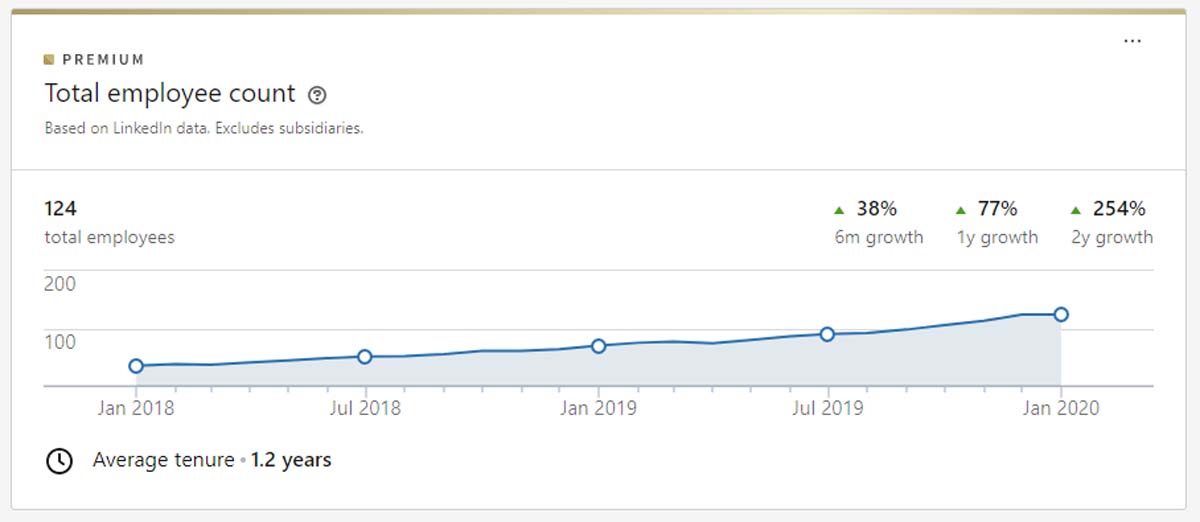

Reonomy – 254%

Reonomy is a commercial real estate “AI-powered” property search tool and platform. They spent 2019 busy inking deals, inking more deals, and raising some money.

The company has partnerships with the biggest names in real estate data like Corelogic and Black Knight. The company hopes to expand internationally in 2020.

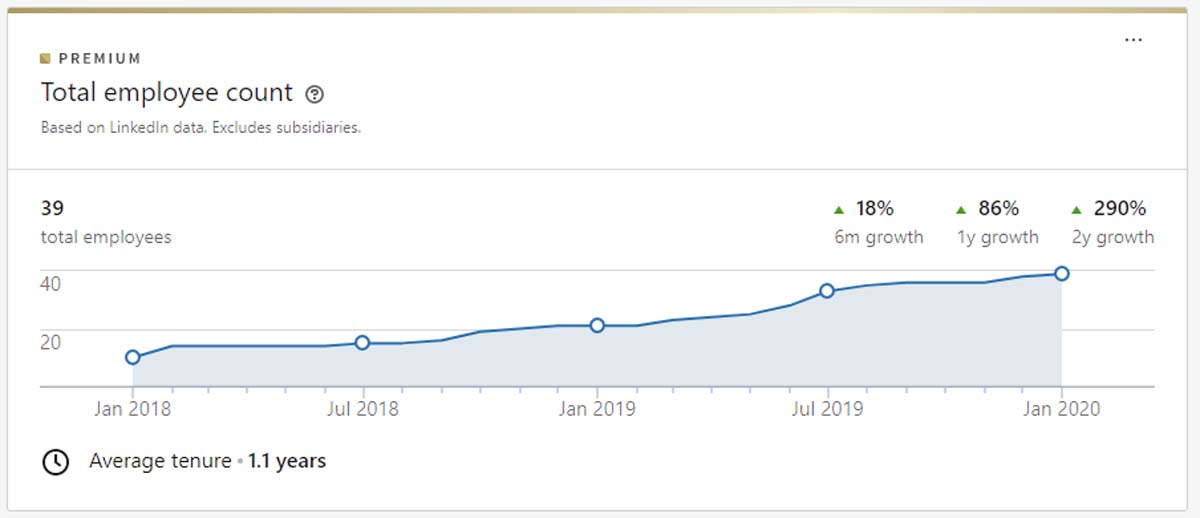

Kodit.io – 290%

We’re going international! It turns out America isn’t the only continent with iBuyers. Kodit.io is a European iBuyer based in Finland, and is also active in Spain, Poland, and Estonia. They raised a respectable 12 million Euros in 2019.

The service is limited to condos (likely as they are usually easy to price)

Zeus Living – 300%

Zeus Living is the Airbnb of corporate rentals. Need to relocate for a job temporarily? Zeus Living has got your back! They had a busy 2019 raising money, prepared to take on Airbnb for this market share.

In response, Airbnb decided they would have none of that and invested in Zeus in December.

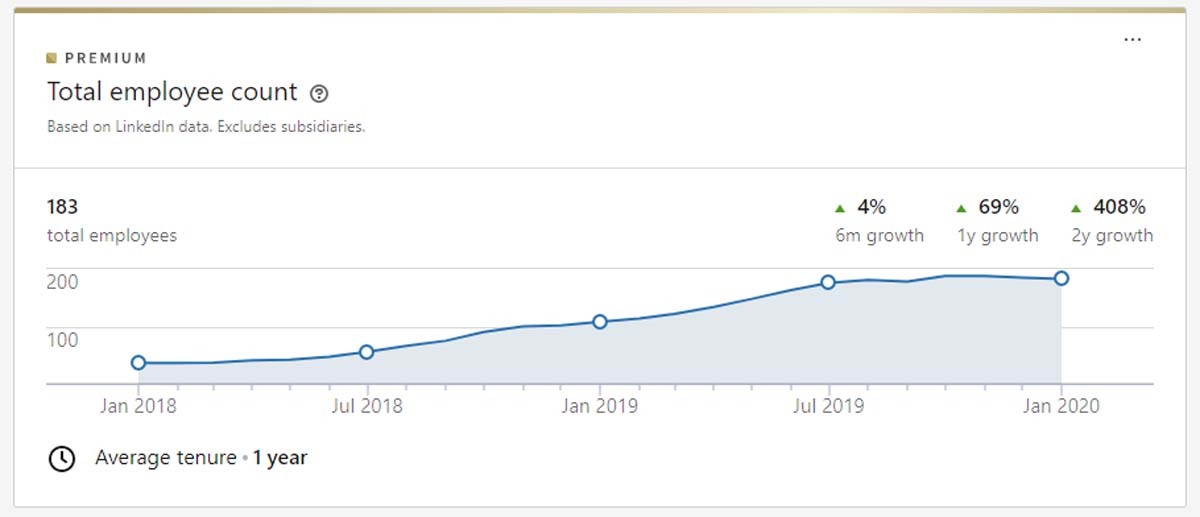

Bungalow – 408%

Bungalow is a rental portal that focuses on finding roommates in unaffordable cities. You use the platform not only to find living accommodations but shop “handpicked housemates” as well.

Bungalow had a strong 2019 with lots of incoming cash, including money from MLB legend A Rod.

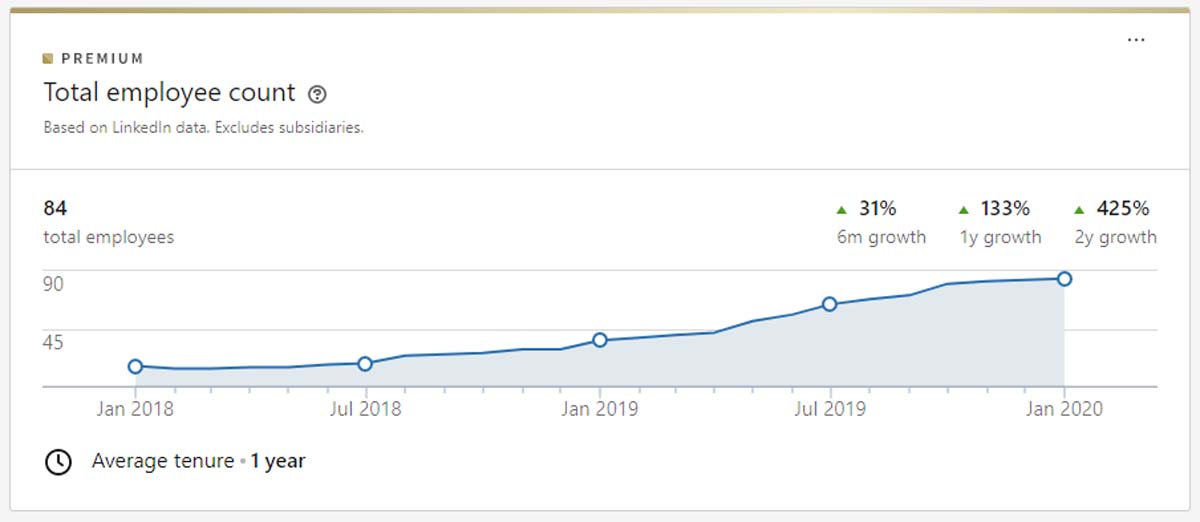

Relocity – 425%

Relocity is a relocation consulting firm that has seen some impressive traction in the past two years if these numbers aren’t lying.

Could this model even be the future of the real estate agent? Relocity has a “personal host” in each city who is an employee with the task of helping relocating professionals not only find a home but introduce them to the city, amenities, and lifestyles.

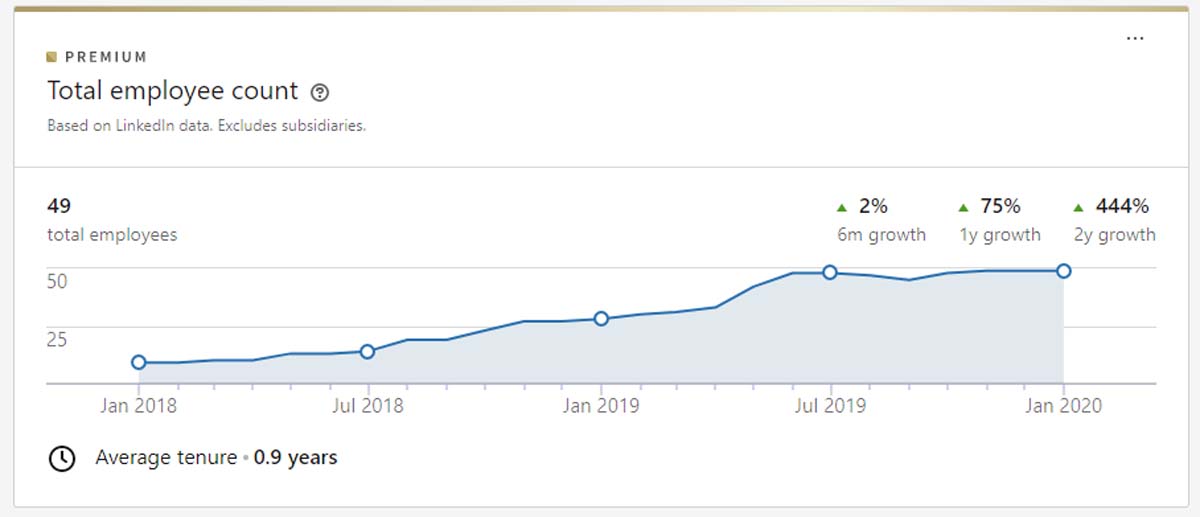

EasyKnock – 444%

Not to be confused with Knock, who also made this list, there is EasyKnock!

Would you sell your home just to turn around and rent it back again? EasyKnock thinks there is a market for that, allowing homeowners to pull out all the equity in their home without moving. Investors seem to agree, as EasyKnock raised a prodigious $215M in 2019, fueling its tremendous growth.

Meero – 485%

Not a real estate company exactly, Meero is a professional photography platform that has achieved unicorn status ($1B company) in just 3 years. Wow. Their most recent fundraising was to the tune of $230M.

Residential, commercial, whatever, Meero promises 24-hour turnarounds on their photography with ever-growing market coverage.

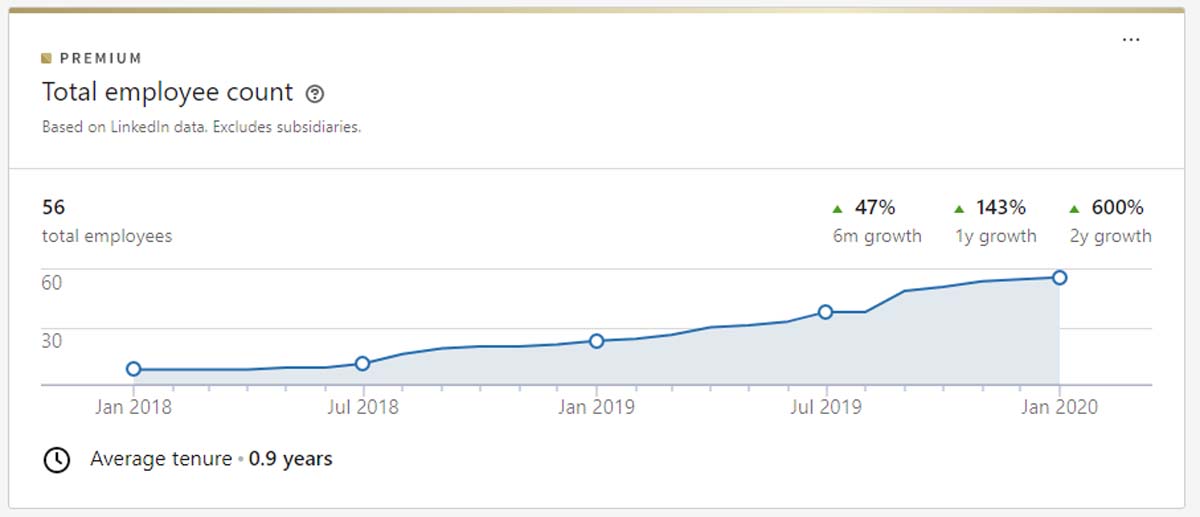

Endpoint – 600%

Who would have guessed a title and escrow company would make this list? That stuff is boring! It doesn’t even have a blockchain angle!

Endpoint is a new company launched by the leader in title and escrow, First American, as a mobile-first title company. In that spirit, Endpoint is designed to be a very tech-forward, very digital company that brings transparency and ease to the closing process.

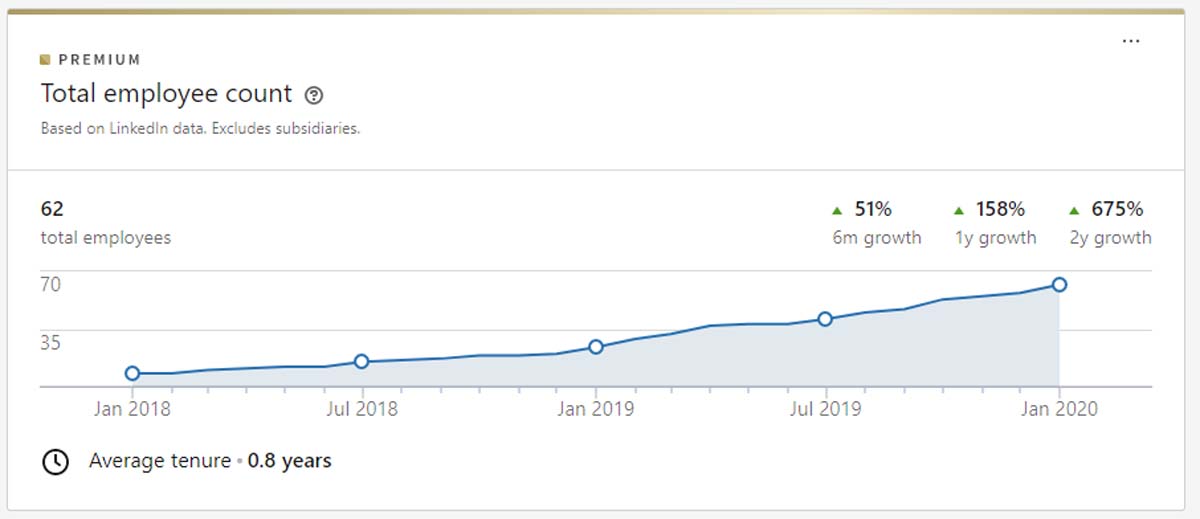

Divvy Homes – 675%

Have you heard of “fractional ownership”?

Well, now you have. Divvy Homes is a company square in the center of this new concept. The goal is to make homeowners out of renters. Divvy buys the home you are renting, and then you pay Divvy as you save up for the downpayment to finance the home traditionally. Anything you pay into it stays with you as equity. That is where the “fractional” part comes in. It’s essentially a lease-to-own.

Investors like it, sending over $100M to the company since they launched. They’re live in Cleveland, Atlanta, and Memphis.

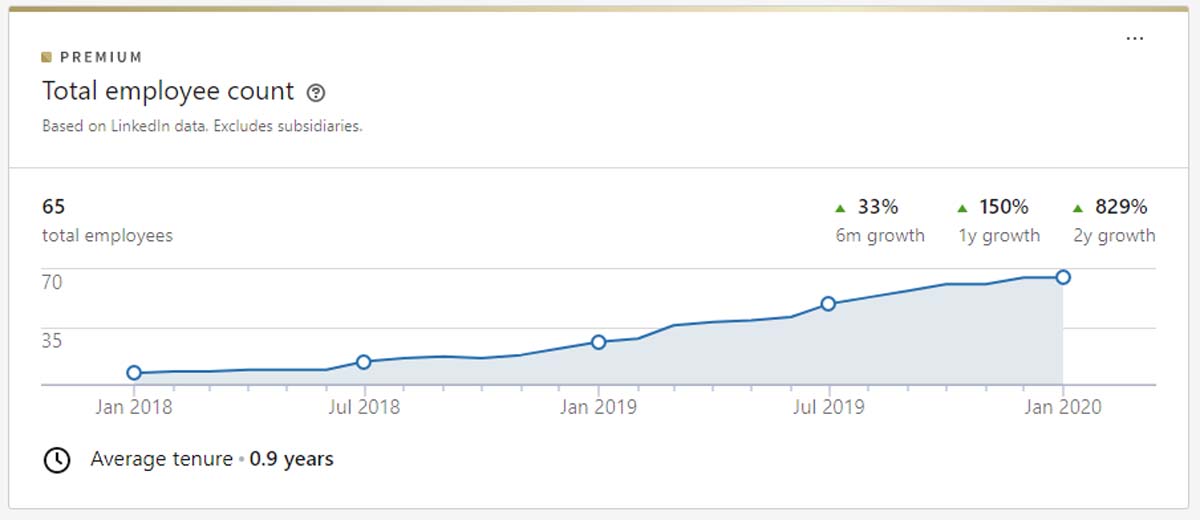

Ribbon – 829%

Flyhomes has some competition in the “cash offer” department in the quickly growing Ribbon. Ribbon closed a whopping $330M funding round in November, which promises much more growth to come!

“Turn your clients’ preapproval into an all-cash offer” is their promise, especially alluring in the hottest of markets.

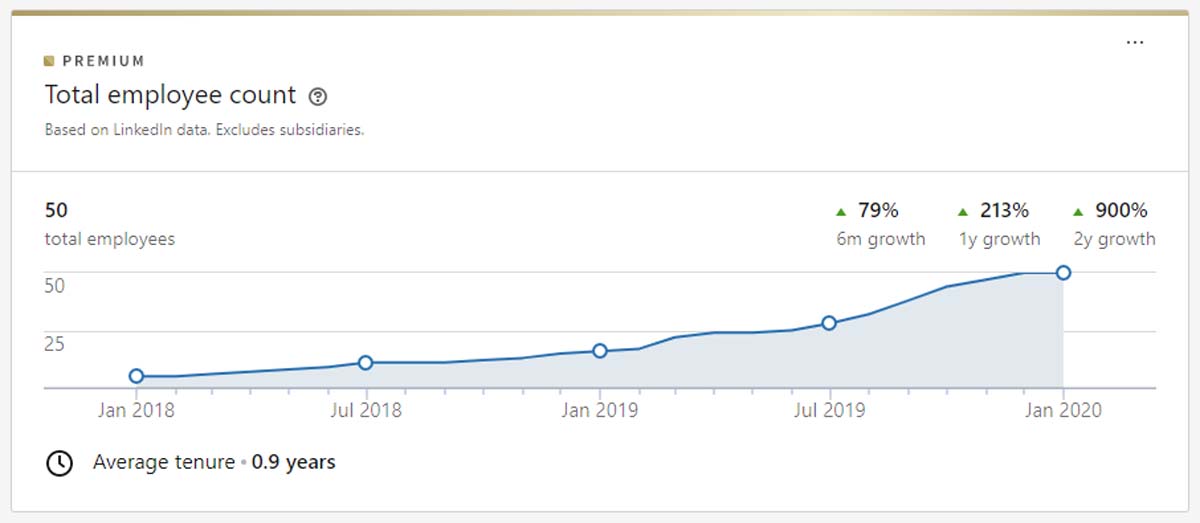

Curbio – 900%

Ever had a seller who couldn’t afford to make the improvements necessary to sell their home for full market value? Curbio to the rescue!

The company finances the repairs needed, and then collects the cost from closing. Their headcount in 2019 was fueled by significant expansion into new markets as well as some new capital raises.

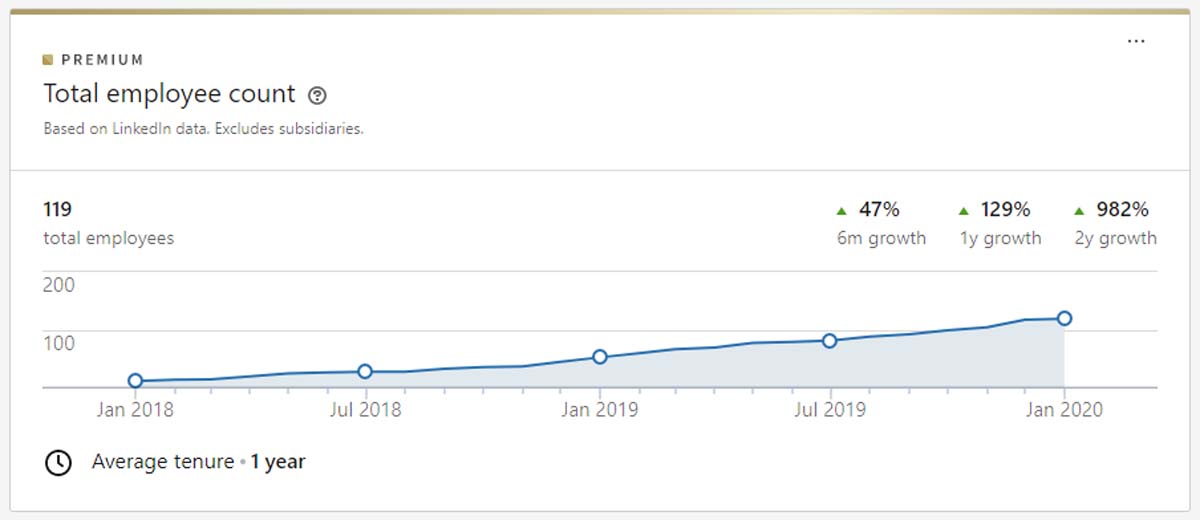

Orchard – 982%

From 11 LinkedIn employees two years ago to 119 today, The Company Formerly Known as Perch takes the top spot for growth on our list!

Orchard is an iBuyer who has expanded outside of Texas into 5 markets now and is growing aggressively to catch up to its bigger brothers.

Conclusion

Again, this list of the fastest-growing real estate industry companies and startups is not gospel by any means. If you know of any other that should be on my radar, please comment below!

Whether you are looking for a job, keeping tabs on your competition, or just monitoring the real estate landscape around us, I hope you found this list helpful!