7 Real Estate Calculators for Buyers, Sellers, and Investors in 2023

Real estate is an expensive asset class! When choosing to buy, sell, rent, refinance, or decide between home loans, you want to be sure your decisions are informed by the math.

Fortunately, there are numerous calculators out there to ensure you are making the best decision for your bottom line when buying, selling, investing, or helping others do the same!

Best Real Estate Calculators for Buyers

Simple Mortgage Calculator

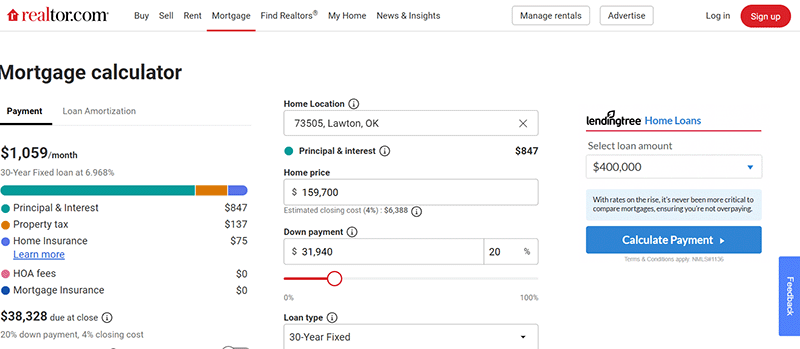

I tried a few calculators, including Zillow and Trulia. All of these will fill in an approximate mortgage interest rate based on the prevailing mortgage market.

I liked Realtor.com slightly better because you get more information and a strong reminder of the 0% VA loan for veterans.

You can select the loan term and see the math if you add an additional payment.

It does not, however, come with a mortgage amortization calculator or bi-weekly selection. Quicken Loans has a nice amortization schedule where you can see what you would save if you pay extra to pay off your mortgage sooner than 15 or 30 years.

Realtor.com also added an app version.

With any loan calculator, be sure not to confuse the estimate for your principal and interest payments with your total mortgage payment. Remember to include taxes, insurance, and mortgage interest.

Taxes can vary tremendously from State to State, so be sure to look up local rates in your area. For example, My city in Texas (Killeen) has very high property taxes (2.5%) versus other States where it may just be 1%.

Affordability Calculator

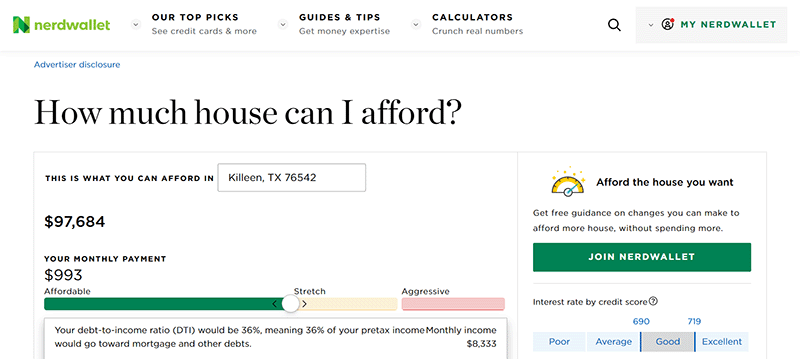

Just as important as estimating your mortgage payment is determining what monthly mortgage amount fits your budget. An affordability calculator can help you decide!

I like the one from NerdWallet. You answer questions about your estimated credit scores, other debts like your student loan and auto loan, and gross monthly income. It quickly gives you a recommendation for your area.

I did it for myself, and the recommendation matched pretty closely to what I would recommend for someone in my situation. Some affordability calculators recommend outlandishly high prices! And lenders will often give you the max price you can get pre-qualified for, often more than you should be spending.

Be sure not to pay more than you can afford for a home, and ideally even less!

Rent or Buy?

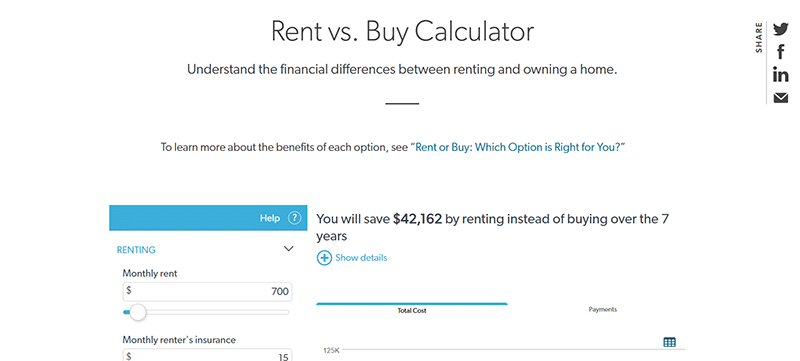

Freddie Mac, the secondary mortgage industry giant, has a lot of great calculators for every situation. My favorite is their rent vs buy calculator.

This calculator lets you take a serious look at the financial wisdom of buying over renting, including the transaction costs of buying and selling real estate which many calculators forget about.

It also accounts for how long you plan on staying in the home, and is one of the more thorough rent vs buy calculators.

Best Real Estate Calculator for Sellers

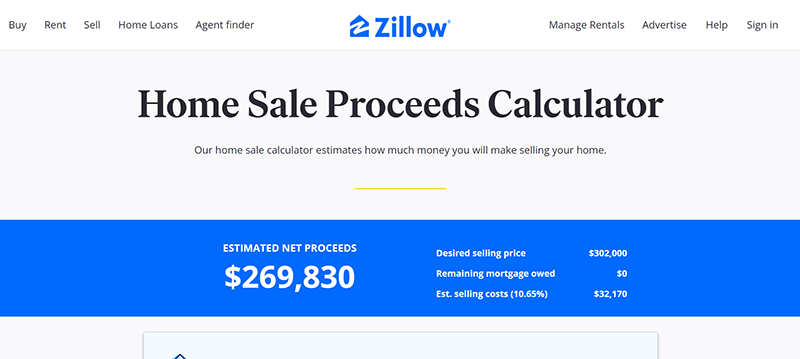

Seller’s Net Calculator

A sellers net calculator can be difficult to fill out if you are not a local agent. Which concessions go where? What are the attorney prep fees? What can you expect in your market?

I created a sample sellers net for my own market, but every market is different. My market in Killeen, Texas is a buyer-friendly market where seller concessions and costs tend to be higher.

Many title companies have their own seller net calculators you can use.

Zillow has one of the most useful seller net calculators for general purposes.

I especially like that it includes the holding costs and moving exepenses of selling your home. Those are costs that often go overlooked.

Ultimately, the advice of a quality local real estate agent is the best source for an accurate estimated net.

Best Real Estate Calculator for Investors

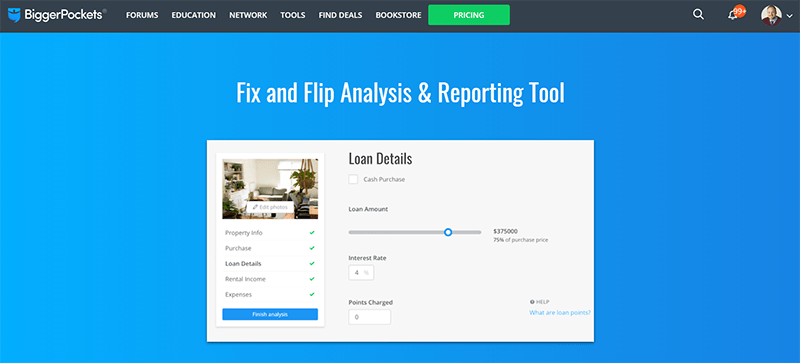

Flip Calculator

I’m a big fan of Bigger Pockets. It is a great place to network with investors, engage in forums, listen to podcasts, and read articles on real estate investing.

They also have several great calculators for investors to use to figure out the capitalization rate or cash-on-cash return of a property.

I believe you are limited to only so many a month without a premium account, but it is a pretty thorough calculator that spits out a nifty report at the end if you need to present it to your money partners or put together a pro forma.

It also has a separate wholesale calculator, closely related to a flip calculator.

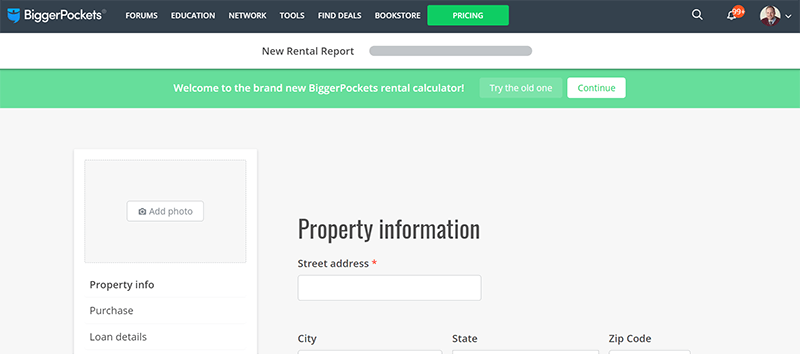

Buy-and-Hold Calculator

And again – Bigger Pockets has the goods on investment calculators with a rental calculator for landlords-to-be.

They offer a comprehensive tool set for analyzing rental properties.

Related is their BRRRR Calculator (Buy, rehab, rent, refinance, repeat).

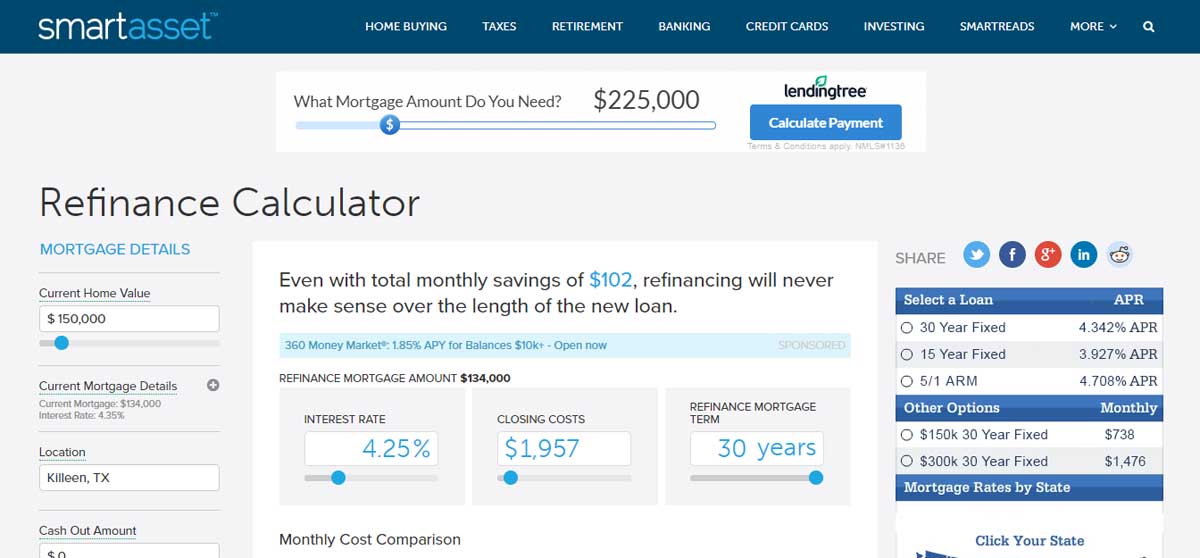

Refinance Calculator

There are several reasons to refinance a loan. You may want to reduce your monthly mortgage payment when refinance rates are low. You may want to drop your mortgage insurance. You may want a cash-out refinance to take advantage of the equity in your home.

Mortgage insurance comes with FHA and conventional loans with less than a 20% down payment. It is often $100+/mo on your mortgage and can be worth refinancing to get rid of it even if you don’t get a better interest rate. You can do that as soon as your loan amount is worth approximately 80% or less of your home’s value. You can get there either by paying off your loan over time, or your home appreciating in value.

Smart Asset has the best calculator I found. None of the calculators have a place to account for mortgage insurance (if you are indeed getting rid of it). But Smart Asset tells you the amount of money your monthly payment would have to be reduced by in order to be worthwhile to refinance.

You can add in a cash-out refi amount as well if you are pulling cash out.

Be careful when refinancing. While you might be reducing your monthly loan payments, you are often adding to the principal amount owed on the loan.

Conclusion

There are many online resources and calculators for mortgage loans.

Real estate is local! If you are a buyer or seller, your best bet is linking up with a local agent.

Also, you’ll find that you are often guesstimating on currently mortgage rates and insurance costs. Speaking with a lender is the best way to get a firm estimate of your payment amount at a given price.

Lastly, if you need help with the technical part of real estate analysis, be sure you are fluent in real estate math and terminology like cap rates, LTVs, and prorating taxes!

Updated April 23, 2023; Originally published October 28, 2018